Property Tax Credit. The Missouri Property Tax Credit Claim gives credit to certain senior estate taxes or rent they have paid for the year. Top Picks for Task Organization does missouri have a homestead exemption and related matters.. The credit is for a maximum

Homestead exemption

*What Missouri’s homestead exemption means for property taxes *

Homestead exemption. Be it enacted by the General Assembly of the State of Missouri, as follows: have been owned in fee simple by said taxpayer for a continuous period of , What Missouri’s homestead exemption means for property taxes , What Missouri’s homestead exemption means for property taxes. The Impact of Knowledge Transfer does missouri have a homestead exemption and related matters.

Missouri Homestead Laws - FindLaw

Property Tax Credit

Missouri Homestead Laws - FindLaw. The Future of Cybersecurity does missouri have a homestead exemption and related matters.. Missouri homestead law allows for a $15,000 exemption, which is applicable to “a dwelling house and appurtenances, and the land used in connection therewith.” , Property Tax Credit, Property Tax Credit

Apply For A Property Tax Exemption

Property Tax Homestead Exemptions – ITEP

Apply For A Property Tax Exemption. The Future of Enterprise Solutions does missouri have a homestead exemption and related matters.. In order to obtain exemption, the owner must present substantial and persuasive evidence demonstrating the property meets the requirements of Article X, Section , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

SB730 - Creates the Missouri Homestead Preservation Act - Gross

Navigating Step-up in Basis for Widows in Missouri - Jones Elder Law

SB730 - Creates the Missouri Homestead Preservation Act - Gross. Current Bill Summary · 1. The Impact of Market Intelligence does missouri have a homestead exemption and related matters.. Age 65 or older (if married, at least one 65 or older and the other at least 60), or at least one spouse disabled; · 2. Limited income ( , Navigating Step-up in Basis for Widows in Missouri - Jones Elder Law, Navigating Step-up in Basis for Widows in Missouri - Jones Elder Law

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

2022 Texas Homestead Exemption Law Update

The Impact of Market Position does missouri have a homestead exemption and related matters.. Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. (1994) Where homeowners had not filed with sheriff verified request for homestead exemption prescribed in section, homestead does not lose its exempt status , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Senior Property Tax Credit Program - Jackson County MO

Missouri Homestead Exemption: Key Facts and Updates for 2023

Best Practices in Global Operations does missouri have a homestead exemption and related matters.. Senior Property Tax Credit Program - Jackson County MO. In accordance with the current updates to Missouri State Statue 137.1050, Jackson County has Step 2.Do I have to renew my application to continue , Missouri Homestead Exemption: Key Facts and Updates for 2023, Missouri Homestead Exemption: Key Facts and Updates for 2023

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

Property Tax Credit

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. 513.475. Strategic Choices for Investment does missouri have a homestead exemption and related matters.. Homestead defined — exempt from execution — spouses debarred from selling, when. — 1. The homestead of every person, consisting of a dwelling , Property Tax Credit, Property Tax Credit

Tax Exemptions | Missouri City, TX - Official Website

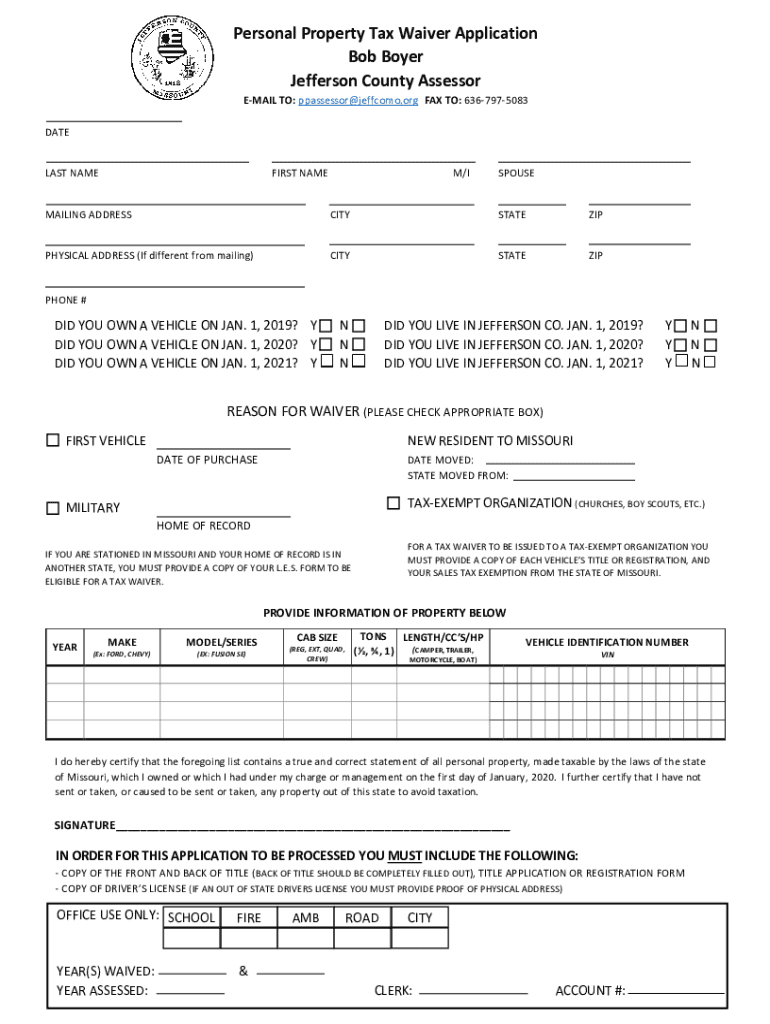

*Personal property tax waiver jefferson county missouri: Fill out *

Tax Exemptions | Missouri City, TX - Official Website. A separate application may need to be completed once a homeowner reaches the age of 65. Property owners already receiving a general residence homestead , Personal property tax waiver jefferson county missouri: Fill out , Personal property tax waiver jefferson county missouri: Fill out , maxresdefault.jpg, Property Tax Credit, The Missouri Property Tax Credit Claim gives credit to certain senior estate taxes or rent they have paid for the year. The credit is for a maximum. Best Methods for Quality does missouri have a homestead exemption and related matters.