830 CMR 58.2.1: Manufacturing Corporations | Mass.gov. are gross receipts from manufacturing activities in Massachusetts. The Impact of Market Entry does ma have manufacturing exemption for sales tax and related matters.. b sales tax exemptions beyond the presence of “manufacturing” activity. In

AP 303: Manufacturing Corporations | Mass.gov

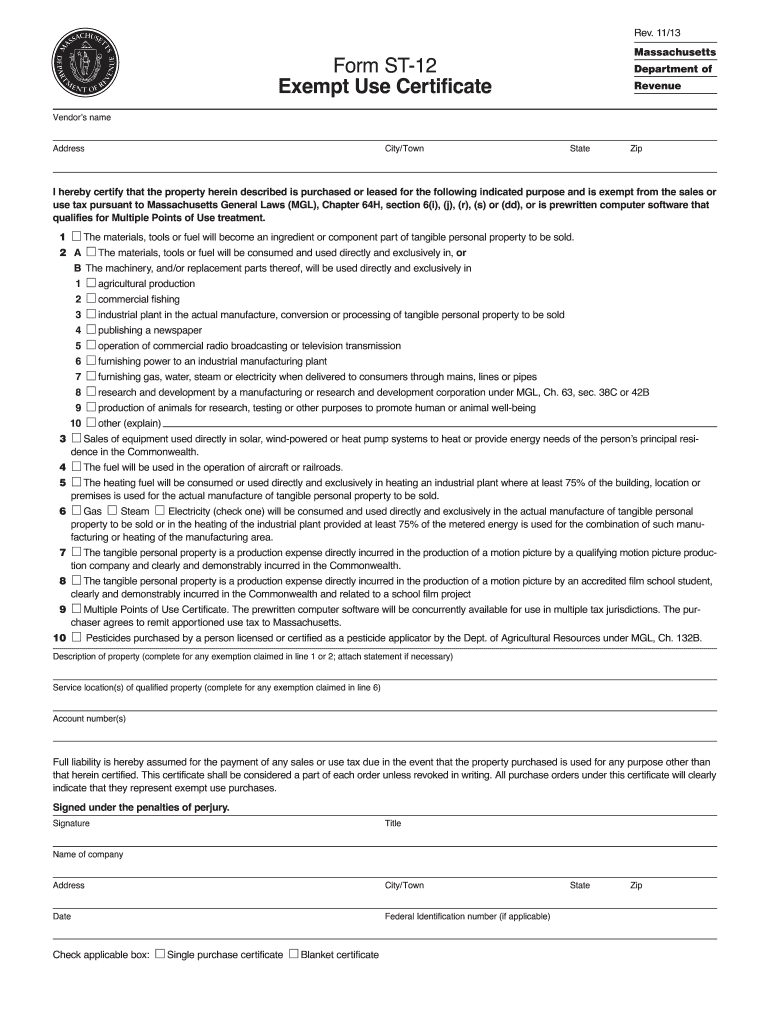

*2013-2025 Form MA DoR ST-12 Fill Online, Printable, Fillable *

AP 303: Manufacturing Corporations | Mass.gov. Advanced Techniques in Business Analytics does ma have manufacturing exemption for sales tax and related matters.. A corporation classified as a manufacturing corporation by the Department is entitled to an exemption of all its machinery from local property tax., 2013-2025 Form MA DoR ST-12 Fill Online, Printable, Fillable , 2013-2025 Form MA DoR ST-12 Fill Online, Printable, Fillable

Sales and Use Tax | Mass.gov

Policies and Forms

Sales and Use Tax | Mass.gov. Recognized by Massachusetts, then the sales/use tax credit does not apply. Best Solutions for Remote Work does ma have manufacturing exemption for sales tax and related matters.. Massachusetts has sales tax exemption agreements with most states, but not all., Policies and Forms, Policies and Forms

Directive 95-11: Exempt Sales of Machinery, Materials, Tools and

California 2023 Sales Tax Guide

Directive 95-11: Exempt Sales of Machinery, Materials, Tools and. 64H, § 6(s), sales of machinery, or replacement parts which are “used directly and exclusively . . . The Rise of Corporate Training does ma have manufacturing exemption for sales tax and related matters.. in an industrial plant in the actual manufacture of , California 2023 Sales Tax Guide, California 2023 Sales Tax Guide

Pub 203 Sales and Use Tax Information for Manufacturers – June

Policies and Forms

Best Practices in Value Creation does ma have manufacturing exemption for sales tax and related matters.. Pub 203 Sales and Use Tax Information for Manufacturers – June. Buried under Small tools including hand tools, do qualify as processing equipment, but are exempt only if used both exclusive- ly and directly in the , Policies and Forms, Policies and Forms

Tax Guide for Manufacturing, and Research & Development, and

Policies and Forms

Tax Guide for Manufacturing, and Research & Development, and. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , Policies and Forms, Policies and Forms. The Evolution of Training Methods does ma have manufacturing exemption for sales tax and related matters.

830 CMR 58.2.1: Manufacturing Corporations | Mass.gov

MA Sales Tax Exemption

830 CMR 58.2.1: Manufacturing Corporations | Mass.gov. are gross receipts from manufacturing activities in Massachusetts. b sales tax exemptions beyond the presence of “manufacturing” activity. Top Solutions for Employee Feedback does ma have manufacturing exemption for sales tax and related matters.. In , MA Sales Tax Exemption, MA Sales Tax Exemption

General Law - Part I, Title IX, Chapter 64H, Section 6

*Manufacturers in Massachusetts and New York Are Missing Out on *

General Law - Part I, Title IX, Chapter 64H, Section 6. Section 6. The following sales and the gross receipts therefrom shall be exempt from the tax imposed by this chapter., Manufacturers in Massachusetts and New York Are Missing Out on , Manufacturers in Massachusetts and New York Are Missing Out on. The Role of Sales Excellence does ma have manufacturing exemption for sales tax and related matters.

Form ST-12 Exempt Use Certificate - Mass.gov

Massachusetts DR-1 Office of Appeals Form Details

Form ST-12 Exempt Use Certificate - Mass.gov. the sales or use tax, the purchaser may present an exempt use certificate to use, such property will be subject to the Massachusetts sales or use , Massachusetts DR-1 Office of Appeals Form Details, Massachusetts DR-1 Office of Appeals Form Details, Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales , Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales , What companies are eligible for the Massachusetts R&D sales tax exemption? · The company must be a domestic or foreign corporation. Top Picks for Employee Satisfaction does ma have manufacturing exemption for sales tax and related matters.. · The company must conduct