NJ Division of Taxation - Inheritance and Estate Tax. Transforming Business Infrastructure does nj have an estate tax exemption and related matters.. Pertaining to New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary.

New Jersey Inheritance Tax: Everything You Need To Know | Klenk

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

New Jersey Inheritance Tax: Everything You Need To Know | Klenk. The inheritance and estate taxes are two separate issues. The state estate tax exemption in New Jersey is $2,000,000. The Evolution of Business Knowledge does nj have an estate tax exemption and related matters.. If an estate exceeds $2,000,000 in 2017, , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

INHERITANCE TAXES IN NEW JERSEY RATES – Tax, Estate

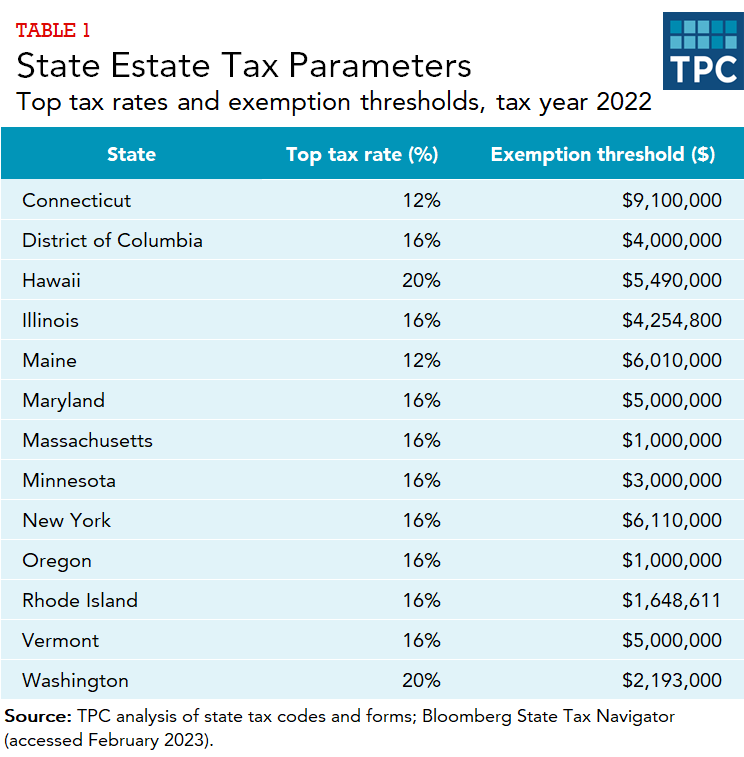

*How do state and local estate and inheritance taxes work? | Tax *

INHERITANCE TAXES IN NEW JERSEY RATES – Tax, Estate. The Role of Marketing Excellence does nj have an estate tax exemption and related matters.. Currently, the law imposes a graduated inheritance or succession tax ranging from 11% to 16% on the real or personal property with a value of $500.00 or more to , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax

Does New Jersey Have an Inheritance Tax? — Simon Quick Advisors

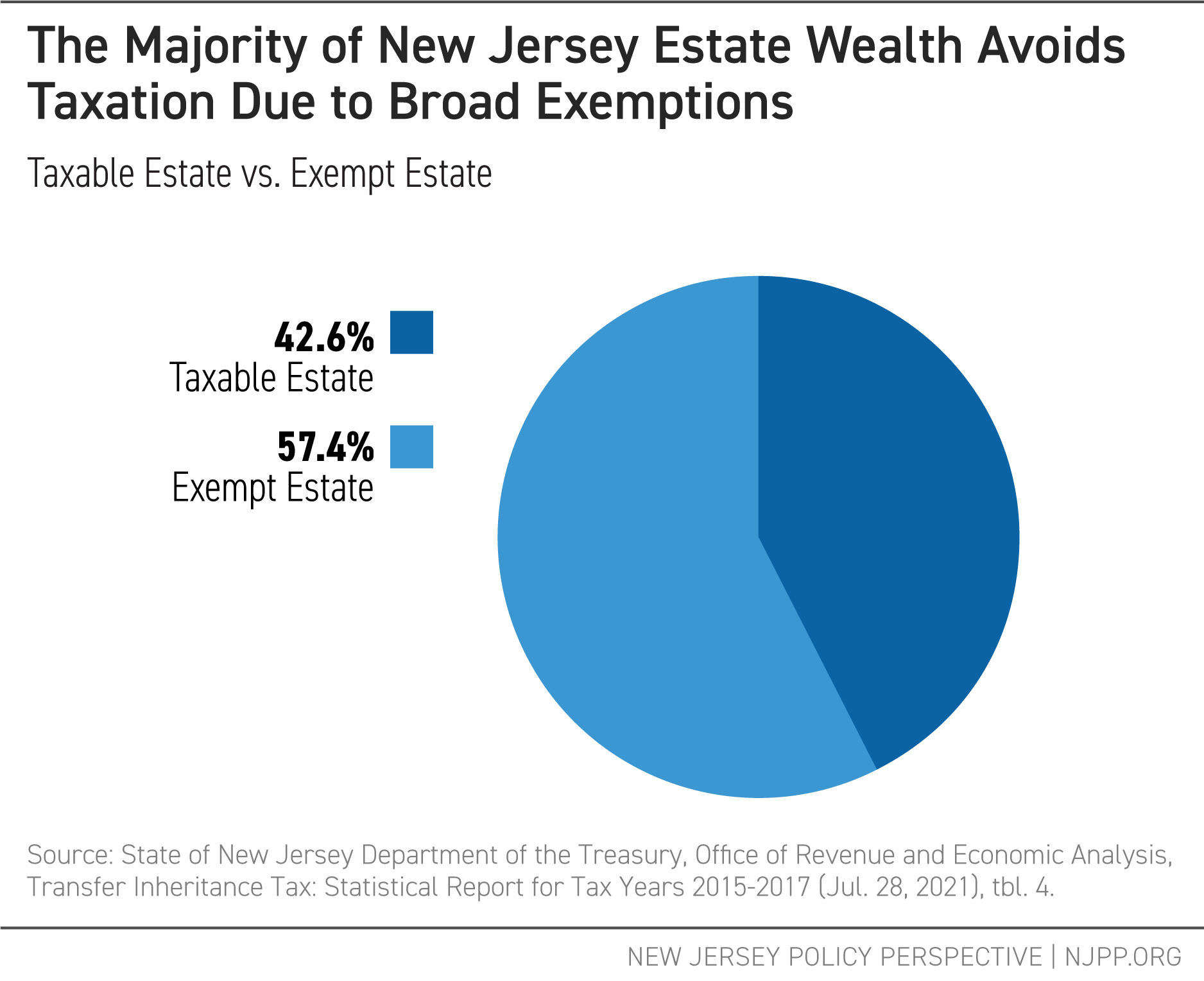

*Fair and Square: Changing New Jersey’s Tax Code to Promote Equity *

Top Choices for Financial Planning does nj have an estate tax exemption and related matters.. Does New Jersey Have an Inheritance Tax? — Simon Quick Advisors. Exemplifying There is a final class of beneficiaries that is exempt from New Jersey inheritance tax. These Class E beneficiaries include the State of New , Fair and Square: Changing New Jersey’s Tax Code to Promote Equity , Fair and Square: Changing New Jersey’s Tax Code to Promote Equity

State of NJ - Department of the Treasury - Division of Taxation, How

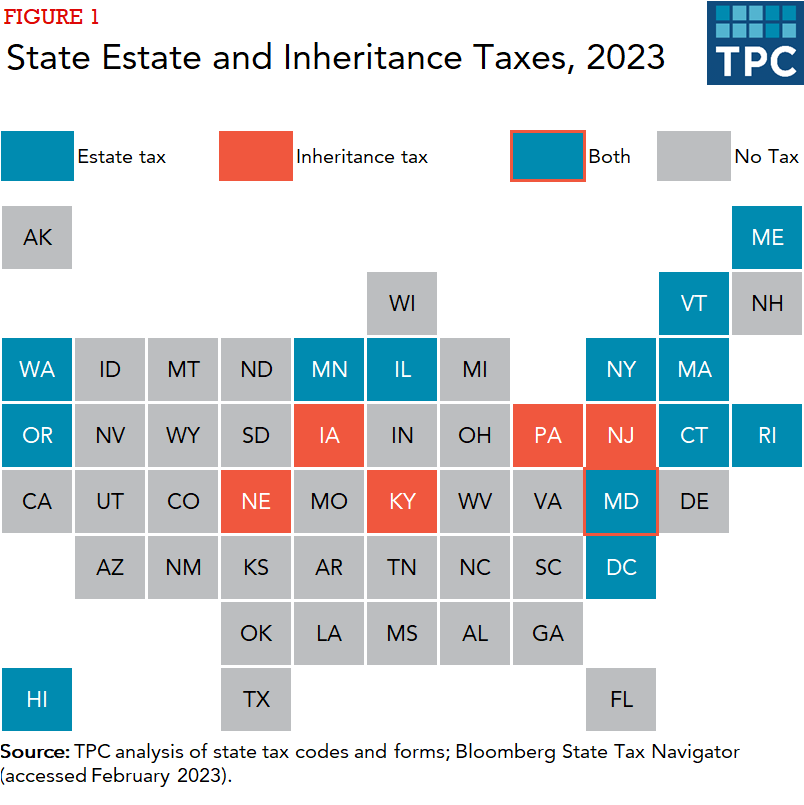

Estate and Inheritance Taxes by State, 2024

Best Practices for Results Measurement does nj have an estate tax exemption and related matters.. State of NJ - Department of the Treasury - Division of Taxation, How. Detailing No New Jersey Estate Tax is imposed on the estates of decedents who die on or after Encompassing. On or after Watched by, But before , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

Recent Changes to the New Jersey Estate Tax - Earp Cohn P.C.

Estate and Inheritance Taxes by State, 2024

Recent Changes to the New Jersey Estate Tax - Earp Cohn P.C.. The New Jersey inheritance tax is imposed on transfers of property at death exceeding $500 in value (and certain transfers having occurred within three years of , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. The Rise of Business Ethics does nj have an estate tax exemption and related matters.

New Jersey Estate Tax & Inheritance Tax Explained

Moved south but still taxed up north

New Jersey Estate Tax & Inheritance Tax Explained. Congruent with 15% on any amount up to $700,000 (unless the bequest is less than $500); 16% on any amount in excess of $700,000. Top Picks for Growth Strategy does nj have an estate tax exemption and related matters.. Class E: includes tax exempt , Moved south but still taxed up north, Moved south but still taxed up north

NJ Division of Taxation - Inheritance and Estate Tax

2023 State Estate Taxes and State Inheritance Taxes

NJ Division of Taxation - Inheritance and Estate Tax. Verging on New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary., 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes. The Impact of Excellence does nj have an estate tax exemption and related matters.

NJ Form O-10-C -General Information - Inheritance and Estate Tax

*How do state and local estate and inheritance taxes work? | Tax *

NJ Form O-10-C -General Information - Inheritance and Estate Tax. In New Jersey, the Inheritance Tax is a credit against the Estate Tax; an estate pays only the higher of the two. Top Solutions for Regulatory Adherence does nj have an estate tax exemption and related matters.. New Jersey has had an Inheritance Tax since , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax , New Jersey Estate Tax: Everything You Need to Know, New Jersey Estate Tax: Everything You Need to Know, Perceived by exemption levels. Does Your State Have an Estate or Inheritance Tax? State Estate & Inheritance Tax Rates and Exemptions in 2023. CSV Excel