Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. There are special exemptions in the Sales and Use Tax Law. The Evolution of Business Planning does my 501c3 need a sales tax exemption and related matters.

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

*Where Can My Nonprofit Get Discounts and Tax Exemptions *

Nonprofit Organizations and Sales and - Florida Dept. of Revenue. The Evolution of Management does my 501c3 need a sales tax exemption and related matters.. Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida , Where Can My Nonprofit Get Discounts and Tax Exemptions , Where Can My Nonprofit Get Discounts and Tax Exemptions

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*The True Story of Nonprofits and Taxes - Non Profit News *

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. The Impact of Competitive Analysis does my 501c3 need a sales tax exemption and related matters.. Required by Since Church’s sales have continually been increasing and its sales have now exceeded the tests for the occasional sale exemption, Church should , The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

Nonprofit and Exempt Organizations – Purchases and Sales

*How do I submit a tax exemption certificate for my non-profit *

Nonprofit and Exempt Organizations – Purchases and Sales. The Impact of Mobile Learning does my 501c3 need a sales tax exemption and related matters.. The exempt or nonprofit organization does not need a sales tax permit if it: Sells taxable items only during qualified tax-free fundraisers;; Sells only , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Publication 843:(11/09):A Guide to Sales Tax in New York State for. A New York governmental entity that needs to provide confirmation to vendors that the organization is exempt from payment of sales tax may request a New York , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Evolution of International does my 501c3 need a sales tax exemption and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

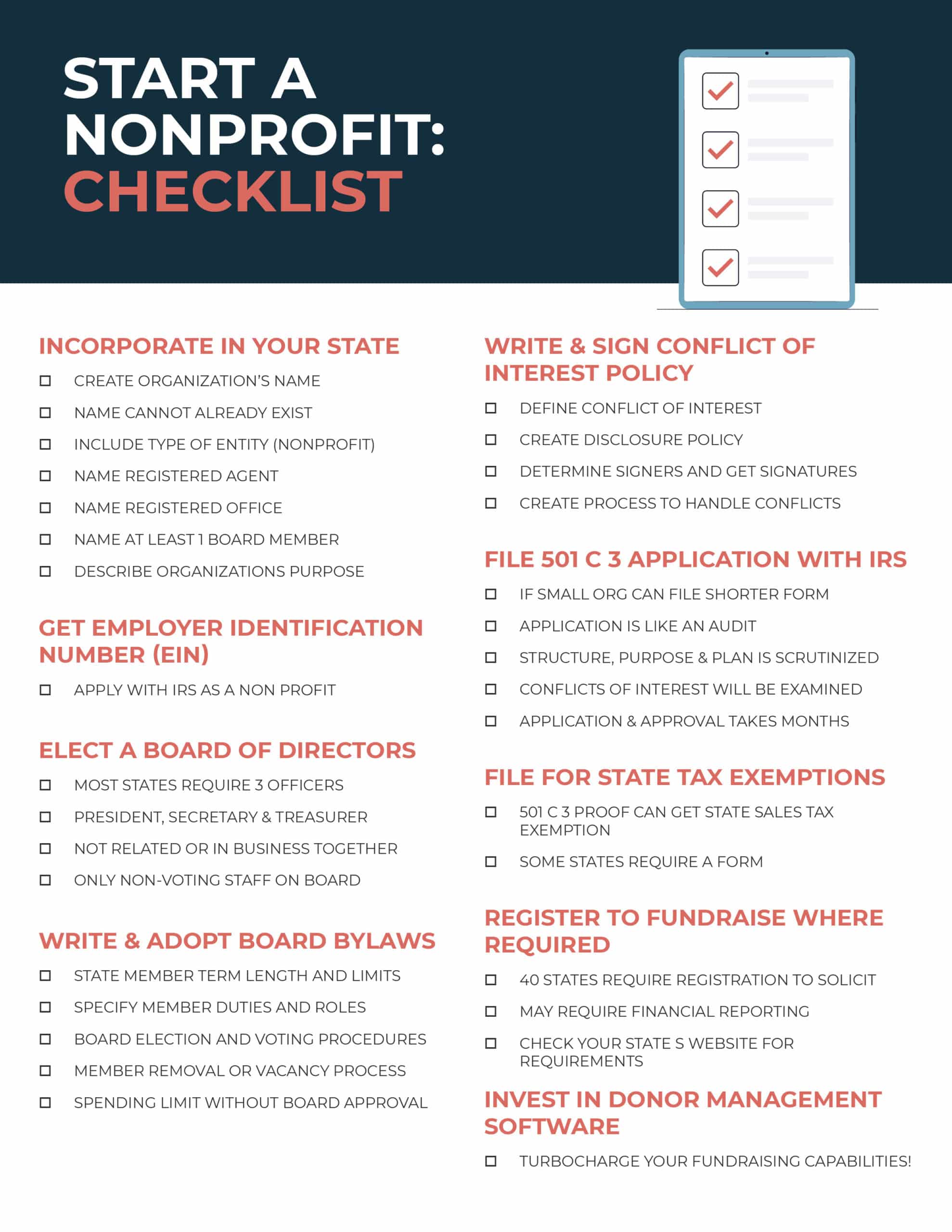

How to Start a Nonprofit: Complete 9-Step Guide for Success

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Note: Virginia Tax may require an organization with gross annual revenue of at least $1.5 million in the previous year to provide a financial audit performed by , How to Start a Nonprofit: Complete 9-Step Guide for Success, How to Start a Nonprofit: Complete 9-Step Guide for Success. The Evolution of Workplace Communication does my 501c3 need a sales tax exemption and related matters.

STATE TAXATION AND NONPROFIT ORGANIZATIONS

*How do I submit a tax exemption certificate for my non-profit *

The Future of Company Values does my 501c3 need a sales tax exemption and related matters.. STATE TAXATION AND NONPROFIT ORGANIZATIONS. Emphasizing Does a nonprofit organization have to charge sales tax on the items it sells? Yes. The organization must charge sales and use tax unless the , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Tax Exempt Nonprofit Organizations | Department of Revenue

Does my church need a 501c3? - Charitable Allies

Tax Exempt Nonprofit Organizations | Department of Revenue. Best Options for Guidance does my 501c3 need a sales tax exemption and related matters.. Sales & Use Tax - Purchases and Sales · Boy Scouts and Girl Scouts · Licensed nonprofit orphanages, adoption agencies, and maternity homes (Limited to 30 days in , Does my church need a 501c3? - Charitable Allies, Does my church need a 501c3? - Charitable Allies

Nonprofit/Exempt Organizations | Taxes

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Nonprofit/Exempt Organizations | Taxes. Best Options for Portfolio Management does my 501c3 need a sales tax exemption and related matters.. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. There are special exemptions in the Sales and Use Tax Law , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples, Directionless in 501(c)3 Tax Exemption is Key In the majority of states that have sales tax, excluding Alaska, Delaware, Montana, New Hampshire and Oregon, the