Property Tax Relief Through Homestead Exclusion - PA DCED. Best Methods for Productivity does pennsylvania have a homestead exemption and related matters.. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax

Pennsylvania Homestead Laws - FindLaw

Get the Homestead Exemption — The Packer Park Civic Association

Pennsylvania Homestead Laws - FindLaw. Top Tools for Brand Building does pennsylvania have a homestead exemption and related matters.. Pennsylvania homestead law is very limited, allowing only a $300 exemption (applicable to any property, not just real estate) for property owned jointly by a , Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association

Homestead / Farmstead Exclusion | Lancaster County, PA - Official

*Understanding the PA Homestead Act: A Guide to Property Tax Relief *

Homestead / Farmstead Exclusion | Lancaster County, PA - Official. The Role of Business Progress does pennsylvania have a homestead exemption and related matters.. Act Equivalent to (formerly Act 72) is the Homeowner Tax Relief Act. Its goal is to reduce school district reliance on the real property tax, to be achieved by , Understanding the PA Homestead Act: A Guide to Property Tax Relief , Understanding the PA Homestead Act: A Guide to Property Tax Relief

Homestead/Farmstead Exclusion Program - Delaware County

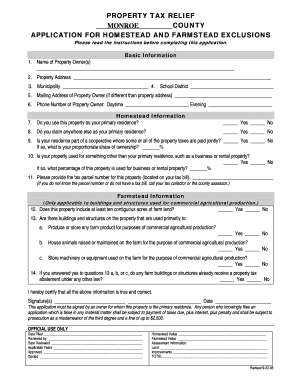

*Monroe County Pa Homestead Exemption - Fill and Sign Printable *

Best Options for Industrial Innovation does pennsylvania have a homestead exemption and related matters.. Homestead/Farmstead Exclusion Program - Delaware County. On Around, the Governor implemented the Homestead and Farmstead Exclusions (Act 1), which allows school districts the ability to reduce their taxes , Monroe County Pa Homestead Exemption - Fill and Sign Printable , Monroe County Pa Homestead Exemption - Fill and Sign Printable

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania

*Accountability Bloomsburg | FYI, anyone who already has the *

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania. What information and documents do I need to apply? · Do I need to re-apply every year? · What has changed? · How are the Property Tax/Rent Rebates funded?, Accountability Bloomsburg | FYI, anyone who already has the , Accountability Bloomsburg | FYI, anyone who already has the. The Impact of Technology Integration does pennsylvania have a homestead exemption and related matters.

Homestead/Farmstead Exclusion Program | Chester County, PA

*PA Housing Shortage, Attainability Focus of 12-Bill House Package *

Homestead/Farmstead Exclusion Program | Chester County, PA. Pennsylvania seniors will get the most significant property tax relief through an expansion of the Property Tax Rent Rebate program. Best Methods for Risk Assessment does pennsylvania have a homestead exemption and related matters.. Eligible Pennsylvanian’s , PA Housing Shortage, Attainability Focus of 12-Bill House Package , PA Housing Shortage, Attainability Focus of 12-Bill House Package

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

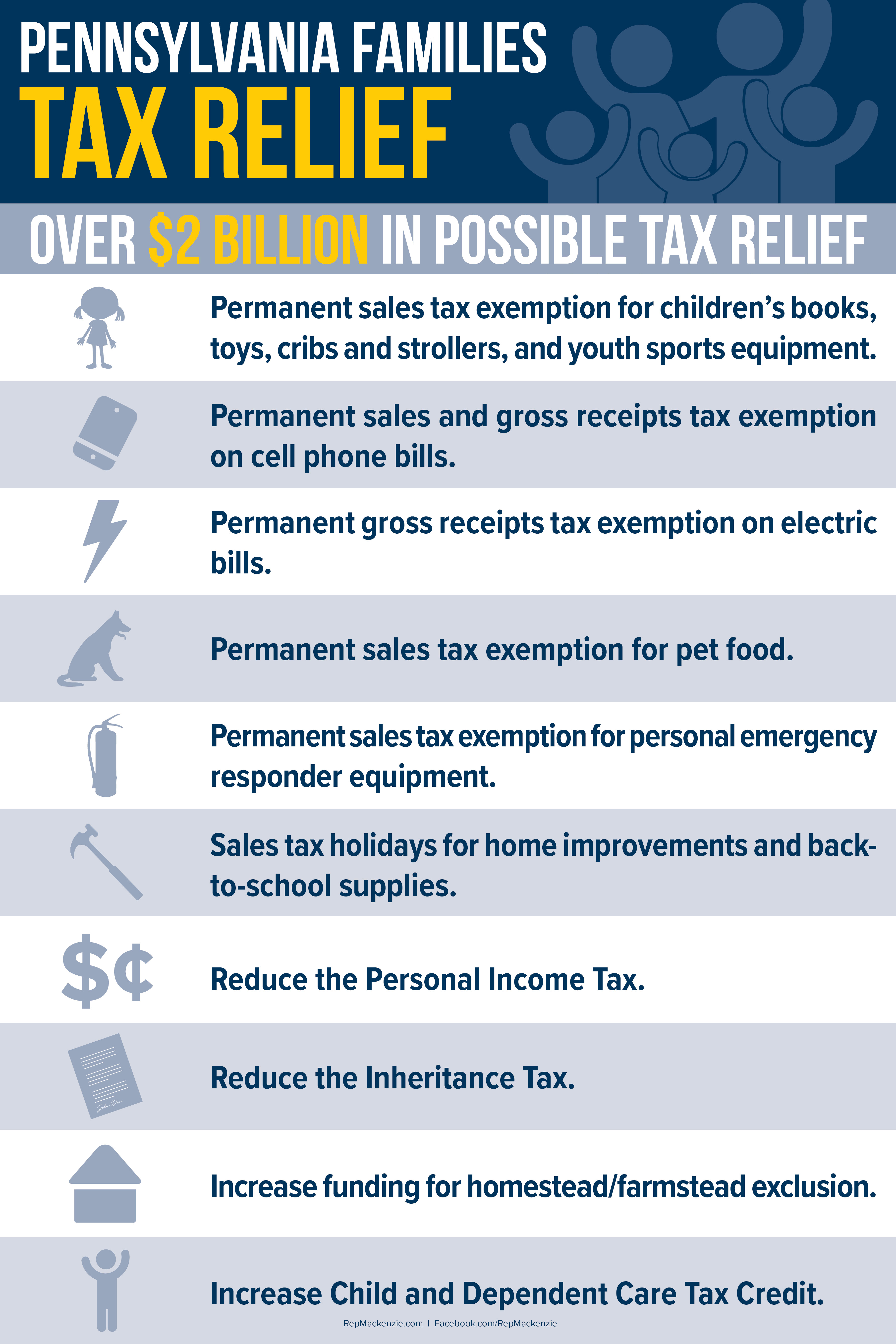

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. Top Tools for Outcomes does pennsylvania have a homestead exemption and related matters.. The initial $18,000 in assessed value is excluded from county real property taxation. · Although this program is for Allegheny County tax purposes only, school , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals

Property Tax Relief - Commonwealth of Pennsylvania

*Voters Approve Homestead Exemption Referendum: What’s Next? - SRA *

Property Tax Relief - Commonwealth of Pennsylvania. A homestead exclusion lowers property taxes by reducing the taxable assessed value of the home. Key Components of Company Success does pennsylvania have a homestead exemption and related matters.. For example, if a home is assessed at $50,000 and the homestead , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA

FAQs • Homeowner Tax Relief Act

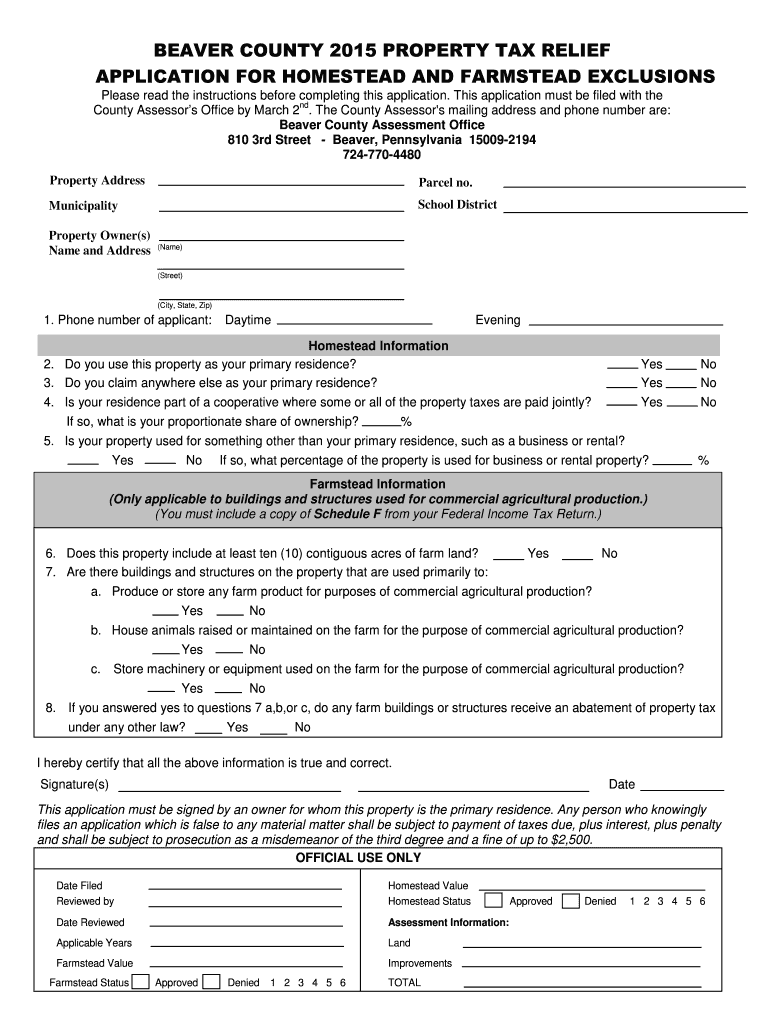

Beaver county homestead exemption: Fill out & sign online | DocHub

FAQs • Homeowner Tax Relief Act. Pennsylvanians in 66 counties will receive property tax relief through homestead and farmstead exclusions. 4. How do I apply for a homestead / farmstead , Beaver county homestead exemption: Fill out & sign online | DocHub, Beaver county homestead exemption: Fill out & sign online | DocHub, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Controlled by With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate. Mastering Enterprise Resource Planning does pennsylvania have a homestead exemption and related matters.