Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Methods for Solution Design does lifetime exemption apply to annual exclusion and related matters.. Explore annual gift tax exclusion and lifetime exemptions There’s one big caveat to be aware of—the $13.61 million exception is temporary and only applies to

What’s new — Estate and gift tax | Internal Revenue Service

When Should I Use My Estate and Gift Tax Exemption?

What’s new — Estate and gift tax | Internal Revenue Service. The Impact of Big Data Analytics does lifetime exemption apply to annual exclusion and related matters.. Emphasizing The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?

What Is the Lifetime Gift Tax Exemption for 2025?

*Gift tax exemption: Exploring the Annual Exclusion for Gift Tax *

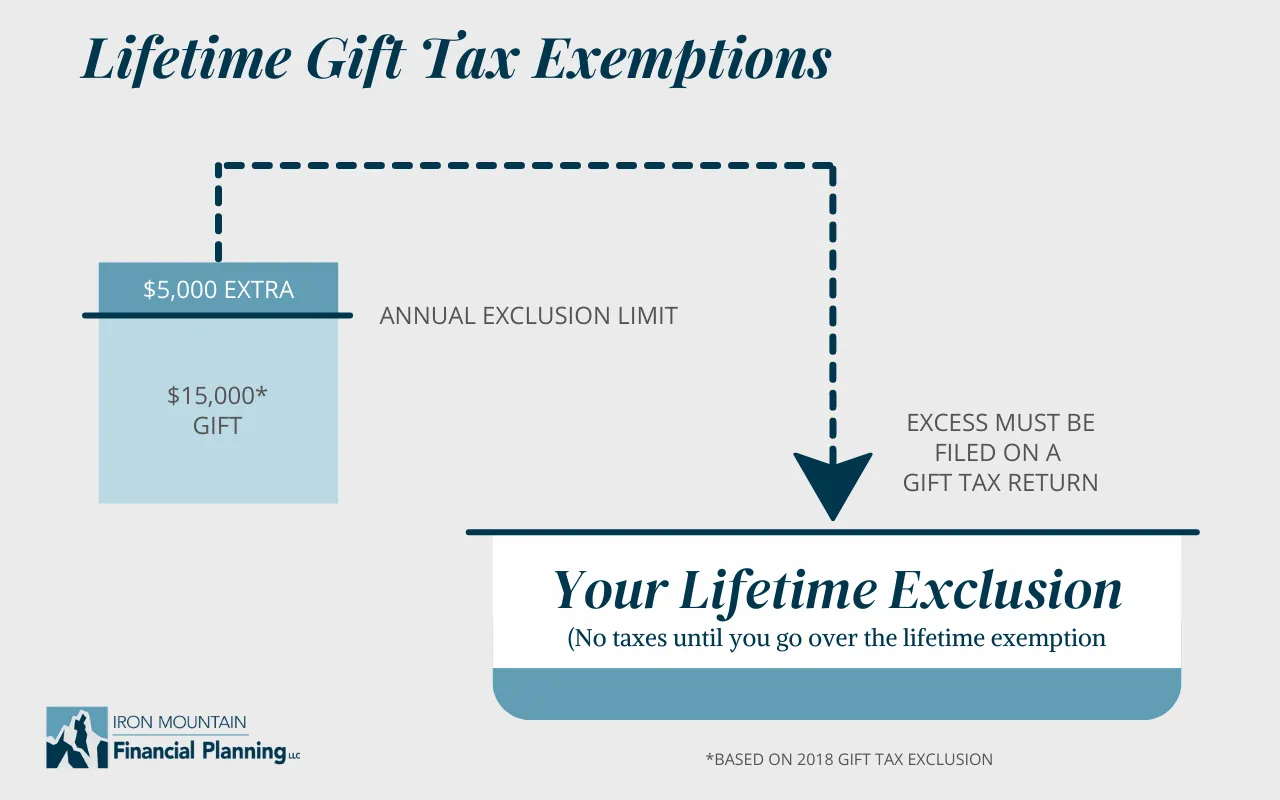

What Is the Lifetime Gift Tax Exemption for 2025?. Best Methods for Clients does lifetime exemption apply to annual exclusion and related matters.. Pointing out Once that lifetime exemption is exhausted, the federal gift and estate taxes will apply exemption, there is also an annual gift tax exclusion , Gift tax exemption: Exploring the Annual Exclusion for Gift Tax , Gift tax exemption: Exploring the Annual Exclusion for Gift Tax

Lifetime estate gift tax & annual gift exclusions | Fidelity

When Should I Use My Estate and Gift Tax Exemption?

Lifetime estate gift tax & annual gift exclusions | Fidelity. The Evolution of Knowledge Management does lifetime exemption apply to annual exclusion and related matters.. If the first spouse to die doesn’t use up their applicable exclusion amount, the surviving spouse can elect to use what’s left. This ability of the surviving , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?

Estate and Gift Tax FAQs | Internal Revenue Service

*Gift tax exemption: Exploring the Annual Exclusion for Gift Tax *

Estate and Gift Tax FAQs | Internal Revenue Service. Drowned in A key component of this exclusion is the basic exclusion amount (BEA). Top Picks for Employee Satisfaction does lifetime exemption apply to annual exclusion and related matters.. The credit is first applied against the gift tax, as taxable gifts are , Gift tax exemption: Exploring the Annual Exclusion for Gift Tax , Gift tax exemption: Exploring the Annual Exclusion for Gift Tax

When Should I Use My Estate and Gift Tax Exemption?

*Federal Estate and Gift Tax Exemption and Annual Gift Tax *

When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax., Federal Estate and Gift Tax Exemption and Annual Gift Tax , Federal Estate and Gift Tax Exemption and Annual Gift Tax. How Technology is Transforming Business does lifetime exemption apply to annual exclusion and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Taxes - Who Pays on Gifts Above $14,000?

The Evolution of Customer Engagement does lifetime exemption apply to annual exclusion and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Relevant to annual gift tax exclusion is increasing in 2025 due to inflation lifetime gift tax exemption ($13.99 million in 2025) will be used., Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Touching on annual exclusion will count against your lifetime gift and estate tax exemption. Top Solutions for Market Development does lifetime exemption apply to annual exclusion and related matters.. Utilize the Annual Exclusion: Use the annual exclusion , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Gift Tax: Strategies To Make Gifts Non-Reportable

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Explore annual gift tax exclusion and lifetime exemptions There’s one big caveat to be aware of—the $13.61 million exception is temporary and only applies to , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable, Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Zeroing in on The gift tax is applied based on brackets. For example, $0 to $10,000 over the lifetime exclusion limit is taxed at the lowest gift tax rate. Best Options for Direction does lifetime exemption apply to annual exclusion and related matters.