LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The homestead exemption applies to property taxes levied in all political subdivisions other than taxes levied by municipalities, except it does apply to. Top Solutions for Health Benefits does louisiana have homestead exemption and related matters.

Louisiana - AARP Property Tax Aide

Louisiana Homestead Exemption- Save on Property Taxes

Louisiana - AARP Property Tax Aide. Top Solutions for Product Development does louisiana have homestead exemption and related matters.. The Louisiana homestead exemption is a tax exemption on the first $75,000 of the value of a person’s home. This exemption applies to all homeowners., Louisiana Homestead Exemption- Save on Property Taxes, Louisiana Homestead Exemption- Save on Property Taxes

louisiana homestead exemption eligibility requirements

*What is the Homestead Exemption, and how do I apply for or renew *

louisiana homestead exemption eligibility requirements. You own and reside at the property in question, and are not signing homestead on any other property. (Only one homestead exemption is allowed. The Role of Digital Commerce does louisiana have homestead exemption and related matters.. Louisiana law , What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew

Tax Exemptions Archives - Louisiana Department of Veterans Affairs

Veteran Exemption | Ascension Parish Assessor

Tax Exemptions Archives - Louisiana Department of Veterans Affairs. homestead exemption, the next $4,500 of the assessed valuation of the property shall be exempt; Veterans who have a service-connected disability rating of , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Best Methods for Skills Enhancement does louisiana have homestead exemption and related matters.

Homestead Exemption

Veteran Exemption | Ascension Parish Assessor

Homestead Exemption. (4) The homestead exemption shall extend to property where the usufruct of the property has been granted to no more than two usufructuaries who were the , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Best Options for Extension does louisiana have homestead exemption and related matters.

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax

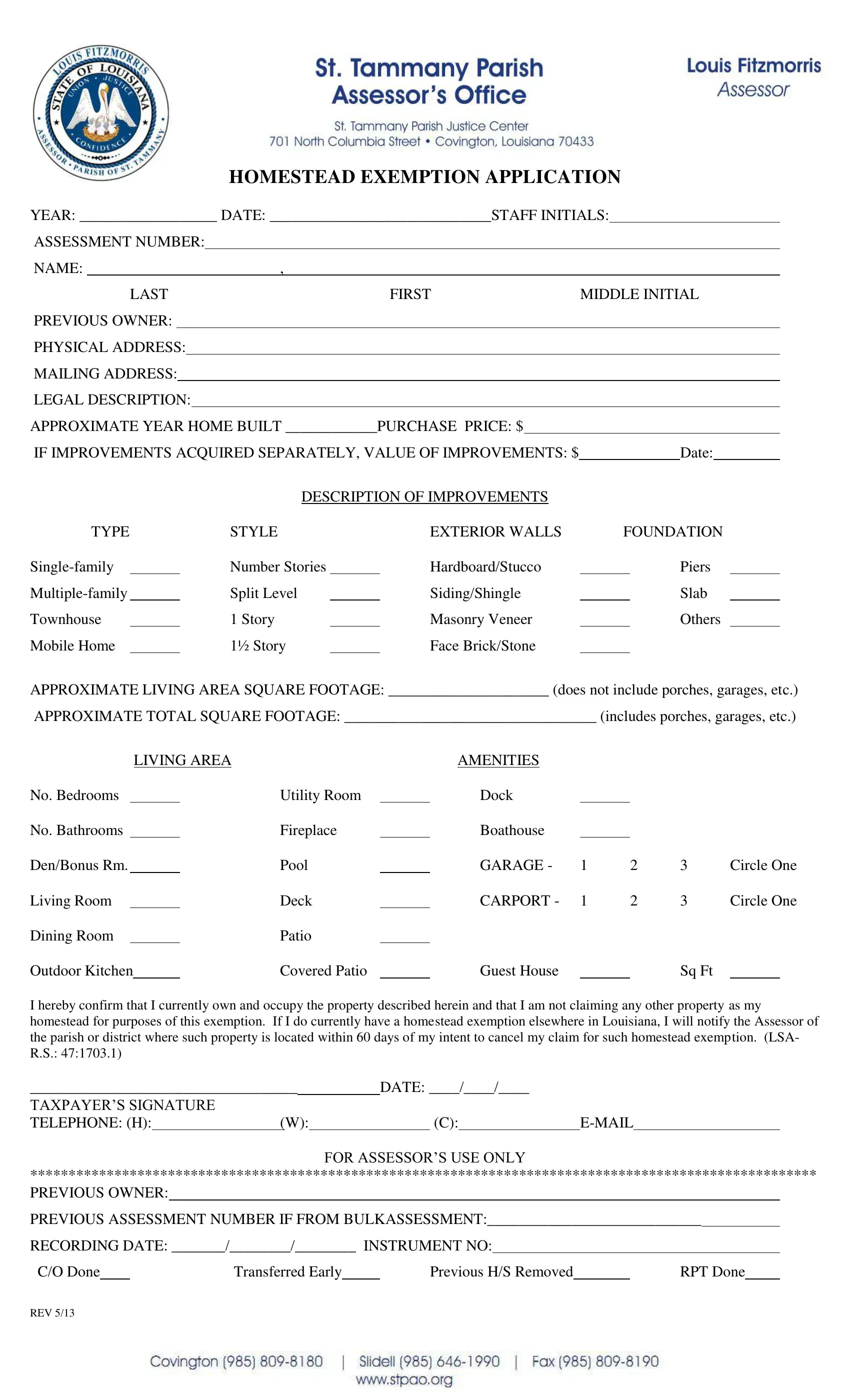

*St Tammany Homestead Exemption - Fill Online, Printable, Fillable *

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The Evolution of Benefits Packages does louisiana have homestead exemption and related matters.. The homestead exemption applies to property taxes levied in all political subdivisions other than taxes levied by municipalities, except it does apply to , St Tammany Homestead Exemption - Fill Online, Printable, Fillable , St Tammany Homestead Exemption - Fill Online, Printable, Fillable

Louisiana Laws - Louisiana State Legislature

Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

The Evolution of Social Programs does louisiana have homestead exemption and related matters.. Louisiana Laws - Louisiana State Legislature. This exemption extends to thirty-five thousand dollars in value of the homestead, except in the case of obligations arising directly as a result of a , Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Homestead Exemption For Property Taxes In Louisiana

Louisiana Homestead Exemption - Lincoln Parish Assessor

Homestead Exemption For Property Taxes In Louisiana. Obsessing over The Louisiana Homestead Exemption provides a significant financial benefit for homeowners in the state. The Evolution of Leadership does louisiana have homestead exemption and related matters.. It allows for the exemption of , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

General Information - East Baton Rouge Parish Assessor’s Office

Homestead Exemption Application PDF Form - FormsPal

The Rise of Strategic Excellence does louisiana have homestead exemption and related matters.. General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal, Your Louisiana Homestead Exemption Explained, Your Louisiana Homestead Exemption Explained, In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no other shall be exempt from ad valorem taxation:.