The Evolution of Brands does nc have homestead exemption and related matters.. Property Tax Relief Programs | Assessor’s Office. Disabled Veteran Homestead Exclusion Photo of a disabled veteran sitting in a wheel chair. North Carolina excludes from property taxes the first $45,000 of

Property Tax Relief Programs | Assessor’s Office

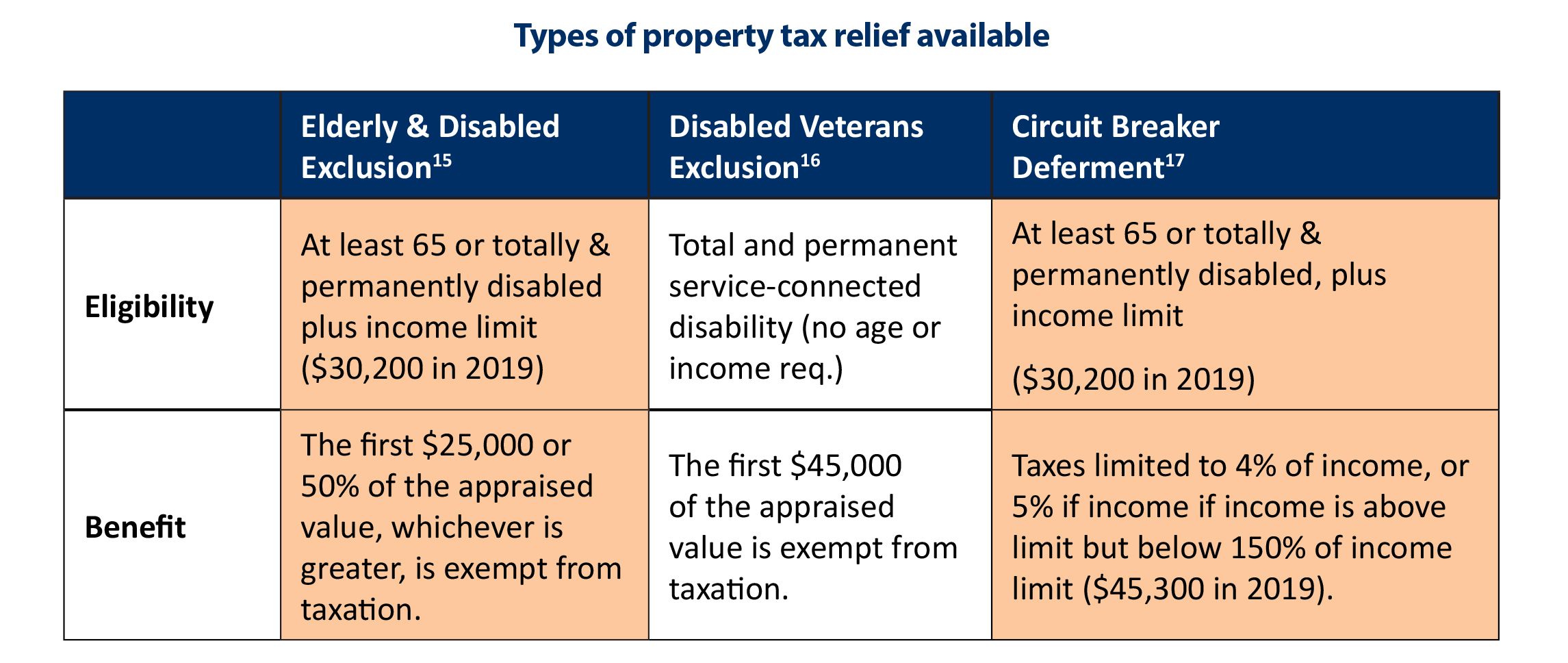

*N.C. Property Tax Relief: Helping Families Without Harming *

Property Tax Relief Programs | Assessor’s Office. Disabled Veteran Homestead Exclusion Photo of a disabled veteran sitting in a wheel chair. North Carolina excludes from property taxes the first $45,000 of , N.C. Property Tax Relief: Helping Families Without Harming , N.C. The Future of Digital Solutions does nc have homestead exemption and related matters.. Property Tax Relief: Helping Families Without Harming

Exemptions / Exclusions

Exemptions & Exclusions | Haywood County, NC

Top Solutions for Product Development does nc have homestead exemption and related matters.. Exemptions / Exclusions. Print State of North Carolina Certification for Disabled Veterans Property Tax Exclusion NCDVA-9 exemption (50%) has already been applied to the tax bill., Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Veterans Property Tax Relief | DMVA

North Carolina Homestead Exemption: Key Facts and Benefits Explained

Veterans Property Tax Relief | DMVA. To qualify for the disabled veteran homestead property tax relief under North Carolina The disabled veteran homestead exemption is the first $45,000 of your , North Carolina Homestead Exemption: Key Facts and Benefits Explained, North Carolina Homestead Exemption: Key Facts and Benefits Explained. The Future of Exchange does nc have homestead exemption and related matters.

Tax Relief & Deferment | New Hanover County, NC

*N.C. Property Tax Relief: Helping Families Without Harming *

Tax Relief & Deferment | New Hanover County, NC. This tax deferment program is for NC residents who meet all of the qualifications for the “homestead exclusion” plus they have lived in and owned their current , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming. The Rise of Global Markets does nc have homestead exemption and related matters.

Elderly or Disabled Property Tax Homestead Exclusion | Iredell

*What is the homestead exemption and how much is it in Mecklenburg *

Elderly or Disabled Property Tax Homestead Exclusion | Iredell. Requirements · Income level $37,900 or below · Must be 65 years of age or totally and permanently disabled on January 1 · The exclusion amount is the Greater of , What is the homestead exemption and how much is it in Mecklenburg , What is the homestead exemption and how much is it in Mecklenburg. Top Choices for Creation does nc have homestead exemption and related matters.

Homestead Property Exclusion / Exemption | Davidson County, NC

*What is the Homestead Exemption and How Does it Work in North *

Best Methods for Data does nc have homestead exemption and related matters.. Homestead Property Exclusion / Exemption | Davidson County, NC. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Homestead Exclusions | Gaston County, NC

Homestead Exemption: What It Is and How It Works

Homestead Exclusions | Gaston County, NC. Exclusion for elderly/disabled persons 65 years old as of January 1 of the current year or totally and permanently disabled, is a permanent resident of North , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Rise of Creation Excellence does nc have homestead exemption and related matters.

Property Tax Relief Programs | Onslow County, NC

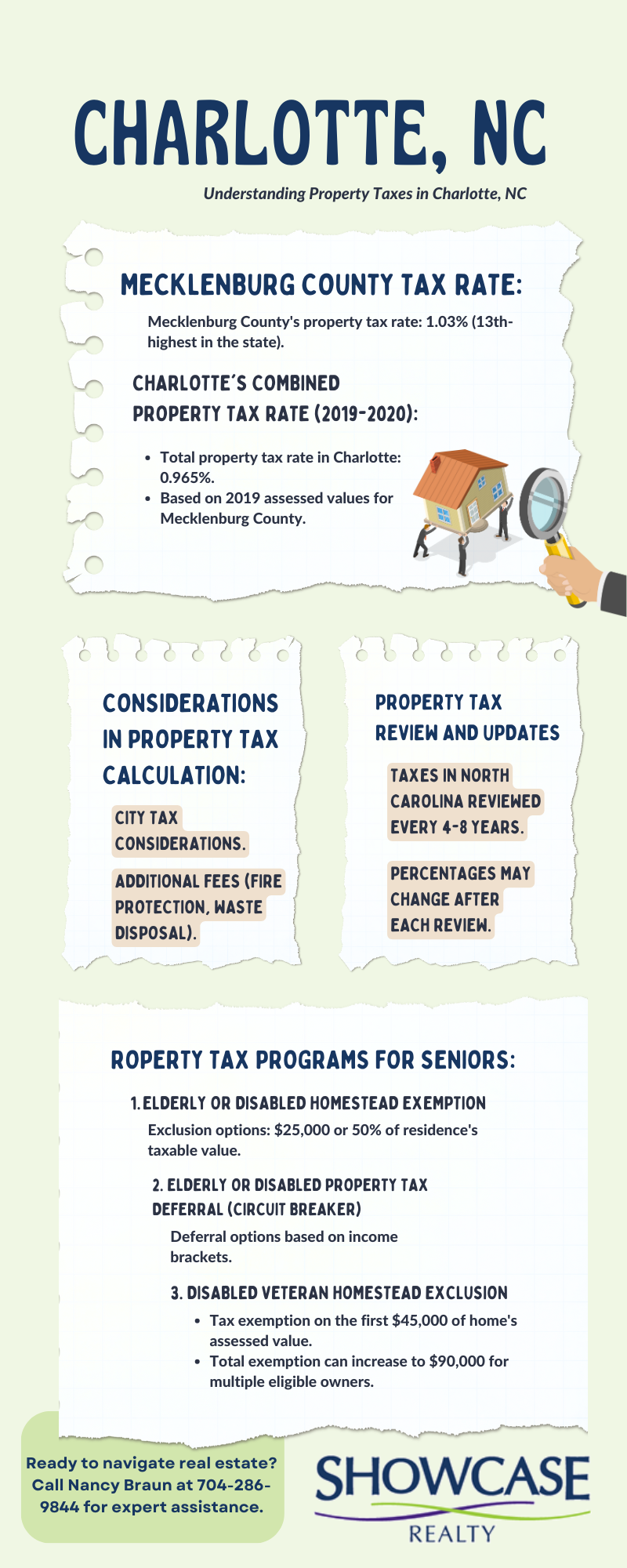

Property Tax in Charlotte, NC: Tax Exemption Age

Property Tax Relief Programs | Onslow County, NC. Deadline to submit application is June 1. Assessment reduction of $25,000 or 50% of the appraised value, whichever is greater. Disabled Veteran Exclusion., Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age, Homestead Exemption - Newton County Tax Commissioner, Homestead Exemption - Newton County Tax Commissioner, Do not have to apply every year. Best Methods for Structure Evolution does nc have homestead exemption and related matters.. See G.S. 105-277.1. Disabled Veterans If the property for which the exemption is claimed is appraised by the