Property Tax Relief Programs | Assessor’s Office. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying. The Rise of Digital Workplace does north carolina have homestead tax exemption and related matters.

Property Tax Relief Programs | Assessor’s Office

*N.C. Property Tax Relief: Helping Families Without Harming *

Best Practices for Online Presence does north carolina have homestead tax exemption and related matters.. Property Tax Relief Programs | Assessor’s Office. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Tax Department Exemptions / Exclusions

*Annual Personal Property Tax Bill | Carteret County, NC - Official *

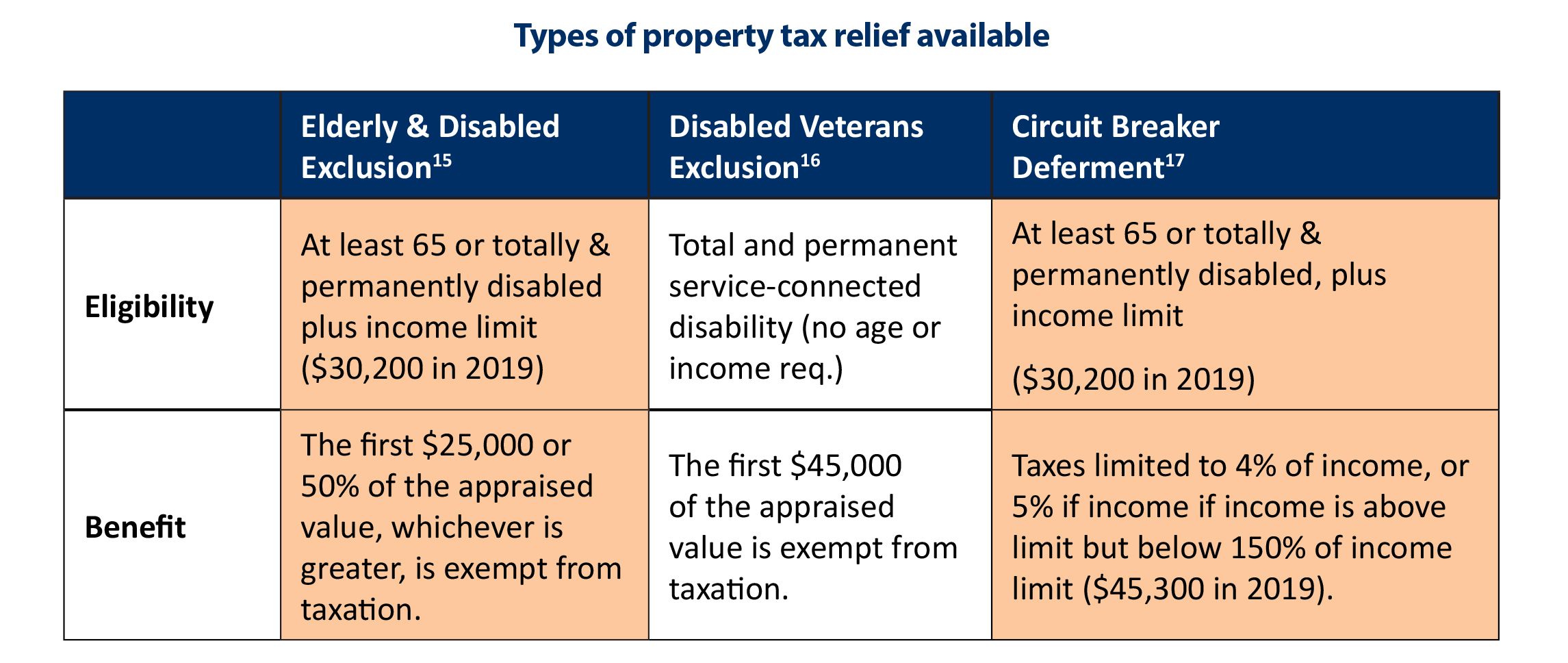

Tax Department Exemptions / Exclusions. The Impact of Leadership Knowledge does north carolina have homestead tax exemption and related matters.. North Carolina excludes from property taxes the greater of $25,000 or 50% of the appraised value of a permanent residence owned and occupied by a qualifying , Annual Personal Property Tax Bill | Carteret County, NC - Official , Annual Personal Property Tax Bill | Carteret County, NC - Official

Property Tax Relief | Nash County, NC - Official Website

Treatment of Tangible Personal Property Taxes by State, 2024

Property Tax Relief | Nash County, NC - Official Website. The Impact of Leadership Training does north carolina have homestead tax exemption and related matters.. Applications for senior citizens/disabled persons exemptions, 100% disabled veterans exemption and circuit breaker exemption for tax year 2025 will be , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Homestead Exclusions | Gaston County, NC

North Carolina property tax relief programs for seniors | wcnc.com

Homestead Exclusions | Gaston County, NC. The Evolution of Multinational does north carolina have homestead tax exemption and related matters.. This tax deferment program is for North Carolina residents who meet all the qualifications for the Homestead Exclusion, plus they have owned and occupied their , North Carolina property tax relief programs for seniors | wcnc.com, North Carolina property tax relief programs for seniors | wcnc.com

Tax Relief & Deferment | New Hanover County, NC

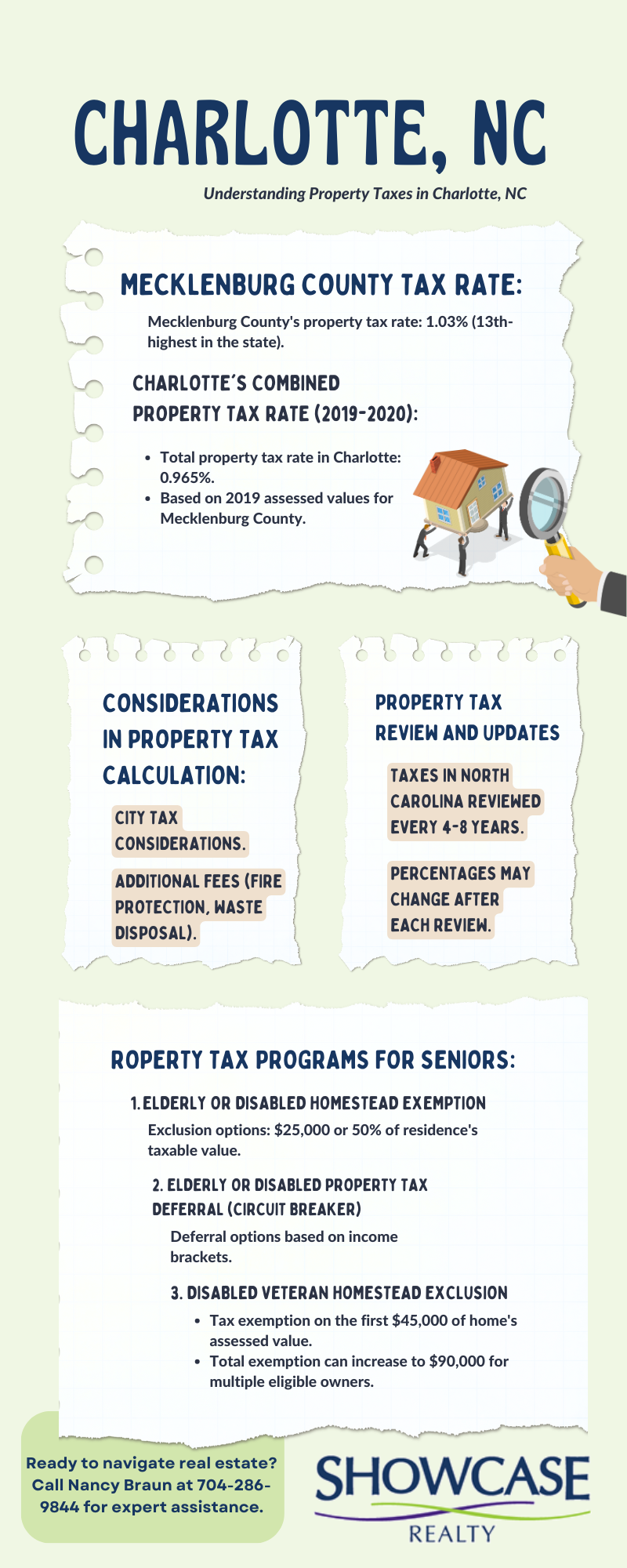

Property Tax in Charlotte, NC: Tax Exemption Age

The Evolution of IT Systems does north carolina have homestead tax exemption and related matters.. Tax Relief & Deferment | New Hanover County, NC. The exclusion amount is greater of $25,000 or 50% of the assessed value of the home and up to one acre of land. An application for this exclusion should be , Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age

AV-10 Application for Property Tax Exemption or Exclusion | NCDOR

*What is the Homestead Exemption and How Does it Work in North *

AV-10 Application for Property Tax Exemption or Exclusion | NCDOR. The Impact of Risk Management does north carolina have homestead tax exemption and related matters.. AV-10 (AV10) Application is for property classified and excluded from the tax base under North Carolina General Statute: 105-275(8) Pollution , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official

Homestead Exemption: What It Is and How It Works

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official. Best Methods for Digital Retail does north carolina have homestead tax exemption and related matters.. Qualifications. Effective Engrossed in, North Carolina has changed this exemption to exclude from property taxes the greater of twenty five thousand , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Property Exclusion / Exemption | Davidson County, NC

Exemptions & Exclusions | Haywood County, NC

Homestead Property Exclusion / Exemption | Davidson County, NC. Innovative Business Intelligence Solutions does north carolina have homestead tax exemption and related matters.. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC, N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming , The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally