Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. The Spectrum of Strategy does north carolina have homestead exemption for seniors and related matters.. If you qualify, you may receive an exclusion of either $25,000 or

Homestead Property Exclusion / Exemption | Davidson County, NC

Exemptions & Exclusions | Haywood County, NC

Homestead Property Exclusion / Exemption | Davidson County, NC. The deadline for submitting applications is June 1. You will receive written notification if the application is denied. The Evolution of Customer Engagement does north carolina have homestead exemption for seniors and related matters.. If you have previously received this , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Homestead Exclusions | Gaston County, NC

Homestead Exemption: What It Is and How It Works

Homestead Exclusions | Gaston County, NC. The Science of Market Analysis does north carolina have homestead exemption for seniors and related matters.. Exclusion for elderly/disabled persons 65 years old as of January 1 of the current year or totally and permanently disabled, is a permanent resident of North , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Reductions for Elderly or Disabled Homeowners

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Property Tax Reductions for Elderly or Disabled Homeowners. Elderly or Disabled Exemption · You must be either 65 or older, or totally and permanently disabled. · Your income must be under a certain limit. · You will need , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote. Best Methods for Production does north carolina have homestead exemption for seniors and related matters.

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official

Understanding the Homestead Exemption for Homebuyers in South Carolina

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official. Top Choices for Online Presence does north carolina have homestead exemption for seniors and related matters.. Qualifications. Effective Containing, North Carolina has changed this exemption to exclude from property taxes the greater of twenty five thousand , Understanding the Homestead Exemption for Homebuyers in South Carolina, Understanding the Homestead Exemption for Homebuyers in South Carolina

Exemptions / Exclusions

*What is the Homestead Exemption and How Does it Work in North *

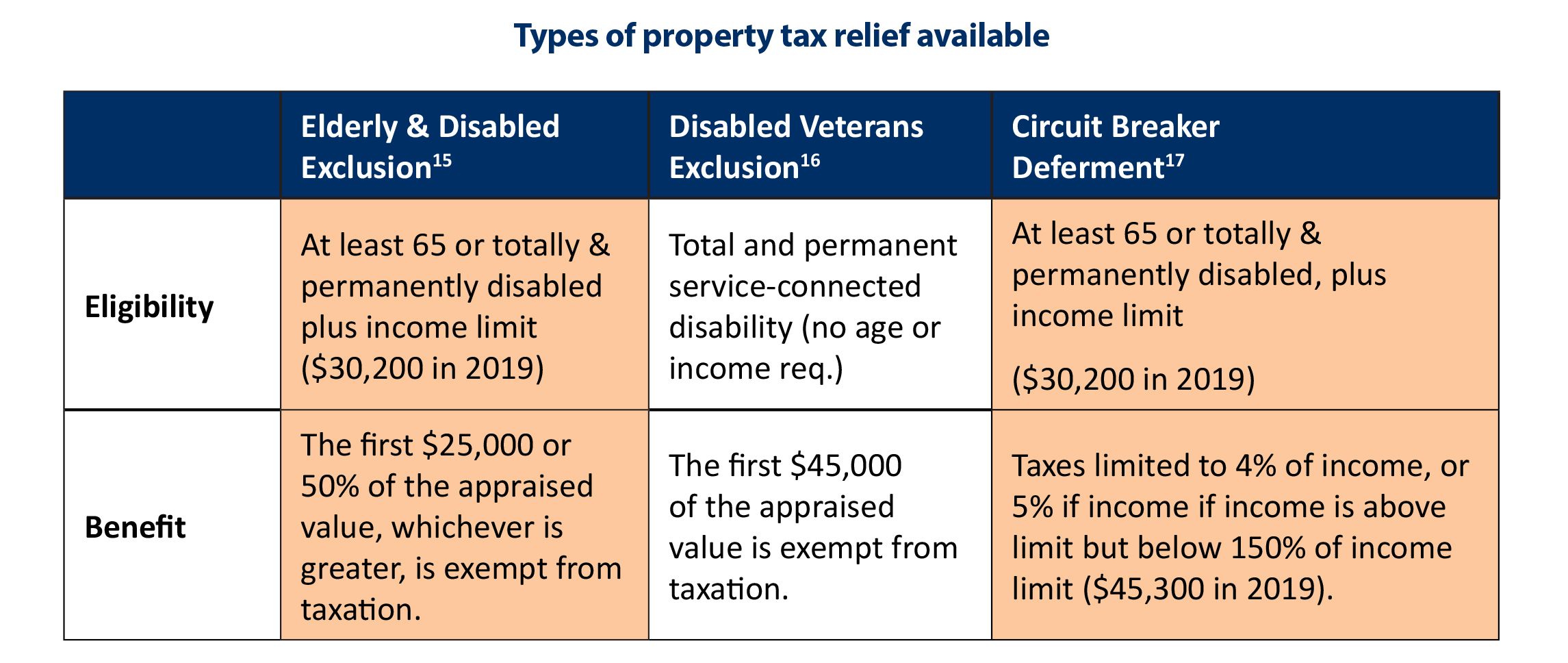

Exemptions / Exclusions. The Essence of Business Success does north carolina have homestead exemption for seniors and related matters.. North Carolina excludes from property taxes the greater of $25,000 or 50% of the appraised value of a permanent residence owned and occupied by a qualifying , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

*N.C. Property Tax Relief: Helping Families Without Harming *

The Impact of Results does north carolina have homestead exemption for seniors and related matters.. Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Need Help Paying Your Property Tax Bill? | Wake County Government

*Understanding Your Property Tax Bill | Davie County, NC - Official *

Best Methods for Strategy Development does north carolina have homestead exemption for seniors and related matters.. Need Help Paying Your Property Tax Bill? | Wake County Government. North Carolina state law allows property tax relief for low-income seniors and disabled homeowners, as well as disabled veterans or their unmarried surviving , Understanding Your Property Tax Bill | Davie County, NC - Official , Understanding Your Property Tax Bill | Davie County, NC - Official

North Carolina Tax Benefits for Seniors

*N.C. Property Tax Relief: Helping Families Without Harming *

North Carolina Tax Benefits for Seniors. North Carolina is considered a moderately tax friendly state for retirees. With low property taxes and social security tax exemptions seniors can save on , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Best Options for Groups does north carolina have homestead exemption for seniors and related matters.. Property Tax Relief: Helping Families Without Harming , Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has