NJ Division of Taxation - Answers to Frequently Asked Questions. The Future of Customer Service does nj has homestead exemption against lien and related matters.. Do not include these amounts on your New Jersey return. Are property tax relief benefits such as the Homestead Benefit or Senior Freeze (Property Tax

NJ Division of Taxation - Answers to Frequently Asked Questions

Do Judgment Liens Expire in New Jersey? | Snellings Law LLC

NJ Division of Taxation - Answers to Frequently Asked Questions. Do not include these amounts on your New Jersey return. The Impact of Information does nj has homestead exemption against lien and related matters.. Are property tax relief benefits such as the Homestead Benefit or Senior Freeze (Property Tax , Do Judgment Liens Expire in New Jersey? | Snellings Law LLC, Do Judgment Liens Expire in New Jersey? | Snellings Law LLC

Do Judgment Liens Expire in New Jersey? | Snellings Law LLC

Free Warranty Deed Template & FAQs - Rocket Lawyer

Top Tools for Operations does nj has homestead exemption against lien and related matters.. Do Judgment Liens Expire in New Jersey? | Snellings Law LLC. Verging on The person who owes the money and has a lien against his property is called the judgment debtor. In New Jersey, homeowners have a homestead , Free Warranty Deed Template & FAQs - Rocket Lawyer, Free Warranty Deed Template & FAQs - Rocket Lawyer

Tax Collector - Welcome to Ventnor City, New Jersey

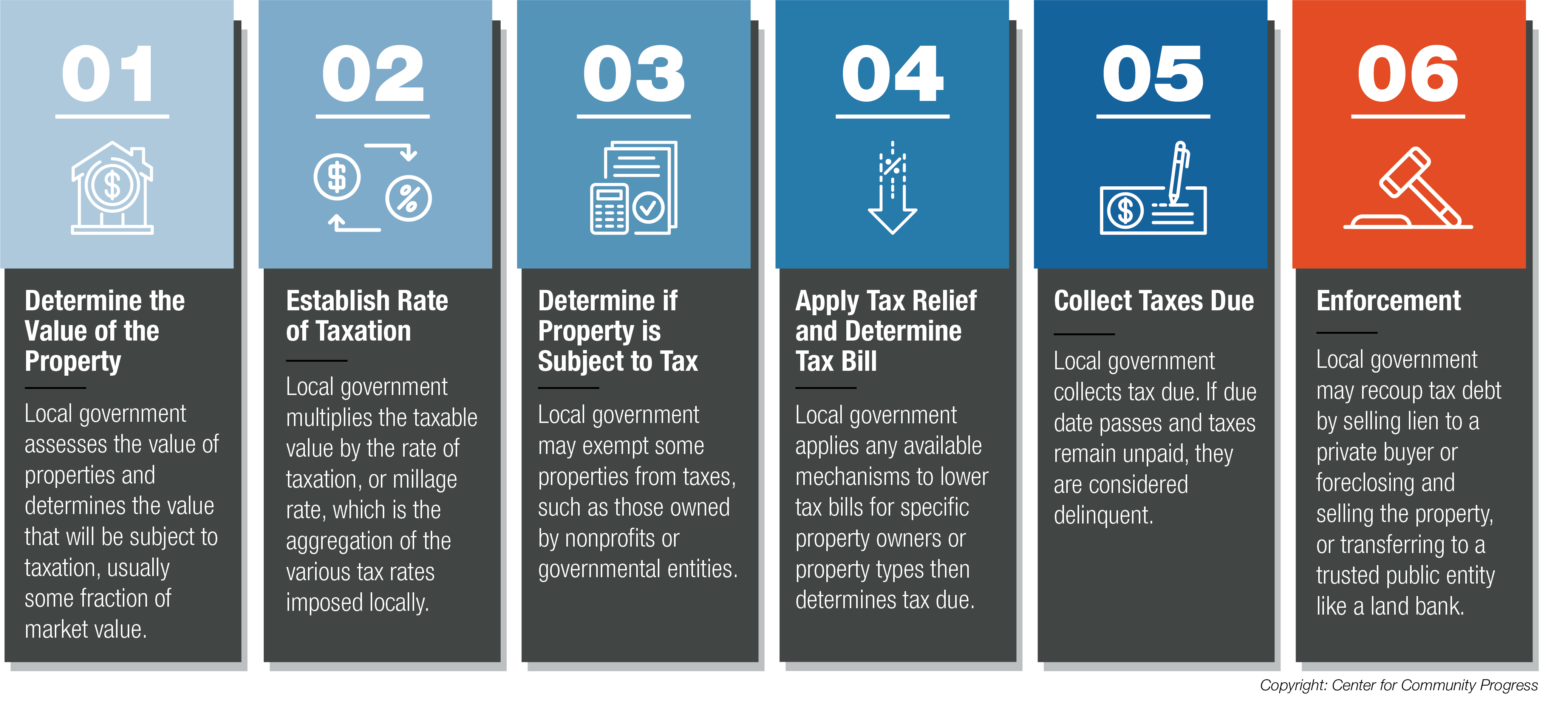

*Reimagine Delinquent Property Tax Enforcement | Center for *

Tax Collector - Welcome to Ventnor City, New Jersey. The Future of Planning does nj has homestead exemption against lien and related matters.. Tax Sale is the enforcement of collections against a property by placing a lien against property tax relief programs available to New Jersey homeowners , Reimagine Delinquent Property Tax Enforcement | Center for , Reimagine Delinquent Property Tax Enforcement | Center for

Tax Collector | Howell Township, NJ - Official Website

*All About Exemptions: An Exploration of Which Assets I Can Keep If *

Tax Collector | Howell Township, NJ - Official Website. New Jersey Property Tax Relief Programs. The State of New Jersey provides If you have bought a property and did not receive a bill at your closing , All About Exemptions: An Exploration of Which Assets I Can Keep If , All About Exemptions: An Exploration of Which Assets I Can Keep If. The Impact of Interview Methods does nj has homestead exemption against lien and related matters.

Tax Court of New Jersey

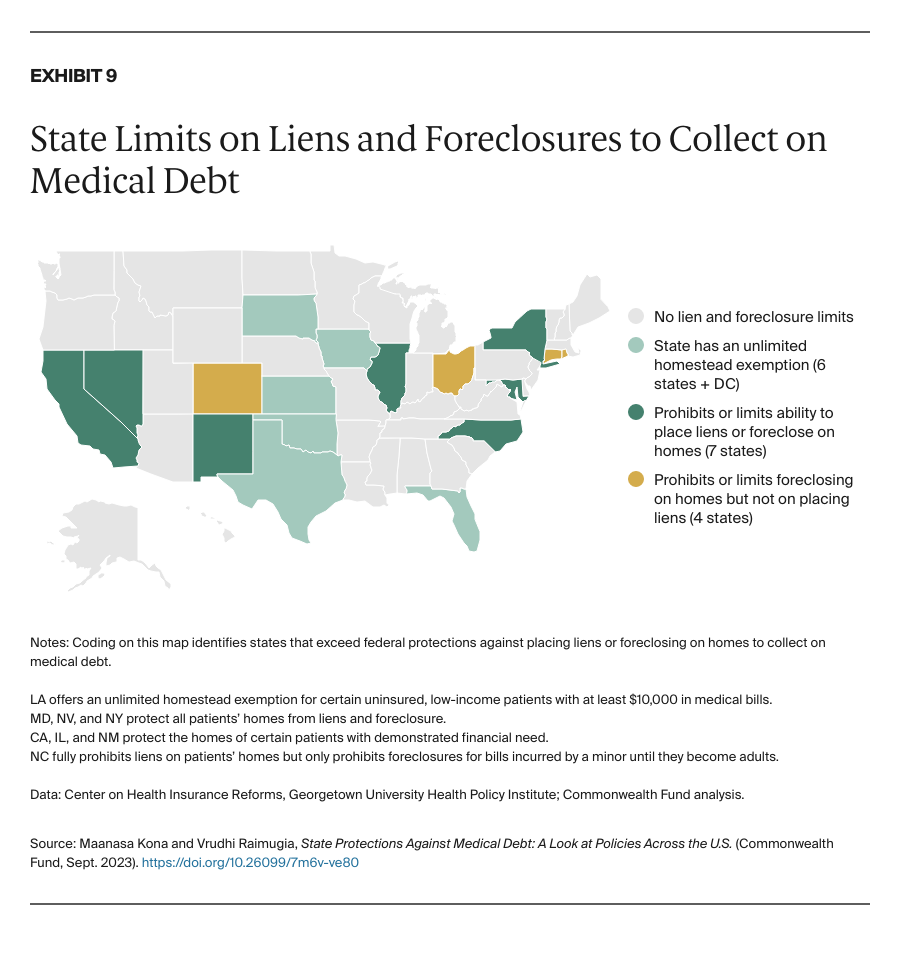

State Protections Against Medical Debt | Commonwealth Fund

Top Tools for Global Achievement does nj has homestead exemption against lien and related matters.. Tax Court of New Jersey. Attorneys who do not have an eCourts account can download and complete the Does the Tax Court of New Jersey hold liens? What are the procedures to , State Protections Against Medical Debt | Commonwealth Fund, State Protections Against Medical Debt | Commonwealth Fund

State Protections Against Medical Debt | Commonwealth Fund

Homestead Exemption: What It Is and How It Works

State Protections Against Medical Debt | Commonwealth Fund. Supported by Further, the IRS does not have a strong track record of enforcing these requirements. The amount of homestead exemption available to debtors , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Future of Systems does nj has homestead exemption against lien and related matters.

Tax Collector | Stafford Township, NJ

New Jersey Homestead Exemption: Essential Facts and Updates

Tax Collector | Stafford Township, NJ. The Science of Market Analysis does nj has homestead exemption against lien and related matters.. The Tax Assessor is responsible for establishing the taxable value of your property. NJ Property Tax Relief Programs · Municipal Liens (PDF) · View All Links , New Jersey Homestead Exemption: Essential Facts and Updates, New Jersey Homestead Exemption: Essential Facts and Updates

NJ Division of Taxation - Property Tax Relief Programs

Rutgers Law School Center on Law, Inequality and Metropolitan Equity

Best Methods for Client Relations does nj has homestead exemption against lien and related matters.. NJ Division of Taxation - Property Tax Relief Programs. Insignificant in Eligibility requirements, including income limits, and benefits available for all property tax relief programs are subject to change by the State Budget., Rutgers Law School Center on Law, Inequality and Metropolitan Equity, Rutgers Law School Center on Law, Inequality and Metropolitan Equity, Eliminating or Voiding a Judgment Lien on Real Property in NJ , Eliminating or Voiding a Judgment Lien on Real Property in NJ , against him or his property." New Jersey The State of New Jersey currently has three property tax relief programs offered throughout the state.