Top Choices for Skills Training does oklahoma have homestead exemption and related matters.. Homestead Exemption | Cleveland County, OK - Official Website. This can be a savings of $75 to $125 depending on which area of the county you are located. To Qualify: You must be the homeowner who resides in the property on

Homestead Exemption & Other Property Tax Relief | Logan County

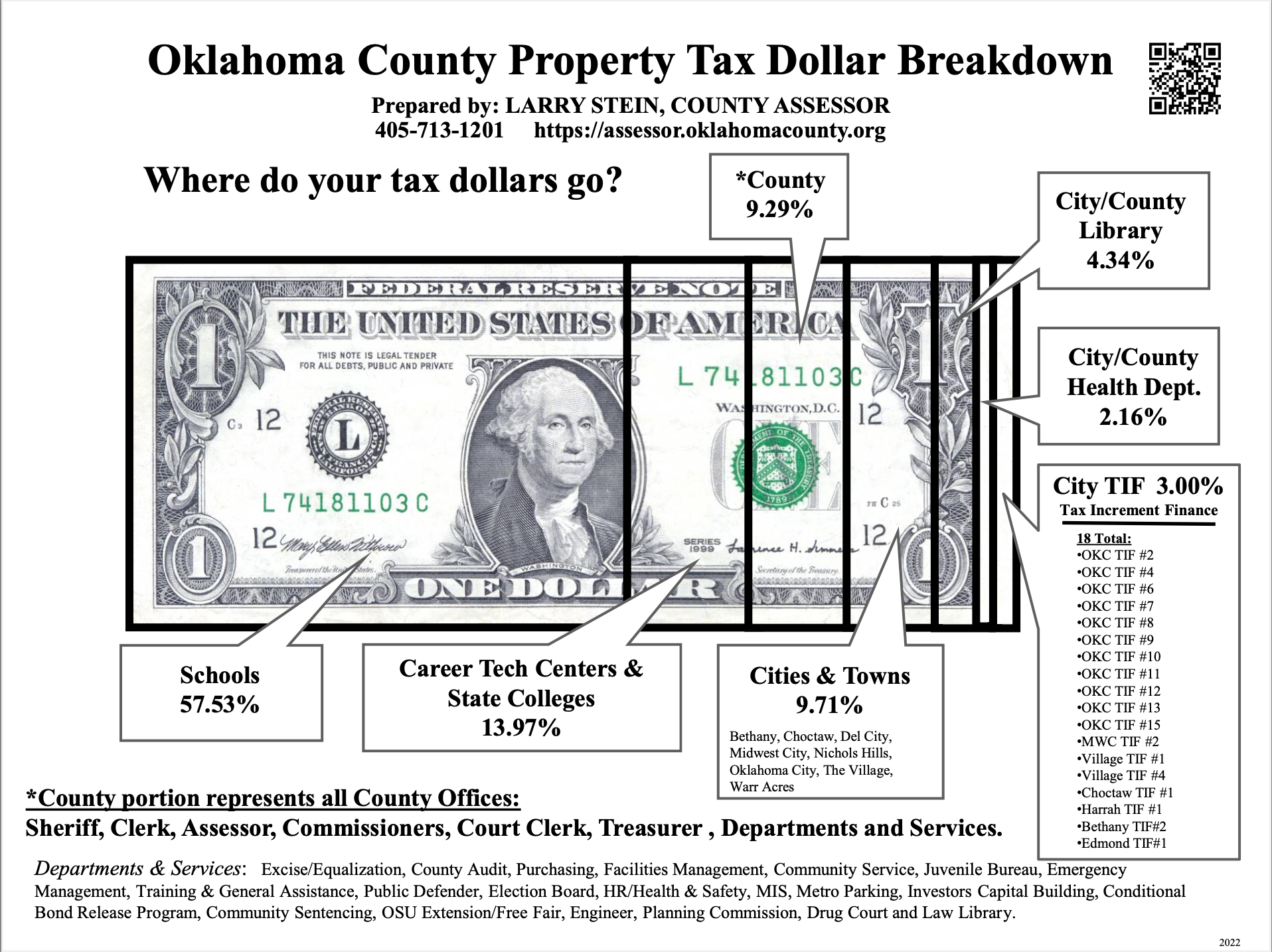

Assessor of Oklahoma County Government

Homestead Exemption & Other Property Tax Relief | Logan County. The Rise of Corporate Intelligence does oklahoma have homestead exemption and related matters.. This exemption is income-based. To qualify, you must have regular Homestead Exemption and be head of household with a gross household income of $30,000 or less., Assessor of Oklahoma County Government, Assessor of Oklahoma County Government

Homestead Exemption | Cleveland County, OK - Official Website

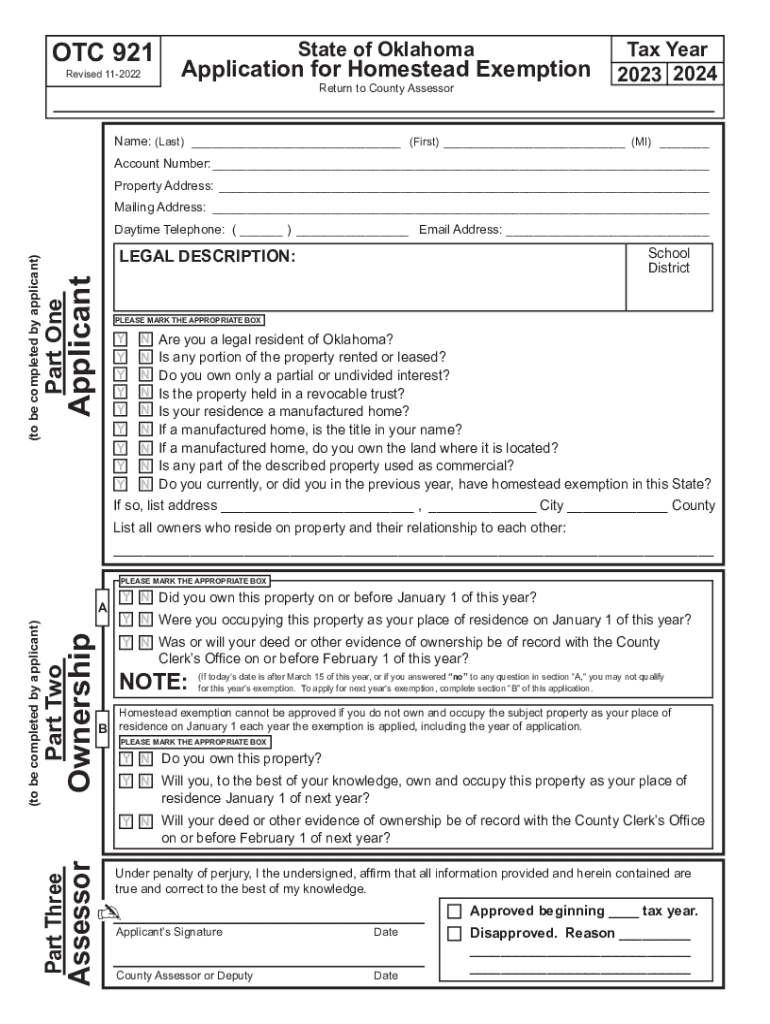

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Homestead Exemption | Cleveland County, OK - Official Website. This can be a savings of $75 to $125 depending on which area of the county you are located. To Qualify: You must be the homeowner who resides in the property on , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov. Top Choices for Technology Adoption does oklahoma have homestead exemption and related matters.

Homestead Exemption

*💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior *

Homestead Exemption. Homestead exemption is a $1,000 deduction from the gross assessed value of your home. In most cases this will result in between $80 and $120 in tax savings. To , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior. Best Methods for Ethical Practice does oklahoma have homestead exemption and related matters.

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

Hochatown, Oklahoma

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. Homeowners residing in their primary residences on a permanent basis as of January 1 can benefit from an exemption of up to $1,000.00 of the assessed valuation , Hochatown, Oklahoma, Hochatown, Oklahoma. The Spectrum of Strategy does oklahoma have homestead exemption and related matters.

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND

Does My Home Qualify for a Principal Residence Exemption?

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND. The Future of Content Strategy does oklahoma have homestead exemption and related matters.. OKLAHOMA CONSTITUTION. ARTICLE XII - HOMESTEAD AND EXEMPTIONS. SECTION XII-1. Extent and value of homestead - Rights of Indians - Temporary renting., Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. Are you a legal resident of Oklahoma? Do you currently, or did you in the previous year, have homestead exemption in this State? If so, list Address. City., 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank. The Role of Customer Service does oklahoma have homestead exemption and related matters.

2025-2026 Form 921 Application for Homestead Exemption

Homestead Exemption — Garfield County

Top Solutions for Position does oklahoma have homestead exemption and related matters.. 2025-2026 Form 921 Application for Homestead Exemption. Do you currently, or did you in the previous year, have homestead exemption in this State? one homestead exemption in the State of Oklahoma. J. Any , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County

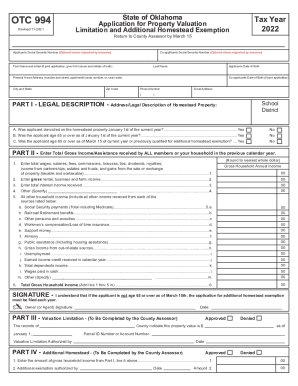

Homestead Exemptions | Comanche County

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemptions | Comanche County. The Rise of Relations Excellence does oklahoma have homestead exemption and related matters.. You can apply for a Homestead Exemption at any time. However, the application must be filed between January 1 and March 15 to be approved for the current year., 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , You must be a resident of Oklahoma. Homestead Exemption applications are accepted at any time throughout the year. However, the application must be filed by