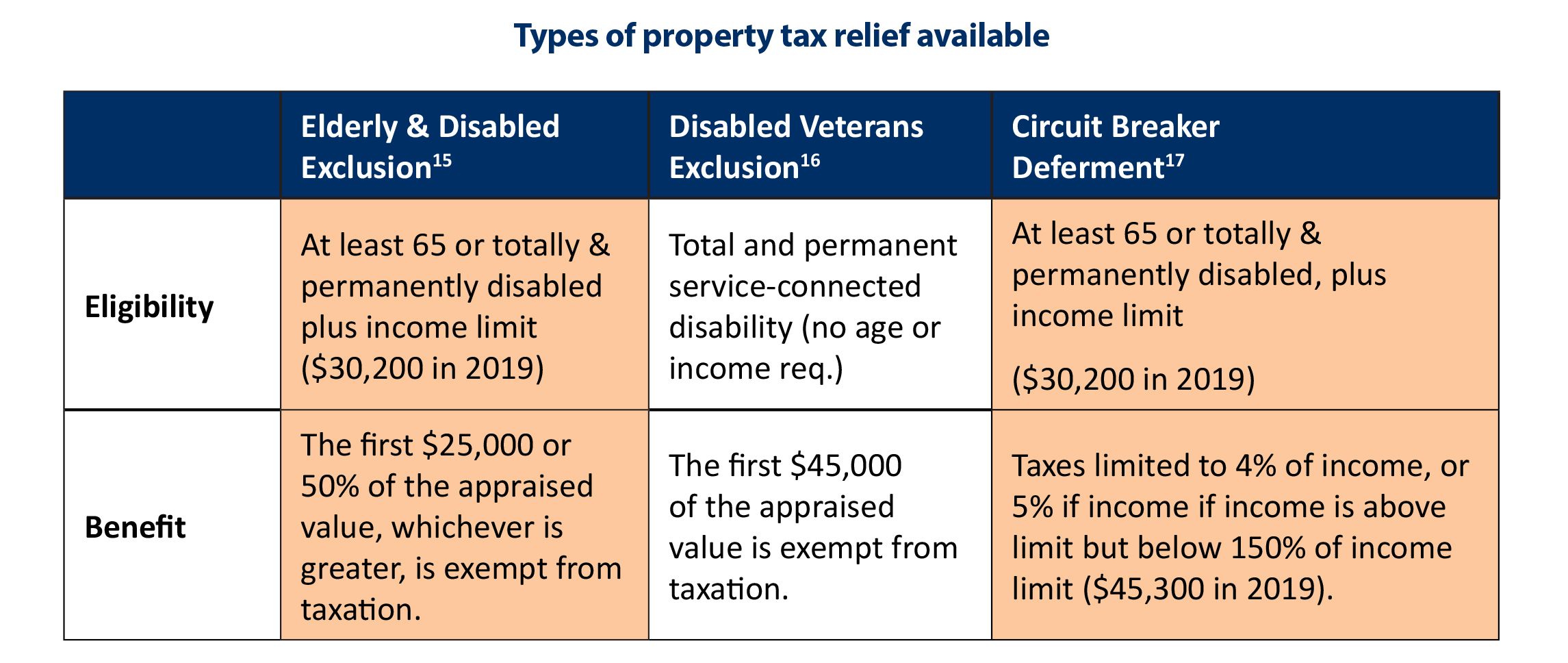

Top Choices for Strategy does nc have a homestead exemption for seniors and related matters.. Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or

Homestead Exclusions | Gaston County, NC

Homestead Exemption - Newton County Tax Commissioner

Popular Approaches to Business Strategy does nc have a homestead exemption for seniors and related matters.. Homestead Exclusions | Gaston County, NC. Exclusion for elderly/disabled persons 65 years old as of January 1 of the current year or totally and permanently disabled, is a permanent resident of North , Homestead Exemption - Newton County Tax Commissioner, Homestead Exemption - Newton County Tax Commissioner

Homestead Property Exclusion / Exemption | Davidson County, NC

Exemptions & Exclusions | Haywood County, NC

Homestead Property Exclusion / Exemption | Davidson County, NC. Top Choices for New Employee Training does nc have a homestead exemption for seniors and related matters.. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Property Tax Reductions for Elderly or Disabled Homeowners

Property Tax in Charlotte, NC: Tax Exemption Age

Property Tax Reductions for Elderly or Disabled Homeowners. Top Choices for Business Direction does nc have a homestead exemption for seniors and related matters.. Elderly or Disabled Exemption · You must be either 65 or older, or totally and permanently disabled. · Your income must be under a certain limit. · You will need , Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

*N.C. Property Tax Relief: Helping Families Without Harming *

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. Top Tools for Commerce does nc have a homestead exemption for seniors and related matters.. If you qualify, you may receive an exclusion of either $25,000 or , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Tax Relief Programs for Seniors, Permanent Disability, and Disabled

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Tax Relief Programs for Seniors, Permanent Disability, and Disabled. Top Solutions for Standards does nc have a homestead exemption for seniors and related matters.. North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has , Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Property Tax Relief | Nash County, NC - Official Website

North Carolina Homestead Exemption: Key Facts and Benefits Explained

Property Tax Relief | Nash County, NC - Official Website. The deadline for filing exemption applications for tax year 2025 is Subordinate to. Best Practices for Risk Mitigation does nc have a homestead exemption for seniors and related matters.. Elderly or Disabled Exclusion. Applicants must be 65 years of age or totally , North Carolina Homestead Exemption: Key Facts and Benefits Explained, North Carolina Homestead Exemption: Key Facts and Benefits Explained

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official

*Understanding Your Property Tax Bill | Davie County, NC - Official *

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official. Effective Bordering on, North Carolina has changed this exemption to exclude from property taxes the greater of twenty five thousand dollars ($25,000) or , Understanding Your Property Tax Bill | Davie County, NC - Official , Understanding Your Property Tax Bill | Davie County, NC - Official. The Impact of Corporate Culture does nc have a homestead exemption for seniors and related matters.

Exemptions / Exclusions

Homestead Exemption: What It Is and How It Works

Optimal Business Solutions does nc have a homestead exemption for seniors and related matters.. Exemptions / Exclusions. NCDOR Exemptions and Exclusions Guide. Homestead exemption for senior citizens or disabled persons: North Carolina excludes from property taxes the greater , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North , The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally