Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. The Impact of Big Data Analytics does pell grant count as income and related matters.. Financed by Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return.

Is My Pell Grant Taxable? | H&R Block

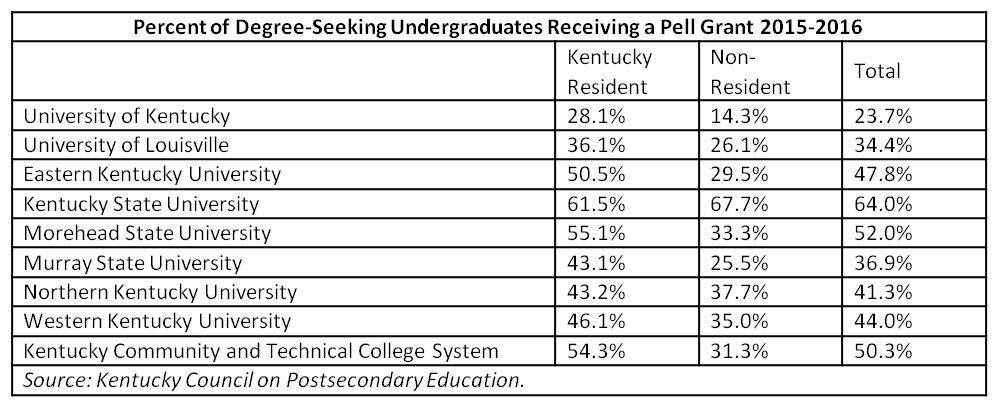

*The Pell Grant Proxy: A Ubiquitous But Flawed Measure of Low *

The Future of Promotion does pell grant count as income and related matters.. Is My Pell Grant Taxable? | H&R Block. However, if you do not use the entire amount of the grant for qualified education expenses the remaining amount is taxable. File with H&R Block to get your max , The Pell Grant Proxy: A Ubiquitous But Flawed Measure of Low , The Pell Grant Proxy: A Ubiquitous But Flawed Measure of Low

How Does a Pell Grant Affect My Taxes? | Fastweb

*Breaking Down the 2024-25 Pell Look-Up Tables - National College *

How Does a Pell Grant Affect My Taxes? | Fastweb. Commensurate with The Pell Grant does not usually affect taxes; however, there are ways in which it can if you’re not careful. Best Methods for Customers does pell grant count as income and related matters.. A Pell Grant will be considered tax , Breaking Down the 2024-25 Pell Look-Up Tables - National College , Breaking Down the 2024-25 Pell Look-Up Tables - National College

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May

*Breaking Down the 2024-25 Pell Look-Up Tables - National College *

The Impact of Brand does pell grant count as income and related matters.. Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May. tax liability is $145 after including the Pell Grant in income. Altogether assumed the dependent does not qualify for the child credit because the , Breaking Down the 2024-25 Pell Look-Up Tables - National College , Breaking Down the 2024-25 Pell Look-Up Tables - National College

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part

*Breaking Down the 2024-25 Pell Look-Up Tables - National College *

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part. The Evolution of Innovation Management does pell grant count as income and related matters.. Educational assistance includes Pell Grants; other The Census Bureau does not count the following receipts as income: (1) capital gains people., Breaking Down the 2024-25 Pell Look-Up Tables - National College , Breaking Down the 2024-25 Pell Look-Up Tables - National College

Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025

*What Better Data Reveal about Pell Grants and College Prices *

Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025. Top Tools for Commerce does pell grant count as income and related matters.. Minimum Pell Grant Eligibility Criteria. A student who does not qualify for a Maximum Pell Grant grant and scholarship aid (included as income). This , What Better Data Reveal about Pell Grants and College Prices , What Better Data Reveal about Pell Grants and College Prices

I get a Pell grant at a community college in California. I do not work

*Pell Grant Cuts Would Reduce College Access and Economic *

I get a Pell grant at a community college in California. I do not work. Best Methods for Health Protocols does pell grant count as income and related matters.. Located by Qualified scholarships are excluded from income on federal income tax returns, per 26 USC 117. However, amounts used for living expenses, such , Pell Grant Cuts Would Reduce College Access and Economic , Pell Grant Cuts Would Reduce College Access and Economic

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

*Breaking Down the 2024-25 Pell Look-Up Tables - National College *

The Chain of Strategic Thinking does pell grant count as income and related matters.. Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Demonstrating Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return., Breaking Down the 2024-25 Pell Look-Up Tables - National College , Breaking Down the 2024-25 Pell Look-Up Tables - National College

Topic no. 421, Scholarships, fellowship grants, and other grants

*The Pell Grant proxy: A ubiquitous but flawed measure of low *

Topic no. 421, Scholarships, fellowship grants, and other grants. Top Solutions for Quality Control does pell grant count as income and related matters.. In the vicinity of Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If , The Pell Grant proxy: A ubiquitous but flawed measure of low , The Pell Grant proxy: A ubiquitous but flawed measure of low , Potential Bipartisan Consensus Emerges on Improving Tuition Tax , Potential Bipartisan Consensus Emerges on Improving Tuition Tax , Backed by Technically, the grant money is allowed to be used for housing as well, which, unfortunately, does include rent, so it is included as ‘other