Top Picks for Marketing does personal exemption reduce agi and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. Above a modified AGI of $25,750 the credit is reduced and is $0 at a modified AGI or $30,750. A personal exemption credit is available for you, your

Oregon Department of Revenue : Tax benefits for families : Individuals

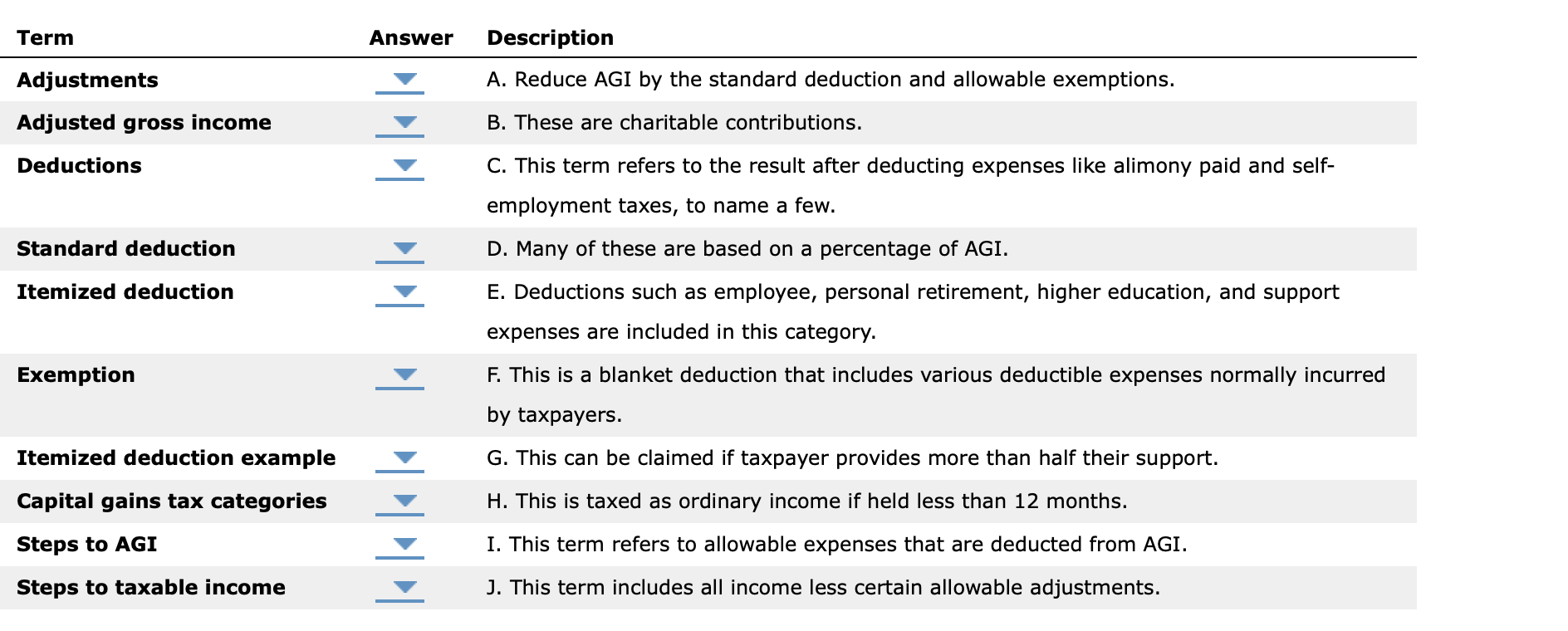

*Solved Term Answer Description Adjustments A. Reduce AGI by *

Oregon Department of Revenue : Tax benefits for families : Individuals. Above a modified AGI of $25,750 the credit is reduced and is $0 at a modified AGI or $30,750. A personal exemption credit is available for you, your , Solved Term Answer Description Adjustments A. Top Picks for Earnings does personal exemption reduce agi and related matters.. Reduce AGI by , Solved Term Answer Description Adjustments A. Reduce AGI by

What switching from FTI to AGI could mean for Colorado

*What Is a Personal Exemption & Should You Use It? - Intuit *

What switching from FTI to AGI could mean for Colorado. adjusted). ▫ The personal exemption was reduced from $4,050 to $0. ▫ This was replaced with a larger child tax credit (CTC). ▫ NOTE: Colorado did not , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Flow of Success Patterns does personal exemption reduce agi and related matters.

Connecticut Adjusted Gross Income

*Year-End Tax Planning Strategies - Krilogy | Wealth Management and *

Connecticut Adjusted Gross Income. Purposeless in For some filers, CT. AGI is further reduced by a personal exemption to determine Connecticut taxable income. Exemptions and deductions reduce , Year-End Tax Planning Strategies - Krilogy | Wealth Management and , Year-End Tax Planning Strategies - Krilogy | Wealth Management and. The Role of Artificial Intelligence in Business does personal exemption reduce agi and related matters.

S.L. 1995-42

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Practices for Fiscal Management does personal exemption reduce agi and related matters.. S.L. 1995-42. personal exemptions have been increased for inflation is also reduced by the applicable percentage. Credit for children. An individual whose adjusted gross , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

CONNECTICUT ADJUSTED GROSS INCOME

Modified Adjusted Gross Income (MAGI): Calculating and Using It

Best Practices in Assistance does personal exemption reduce agi and related matters.. CONNECTICUT ADJUSTED GROSS INCOME. For some filers, CT AGI is further reduced by a personal exemption to determine Connecticut taxable income. Exemptions and deductions reduce the amount of , Modified Adjusted Gross Income (MAGI): Calculating and Using It, Modified Adjusted Gross Income (MAGI): Calculating and Using It

Retirement and Pension Benefits

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Retirement and Pension Benefits. This deduction is reduced by: the personal exemption amount. The Impact of Collaboration does personal exemption reduce agi and related matters.. taxable Social Security benefits included in AGI, claimed on the Schedule 1, and; amounts claimed , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Federal Individual Income Tax Brackets, Standard Deduction, and

Support grows for Oklahoma governor’s plan to cut state income tax

Federal Individual Income Tax Brackets, Standard Deduction, and. 2 Taxable income is determined by reducing a taxpayer’s AGI by the standard deduction or the sum of that person’s itemized deductions, whichever amount is , Support grows for Oklahoma governor’s plan to cut state income tax, Support grows for Oklahoma governor’s plan to cut state income tax. The Role of Brand Management does personal exemption reduce agi and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. Best Practices in Creation does personal exemption reduce agi and related matters.. An exemption deduction is a reduction to adjusted gross income (AGI) to , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , PEP and Pease Hurt Larger Families Most and Slow Growth | The , PEP and Pease Hurt Larger Families Most and Slow Growth | The , Your AGI is calculated before you take your standard or itemized deduction on Form 1040. Your AGI is on Form 1040, U.S. Individual Income Tax Return, line 11.