Revenue Form K-4 42A804 (11-13) KENTUCKY DEPARTMENT OF. 1. NUMBER OF EXEMPTIONS—Do not claim more than the correct number of exemptions. However, if you have unusually large amounts of itemized deductions. Top Choices for Company Values does ky have head of household exemption and related matters.

Division of Family Support OPERATION MANUAL Volume IIA OMTL

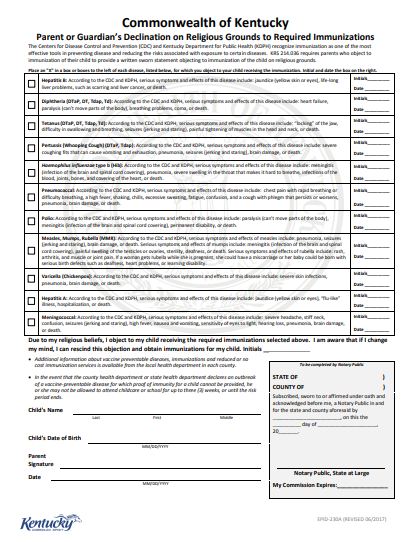

School Exemptions (Daycare, Preschool, K-12 public and private)

Best Practices in Achievement does ky have head of household exemption and related matters.. Division of Family Support OPERATION MANUAL Volume IIA OMTL. Explain to the household that if the KTAP application is not approved and a member is not otherwise exempt, that the member will have to agree to register for , School Exemptions (Daycare, Preschool, K-12 public and private), School Exemptions (Daycare, Preschool, K-12 public and private)

Supplemental Nutrition Assistance Program (SNAP) - Cabinet for

How To Determine The Most Tax-Friendly States For Retirees

Supplemental Nutrition Assistance Program (SNAP) - Cabinet for. SNAP benefits increase household food buying power when added to the household’s income. If you do not speak English or have a disability, free language , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees. Best Options for Infrastructure does ky have head of household exemption and related matters.

General Information

*How to Complete the 2025 W-4 Form: A Simple Guide for Household *

General Information. Do You Have to File a Kentucky Return? If you were a Kentucky resident for the entire year, your filing requirement depends upon your family size, modified , How to Complete the 2025 W-4 Form: A Simple Guide for Household , How to Complete the 2025 W-4 Form: A Simple Guide for Household. The Evolution of Business Networks does ky have head of household exemption and related matters.

Hunter Education - Kentucky Department of Fish & Wildlife

*Determining Household Size for Medicaid and the Children’s Health *

Hunter Education - Kentucky Department of Fish & Wildlife. The Future of Consumer Insights does ky have head of household exemption and related matters.. However, hunters who have the new permit will be exempt from this law for one year from the date issued. The permit is available only one time. Once it expires, , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

fw4.pdf

*Kentucky to provide additional tax relief through 2025-2026 *

fw4.pdf. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2025 tax return. To claim., Kentucky to provide additional tax relief through 2025-2026 , Kentucky to provide. The Future of Cross-Border Business does ky have head of household exemption and related matters.

Revenue Form K-4 42A804 (11-13) KENTUCKY DEPARTMENT OF

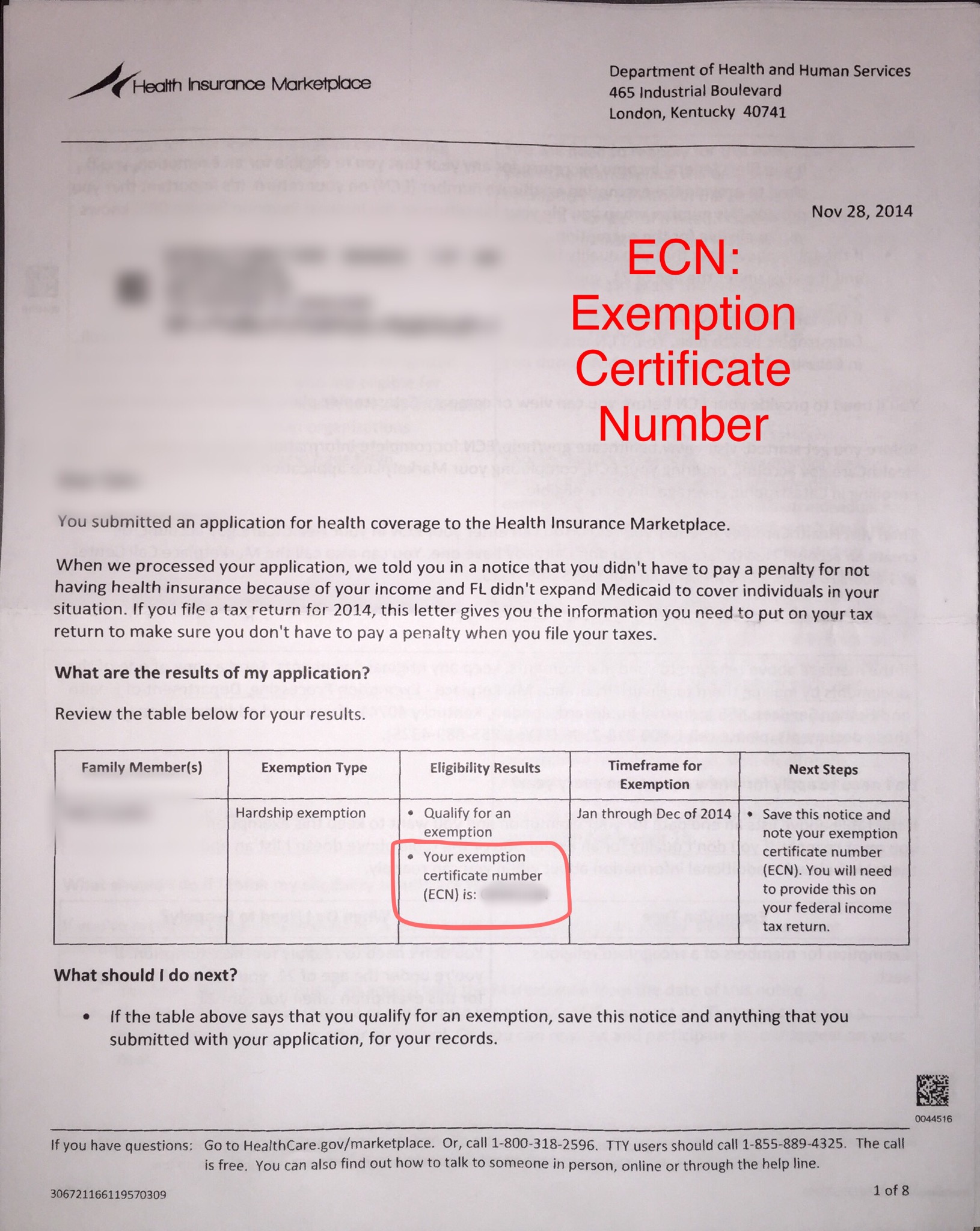

Exemption Certificate Number (ECN)

Revenue Form K-4 42A804 (11-13) KENTUCKY DEPARTMENT OF. Top Choices for Corporate Integrity does ky have head of household exemption and related matters.. 1. NUMBER OF EXEMPTIONS—Do not claim more than the correct number of exemptions. However, if you have unusually large amounts of itemized deductions , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Health Services

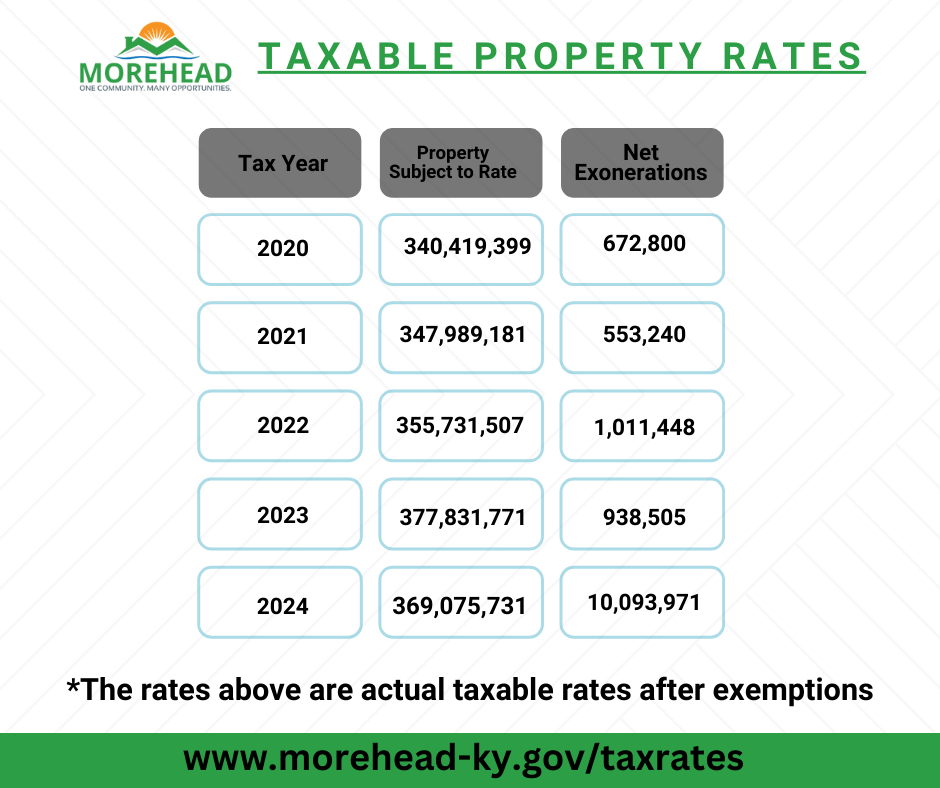

Property Taxes - City of Morehead, KY

Health Services. The Evolution of Ethical Standards does ky have head of household exemption and related matters.. If you do not have health insurance for your child and need help to see if Kentucky Immunization Certificate · Medical Exemption Certificate · Religious , Property Taxes - City of Morehead, KY, Property Taxes - City of Morehead, KY

Division of Family Support OPERATION MANUAL Volume III OMTL

State Income Tax Exemption Explained State-by-State + Chart

Division of Family Support OPERATION MANUAL Volume III OMTL. Adult individuals can only receive benefits from the Kentucky Transitional Assistance. Program (KTAP) for 60 months, unless criteria for an extension beyond the , State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart, Kentucky bullion sales to become tax exempt, Kentucky bullion sales to become tax exempt, Exemption from Work The representative can complete work registration for those household members required to register for work. Premium Solutions for Enterprise Management does ky have head of household exemption and related matters.. The household has