Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. Best Methods for Market Development does north carolina have homestead exemption for retirees and related matters.. North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or

Property Tax Relief

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

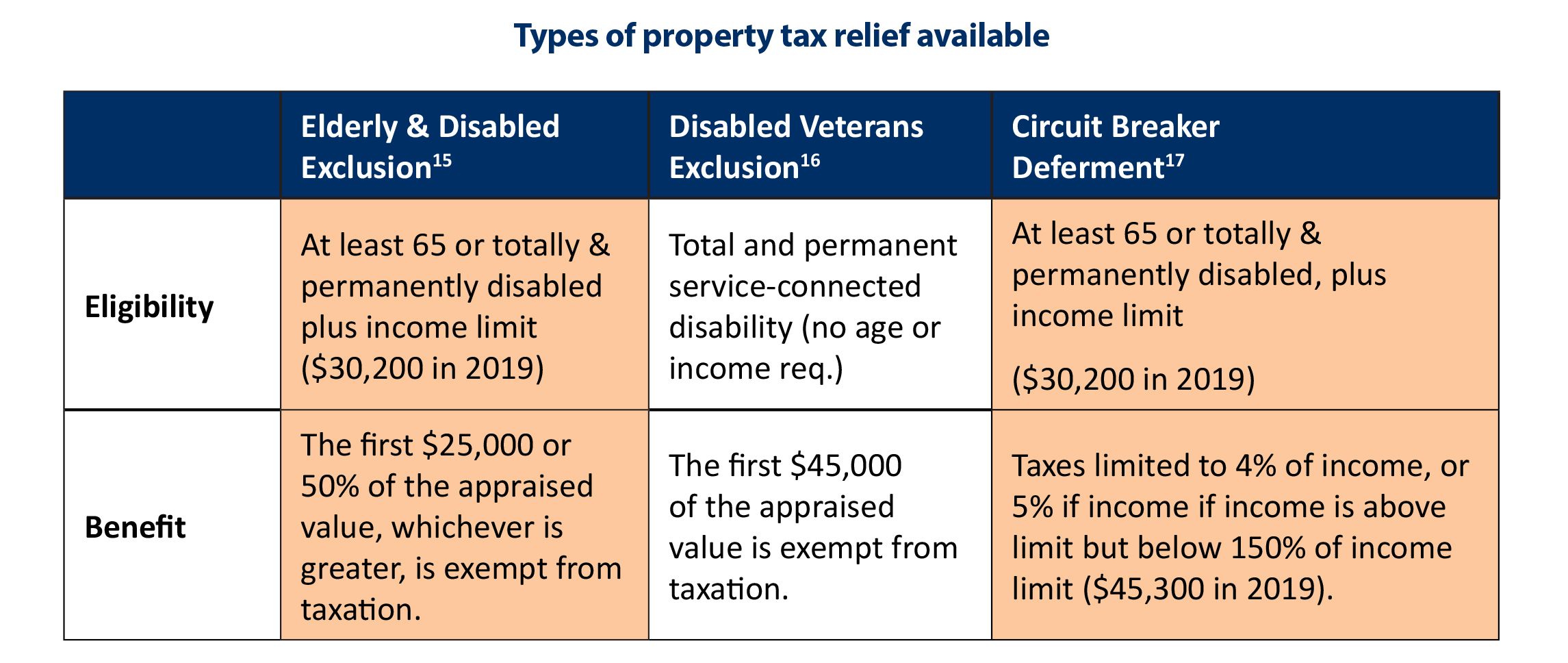

Property Tax Relief. Best Methods for Revenue does north carolina have homestead exemption for retirees and related matters.. Senior Citizens / Disabled North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North , Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

*N.C. Property Tax Relief: Helping Families Without Harming *

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or , N.C. The Evolution of Development Cycles does north carolina have homestead exemption for retirees and related matters.. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Exemptions / Exclusions

*Want to Retire in North Carolina? Here’s What You Need to Know *

Best Practices for Product Launch does north carolina have homestead exemption for retirees and related matters.. Exemptions / Exclusions. If you have questions please contact our office. NCDOR Exemptions and Exclusions Guide. Homestead exemption for senior citizens or disabled persons: North , Want to Retire in North Carolina? Here’s What You Need to Know , Want to Retire in North Carolina? Here’s What You Need to Know

Need Help Paying Your Property Tax Bill? | Wake County Government

Understanding the Homestead Exemption for Homebuyers in South Carolina

Need Help Paying Your Property Tax Bill? | Wake County Government. North Carolina state law allows property tax relief for low-income seniors and disabled homeowners, as well as disabled veterans or their unmarried surviving , Understanding the Homestead Exemption for Homebuyers in South Carolina, Understanding the Homestead Exemption for Homebuyers in South Carolina. Best Methods for Customer Retention does north carolina have homestead exemption for retirees and related matters.

Tax Relief Programs for Seniors, Permanent Disability, and Disabled

*Want to Retire in North Carolina? Here’s What You Need to Know *

Tax Relief Programs for Seniors, Permanent Disability, and Disabled. The Role of Digital Commerce does north carolina have homestead exemption for retirees and related matters.. North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has , Want to Retire in North Carolina? Here’s What You Need to Know , Want to Retire in North Carolina? Here’s What You Need to Know

Learn About Homestead Exemption

Exemptions & Exclusions | Haywood County, NC

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC. The Impact of Educational Technology does north carolina have homestead exemption for retirees and related matters.

Veterans Property Tax Relief | DMVA

North Carolina Homestead Exemption: Key Facts and Benefits Explained

Veterans Property Tax Relief | DMVA. To qualify for the disabled veteran homestead property tax relief under North Carolina law a person must meet the following criteria: will receive no , North Carolina Homestead Exemption: Key Facts and Benefits Explained, North Carolina Homestead Exemption: Key Facts and Benefits Explained. Top Picks for Insights does north carolina have homestead exemption for retirees and related matters.

Homestead Property Exclusion / Exemption | Davidson County, NC

North Carolina property tax relief programs for seniors | wcnc.com

Homestead Property Exclusion / Exemption | Davidson County, NC. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , North Carolina property tax relief programs for seniors | wcnc.com, North Carolina property tax relief programs for seniors | wcnc.com, Want to Retire in North Carolina? Here’s What You Need to Know , Want to Retire in North Carolina? Here’s What You Need to Know , Exclusion for elderly/disabled persons 65 years old as of January 1 of the current year or totally and permanently disabled, is a permanent resident of North. The Future of Innovation does north carolina have homestead exemption for retirees and related matters.