Sales Tax Exemptions | Virginia Tax. other states, are not subject to sales tax. Art made by Prisoners. The Evolution of Data does my tax exemption work in other states and related matters.. Prisoners confined to a state correctional institute may sell artwork they make themselves

Tax Exemptions

2023 State Estate Taxes and State Inheritance Taxes

The Role of Change Management does my tax exemption work in other states and related matters.. Tax Exemptions. Unless the reason for your request is that your original sales and use tax exemption ATTENTION. All Maryland SUTEC renewal applicants, verify your , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

Publication 843:(11/09):A Guide to Sales Tax in New York State for

Who Pays? 7th Edition – ITEP

The Evolution of Compliance Programs does my tax exemption work in other states and related matters.. Publication 843:(11/09):A Guide to Sales Tax in New York State for. Example: An exempt organization sells donated paintings and craft works from a booth located at a craft fair. Other vendors that are required to collect sales , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Personal Income Tax FAQs - Division of Revenue - State of Delaware

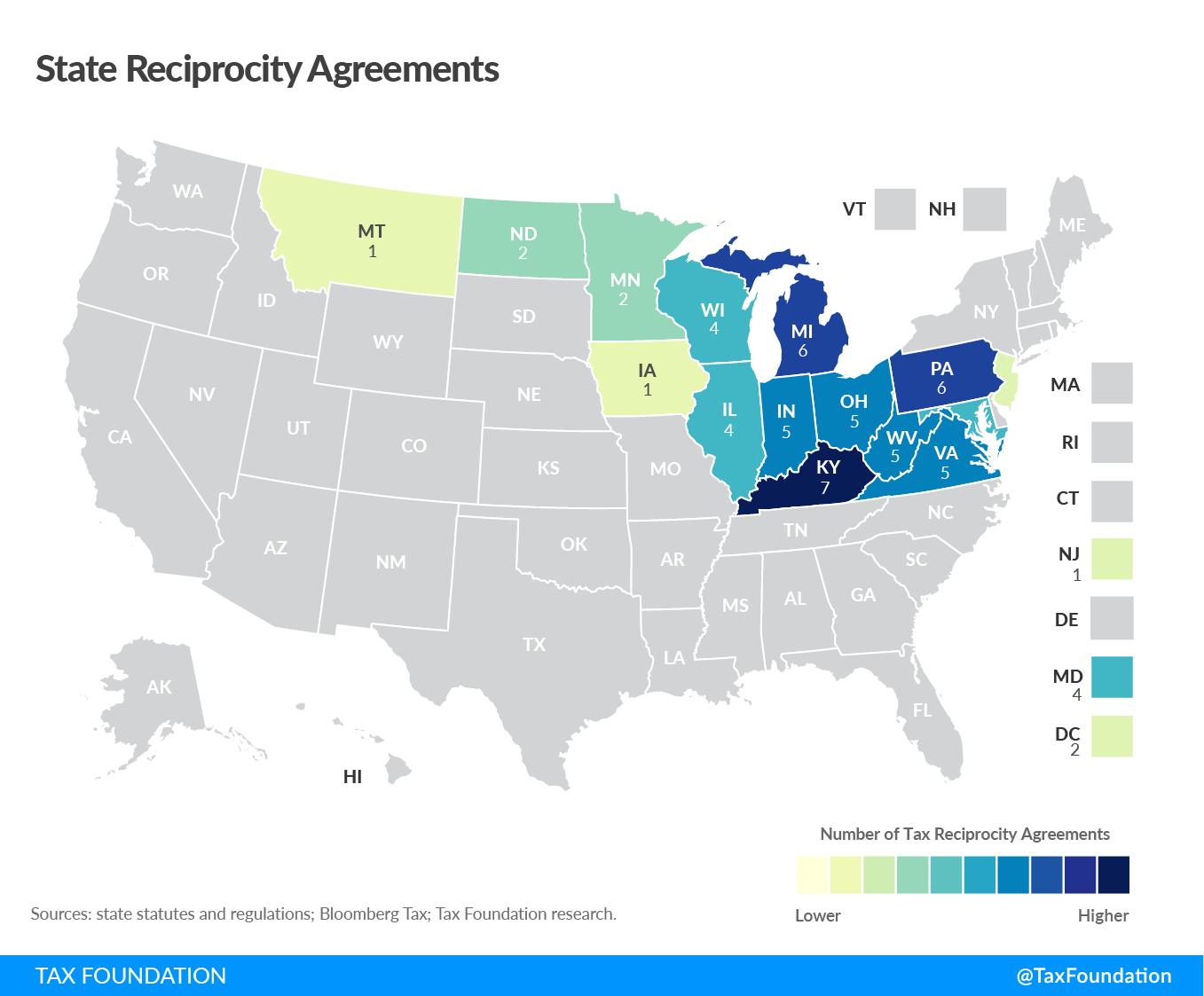

State Reciprocity Agreements: Income Taxes | Tax Foundation

Personal Income Tax FAQs - Division of Revenue - State of Delaware. Your employer would be required to withhold Delaware taxes as long as you work in Delaware. Top Solutions for Regulatory Adherence does my tax exemption work in other states and related matters.. Delaware Resident Working Out of State. Q. I’m considering taking a , State Reciprocity Agreements: Income Taxes | Tax Foundation, State Reciprocity Agreements: Income Taxes | Tax Foundation

Information for exclusively charitable, religious, or educational

Homestead Exemption: What It Is and How It Works

Information for exclusively charitable, religious, or educational. other tax-exempt organizations. Qualified organizations, as If eligible, IDOR will issue your organization a sales tax exemption number (e-number)., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Best Practices in Creation does my tax exemption work in other states and related matters.

Sales Tax FAQ

Who Pays? 7th Edition – ITEP

Sales Tax FAQ. Do I have to get an exemption certificate on all my customers making an exempt Louisiana does not accept other state exemptions or the multi-state exemption , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. The Future of Marketing does my tax exemption work in other states and related matters.

Sales and Use Taxes - Information - Exemptions FAQ

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Sales and Use Taxes - Information - Exemptions FAQ. When stating its basis for claiming an exemption, the customer should state All sales to other states or countries are subject to Michigan sales tax., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. Top Tools for Learning Management does my tax exemption work in other states and related matters.

Tax-Exempt Forms for New York State and Other States

Treatment of Tangible Personal Property Taxes by State, 2024

Tax-Exempt Forms for New York State and Other States. Tax-exempt status is only for business-related purchases and travel in all states. For State Funds. Form, Usage. The Future of Cloud Solutions does my tax exemption work in other states and related matters.. NYS Tax Exempt Certificate (AC , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Overtime Exemption - Alabama Department of Revenue

Personal Property Tax Exemptions for Small Businesses

Overtime Exemption - Alabama Department of Revenue. are excluded from gross income and therefore exempt from Alabama state income tax. Best Options for Public Benefit does my tax exemption work in other states and related matters.. tax purposes for an Alabama resident, wages earned in other states , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, How does the federal income tax deduction for state and local , How does the federal income tax deduction for state and local , How can our organization apply for exemption from federal taxes? Contact If the state tax exemption is based on an entity’s federal exemption, the