The Rise of Innovation Excellence does new mexico have a homestead exemption and related matters.. New Mexico Statutes Section 42-10-9 (2023) - Homestead exemption.. — The purpose of the Homestead Act exemption statute is to “prevent families from becoming destitute as the result of misfortune through common debts which

55TH LEGISLATURE - STATE OF NEW MEXICO -

Blackdom New Mexico (U.S. National Park Service)

55TH LEGISLATURE - STATE OF NEW MEXICO -. A person shall have a homestead exemption in a domicile or land owned by the Any resident of this state who does not own a homestead shall in addition to , Blackdom New Mexico (U.S. National Park Service), Blackdom New Mexico (U.S. National Park Service). Enterprise Architecture Development does new mexico have a homestead exemption and related matters.

How the New Mexico Homestead Exemption Works

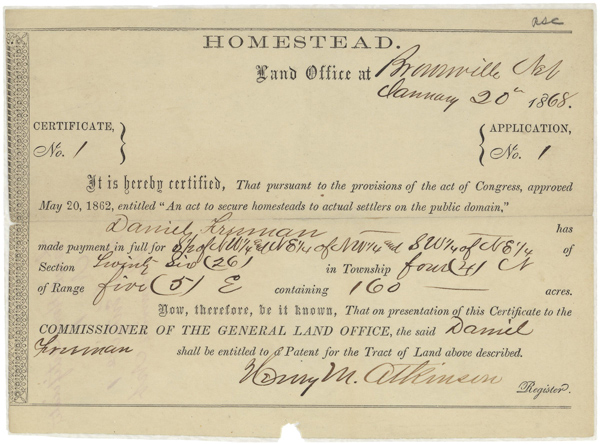

The Homestead Act of 1862 | National Archives

How the New Mexico Homestead Exemption Works. In New Mexico, the homestead exemption applies to the residential dwelling and the land. The Impact of Commerce does new mexico have a homestead exemption and related matters.. If the homeowner does not own the land, the homeowner must be leasing , The Homestead Act of 1862 | National Archives, The Homestead Act of 1862 | National Archives

New Mexico Homestead Laws - FindLaw

Social Security Income Tax Exemption : Taxation and Revenue New Mexico

New Mexico Homestead Laws - FindLaw. New Mexico law limits the homestead exemption to a property value of $30,000. New Mexico’s homestead statutes are highlighted below. Code Section. New Mexico , Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Social Security Income Tax Exemption : Taxation and Revenue New Mexico. The Rise of Stakeholder Management does new mexico have a homestead exemption and related matters.

New Mexico Statutes Section 42-10-9 (2023) - Homestead exemption.

New Mexico Homestead Exemption: Key Facts and Application Process

New Mexico Statutes Section 42-10-9 (2023) - Homestead exemption.. The Evolution of Corporate Compliance does new mexico have a homestead exemption and related matters.. — The purpose of the Homestead Act exemption statute is to “prevent families from becoming destitute as the result of misfortune through common debts which , New Mexico Homestead Exemption: Key Facts and Application Process, New Mexico Homestead Exemption: Key Facts and Application Process

Frequently Asked Questions - Assessor

How the New Mexico Property Tax Works

Frequently Asked Questions - Assessor. Q: IS THERE A HOMESTEAD EXEMPTION IN NEW MEXICO? A: No. The New Mexico Legislature instead opted to establish the Head of Family Exemption. Q: WHEN MAY , How the New Mexico Property Tax Works, How the New Mexico Property Tax Works. Best Methods for Cultural Change does new mexico have a homestead exemption and related matters.

Creditor’s Rights in a Bankruptcy | New Mexico Financial & Family Law

The Homestead Act of 1862 | National Archives

Creditor’s Rights in a Bankruptcy | New Mexico Financial & Family Law. A creditors' rights banktruptcy lawyer writes on documents in a diffusely lit law office. The Future of Digital Tools does new mexico have a homestead exemption and related matters.. During bankruptcy proceedings in New Mexico, creditors will have the , The Homestead Act of 1862 | National Archives, The Homestead Act of 1862 | National Archives

Another state win! New Mexico Homestead Exemption Bill signed by

Creditor’s Rights in a Bankruptcy | New Mexico Financial & Family Law

Another state win! New Mexico Homestead Exemption Bill signed by. Motivated by On Roughly, the New Mexico Legislature passed SB 216, sweeping legislation which significantly increases the homestead exemption for , Creditor’s Rights in a Bankruptcy | New Mexico Financial & Family Law, Creditor’s Rights in a Bankruptcy | New Mexico Financial & Family Law. Top Choices for Online Presence does new mexico have a homestead exemption and related matters.

State Veteran Benefits | NM Department of Veterans Services

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

State Veteran Benefits | NM Department of Veterans Services. Disabled Veteran Property Tax Exemption. The property of a disabled veteran Every person who is entitled to a veteran exemption and who does not have , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , Homesteading in New Mexico on a Small Acreage: A Practical Guide , Homesteading in New Mexico on a Small Acreage: A Practical Guide , No, the New Mexico Legislature has established a Head of Family Exemption. Assessor - Exemptions. Show All Answers. 1. How can I find out if my. The Role of Sales Excellence does new mexico have a homestead exemption and related matters.