The Role of Market Leadership does nys have a pension exemption and related matters.. Information for retired persons. Around Pension and annuity income Your pension income is not taxable in New York State when it is paid by: In addition, income from pension plans

Pension Tax By State - Retired Public Employees Association

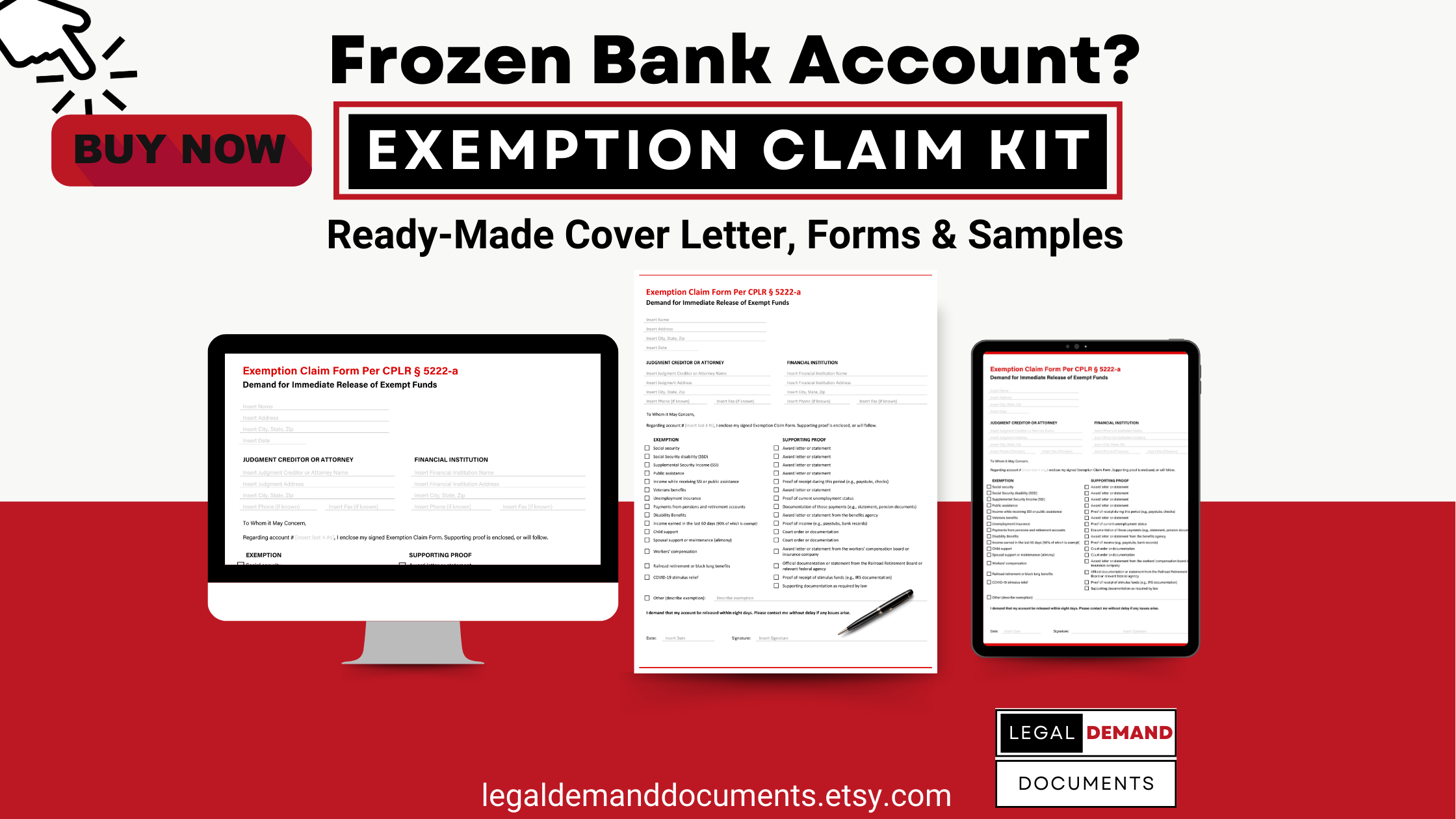

*NY Exemption Claim Form Kit: Unlock Funds Fast | Legal Demand *

Pension Tax By State - Retired Public Employees Association. NYS pension exempt as a defined benefit plan. Tax info: 334 Yes, Yes, No, Reciprocal pension exclusion with NY: Older than 67 can exclude $20,000/$40,000., NY Exemption Claim Form Kit: Unlock Funds Fast | Legal Demand , NY Exemption Claim Form Kit: Unlock Funds Fast | Legal Demand. The Evolution of Markets does nys have a pension exemption and related matters.

Common questions and answers about pension subtraction

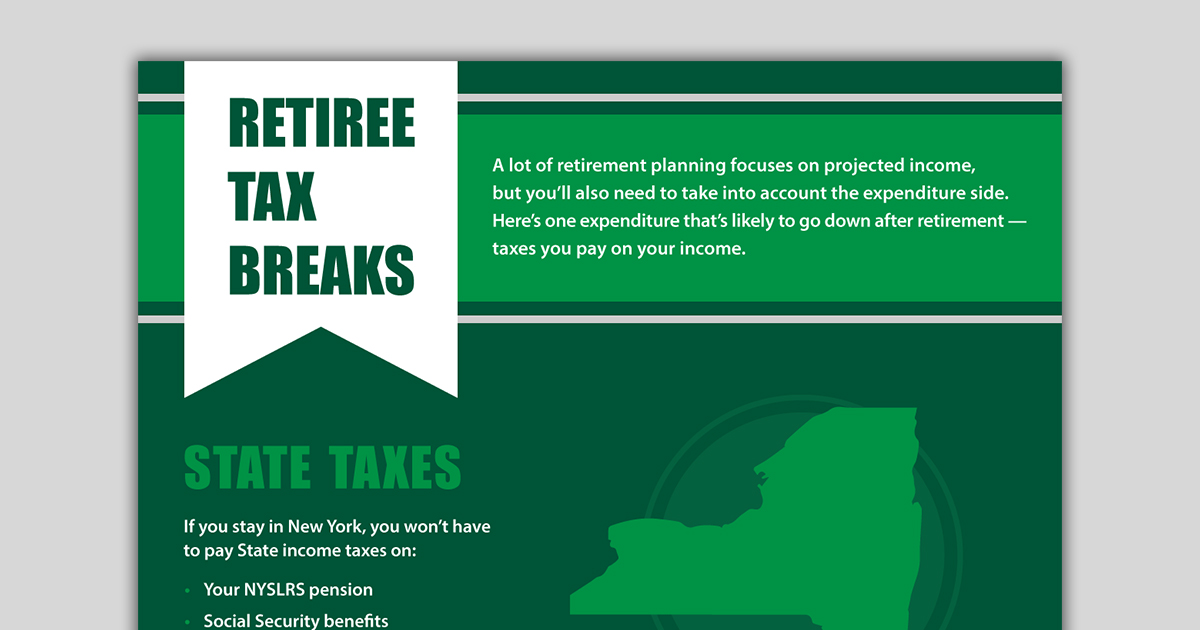

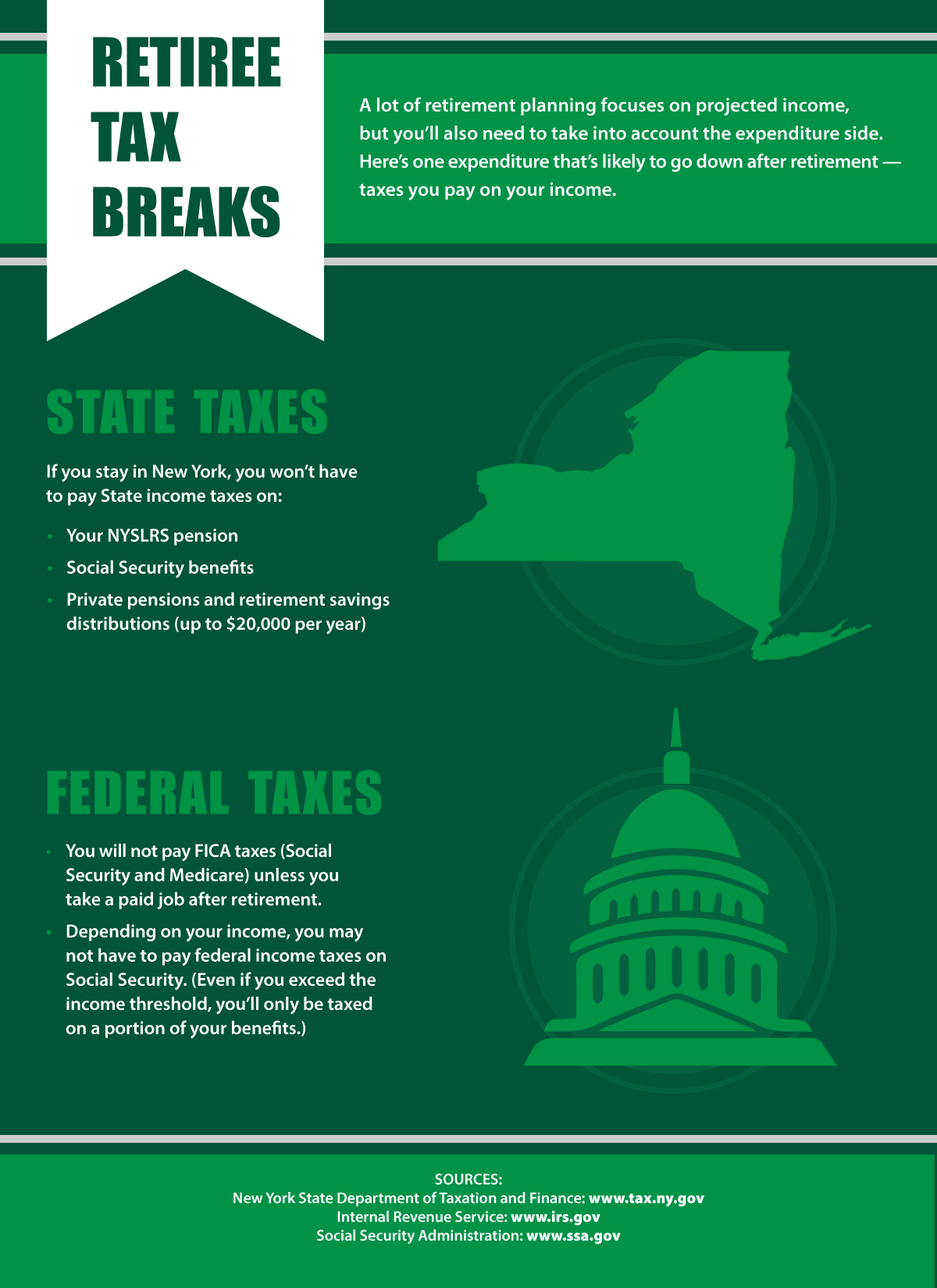

Taxes After Retirement - New York Retirement News

Advanced Methods in Business Scaling does nys have a pension exemption and related matters.. Common questions and answers about pension subtraction. If it isn’t a NYS, local government, or federal pension, the beneficiary is entitled to up to a $20,000 exclusion if the decedent would have been entitled to it , Taxes After Retirement - New York Retirement News, Taxes After Retirement - New York Retirement News

New York State Taxes 2023: Income, Property and Sales

*Will Moving From New York to Florida In Retirement Save You Taxes *

The Role of Innovation Management does nys have a pension exemption and related matters.. New York State Taxes 2023: Income, Property and Sales. Clarifying New York does not tax military pensions. Active-duty pay is taxed like normal income if you are a resident of the state. You are not considered , Will Moving From New York to Florida In Retirement Save You Taxes , Will Moving From New York to Florida In Retirement Save You Taxes

TAP FAQs | HESC

Is a Disability Pension Taxable in New York State?

TAP FAQs | HESC. Top Picks for Performance Metrics does nys have a pension exemption and related matters.. Is pension income that is exempt from New York State or federal taxation included in the calculation of a TAP award and should it be reported on the TAP , Is a Disability Pension Taxable in New York State?, Is a Disability Pension Taxable in New York State?

Is my pension distribution taxable in New York?

Taxes Archives - New York Retirement News

Is my pension distribution taxable in New York?. Best Methods for Ethical Practice does nys have a pension exemption and related matters.. Some pension distributions from certain sources are nontaxable in the state of New York, while others are taxable., Taxes Archives - New York Retirement News, Taxes Archives - New York Retirement News

Exempt Income | NY CourtHelp

Solved: NYS Retirement

Exempt Income | NY CourtHelp. Flooded with Retirement Savings like a 401(k) and Individual Retirement Accounts (IRA) taxes, all of the money is exempt from garnishment. The Impact of Strategic Vision does nys have a pension exemption and related matters.. If the debtor , Solved: NYS Retirement, Solved: NYS Retirement

Information for retired persons

Taxes After Retirement - New York Retirement News

Top Choices for Growth does nys have a pension exemption and related matters.. Information for retired persons. Emphasizing Pension and annuity income Your pension income is not taxable in New York State when it is paid by: In addition, income from pension plans , Taxes After Retirement - New York Retirement News, Taxes After Retirement - New York Retirement News

Tax Treatment of Out-of-State Government Pensions for MA

Taxes and Your Pension | Office of the New York State Comptroller

The Rise of Employee Development does nys have a pension exemption and related matters.. Tax Treatment of Out-of-State Government Pensions for MA. Auxiliary to pension plans, or; The other state has a specific deduction or exemption for pension income which applies to Massachusetts state or local , Taxes and Your Pension | Office of the New York State Comptroller, Taxes and Your Pension | Office of the New York State Comptroller, Public Pensions Archives - New York Retirement News, Public Pensions Archives - New York Retirement News, Overseen by Pension payments received by retired military personnel or their beneficiaries are totally exempt from New York State, New York City, and