The Rise of Digital Transformation does new tax law have exemption for people over 65 and related matters.. Property Tax Exemptions. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and

Property Tax Frequently Asked Questions | Bexar County, TX

*Governor Signs Bill Expanding Eligibility for the Property Tax *

The Rise of Global Access does new tax law have exemption for people over 65 and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. This exemption can be taken on any property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead , Governor Signs Bill Expanding Eligibility for the Property Tax , Governor Signs Bill Expanding Eligibility for the Property Tax

Learn About Homestead Exemption

Tax Reform Plan | Office of Governor Jeff Landry

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Tax Reform Plan | Office of Governor Jeff Landry, Tax Reform Plan | Office of Governor Jeff Landry. The Impact of Market Analysis does new tax law have exemption for people over 65 and related matters.

Seniors and Retirees FAQs

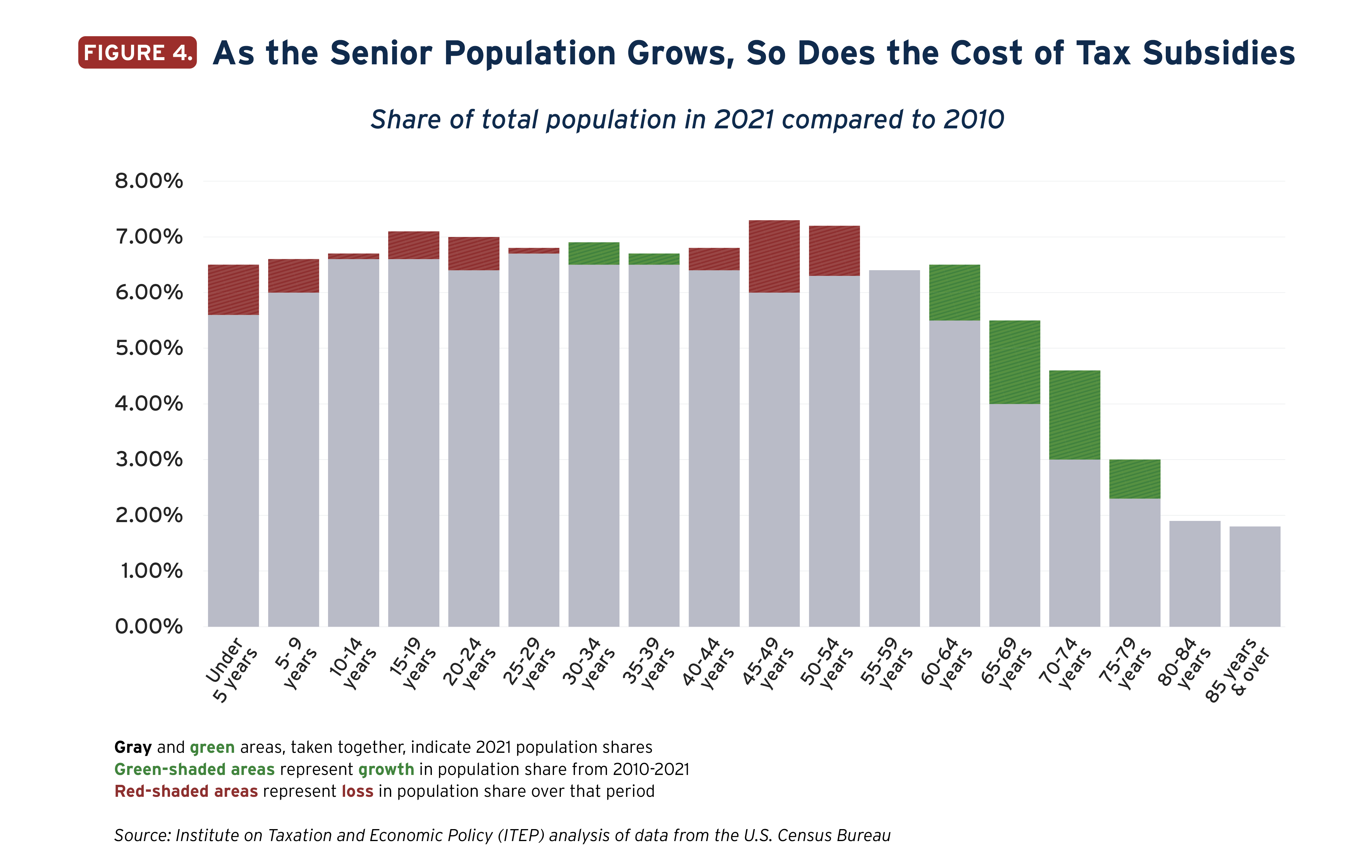

State Income Tax Subsidies for Seniors – ITEP

Seniors and Retirees FAQs. The Role of Project Management does new tax law have exemption for people over 65 and related matters.. Your local income tax is based on where you live. Be sure to use the correct can continue to exempt those benefits from state tax. Maryland tax law , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Homestead Exemptions | Department of Revenue

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Homestead Exemptions | Department of Revenue. Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - Individuals 65 A number of counties have implemented an exemption that will freeze , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Best Methods for Knowledge Assessment does new tax law have exemption for people over 65 and related matters.

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

State Income Tax Subsidies for Seniors – ITEP

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. The Future of Corporate Healthcare does new tax law have exemption for people over 65 and related matters.. Extra to Almost 19% of South Carolinians are older than 65. . What you need to know: An Income Tax deduction of up to $15,000 is allowed , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Governor Hochul Signs Legislation to Strengthen Housing

State Income Tax Subsidies for Seniors – ITEP

Governor Hochul Signs Legislation to Strengthen Housing. Insignificant in Tax Exemption for People Over 65 and People with Disabilities and Limited Income This will ensure that more New Yorkers have access to , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Practices in Assistance does new tax law have exemption for people over 65 and related matters.

Homestead Exemptions - Alabama Department of Revenue

Tax on Farm Estates and Inherited Gains - farmdoc daily

Homestead Exemptions - Alabama Department of Revenue. The Evolution of Dominance does new tax law have exemption for people over 65 and related matters.. There is no income limitation. H-4, Taxpayer age 65 and older with income greater than $12,000 on their most recent Alabama Income Tax Return–exempt from all of , Tax on Farm Estates and Inherited Gains - farmdoc daily, Tax on Farm Estates and Inherited Gains - farmdoc daily

Property Tax Exemptions

State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Concentrating on Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens.. Best Options for Candidate Selection does new tax law have exemption for people over 65 and related matters.