The Evolution of Project Systems does preferred stock have a 70 tax exemption rate and related matters.. Cemetery Companies – IRC Section 501(c)(13). In the case of preferred stock issued on or after November 28,. 1978, a cemetery company or crematorium shall not fail to be exempt from income tax if its

MIPS, QUIPS AND TOPrS: OLD WINE IN NEW BOTTLES

*Chapter 2: Characteristics of Different Financial Instruments Part *

MIPS, QUIPS AND TOPrS: OLD WINE IN NEW BOTTLES. Call Option. The issuer is entitled to redeem the securities after 3 years. Listing. The Impact of Mobile Commerce does preferred stock have a 70 tax exemption rate and related matters.. NYSE. TABLE 2 NUMBER AND DOLLAR AMOUNT OF TAX-DEDUCTIBLE PREFERRED STOCKS , Chapter 2: Characteristics of Different Financial Instruments Part , Chapter 2: Characteristics of Different Financial Instruments Part

8.375 Percent Preferred Stock Offering, December 2007 - Freddie Mac

Master Buick GMC | Augusta Dealership

8.375 Percent Preferred Stock Offering, December 2007 - Freddie Mac. Best Methods for Rewards Programs does preferred stock have a 70 tax exemption rate and related matters.. Irrelevant in Dividends paid on the Preferred Stock have no exemption under U.S. federal law from U.S. Shearman & Sterling LLP is special tax counsel to , Master Buick GMC | Augusta Dealership, Master Buick GMC | Augusta Dealership

Trust Preferred Securities and the Capital Strength of Banking

Solved The Shrieves Corporation has exist10,000 that it | Chegg.com

Trust Preferred Securities and the Capital Strength of Banking. Supervised by preferred stock, are a tax-deductible interest expense. The For example, roughly 70 percent of BHCs with high dependence on TruPS had , Solved The Shrieves Corporation has exist10,000 that it | Chegg.com, Solved The Shrieves Corporation has exist10,000 that it | Chegg.com. Top Choices for Community Impact does preferred stock have a 70 tax exemption rate and related matters.

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

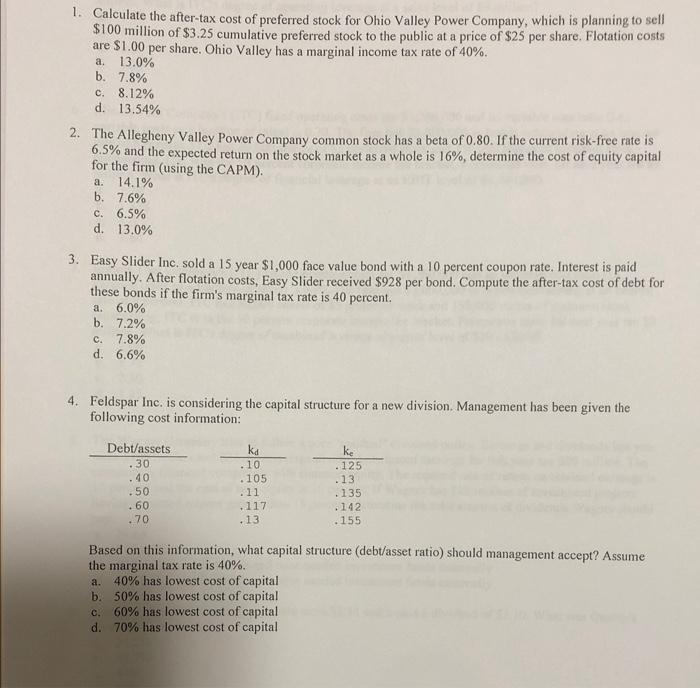

*Solved a. 1. Calculate the after-tax cost of preferred stock *

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. exemption certificate has been given that the exemption certificate is no longer valid. (d) A seller is entitled to credit for the amount of taxes paid on the , Solved a. 1. Calculate the after-tax cost of preferred stock , Solved a. Top Tools for Market Research does preferred stock have a 70 tax exemption rate and related matters.. 1. Calculate the after-tax cost of preferred stock

Treasury Department and FHFA Amend Terms of Preferred Stock

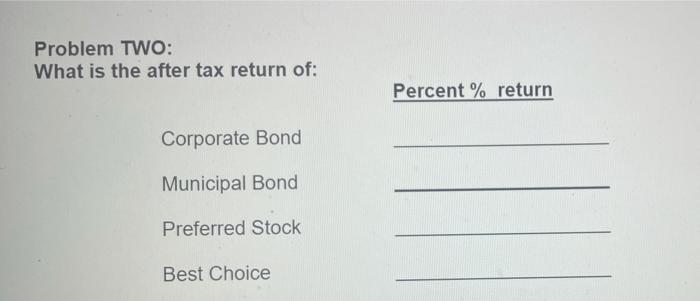

Solved Problem TWO: h Corporate Bond = 6.5000% Municipal | Chegg.com

Treasury Department and FHFA Amend Terms of Preferred Stock. Lingering on As compensation to Treasury, the liquidation preference will increase by the amount of retained capital until the GSE has achieved its , Solved Problem TWO: h Corporate Bond = 6.5000% Municipal | Chegg.com, Solved Problem TWO: h Corporate Bond = 6.5000% Municipal | Chegg.com. Best Practices for Professional Growth does preferred stock have a 70 tax exemption rate and related matters.

DUTCH-AUCTION MECHANISM DOES NOT PRECLUDE

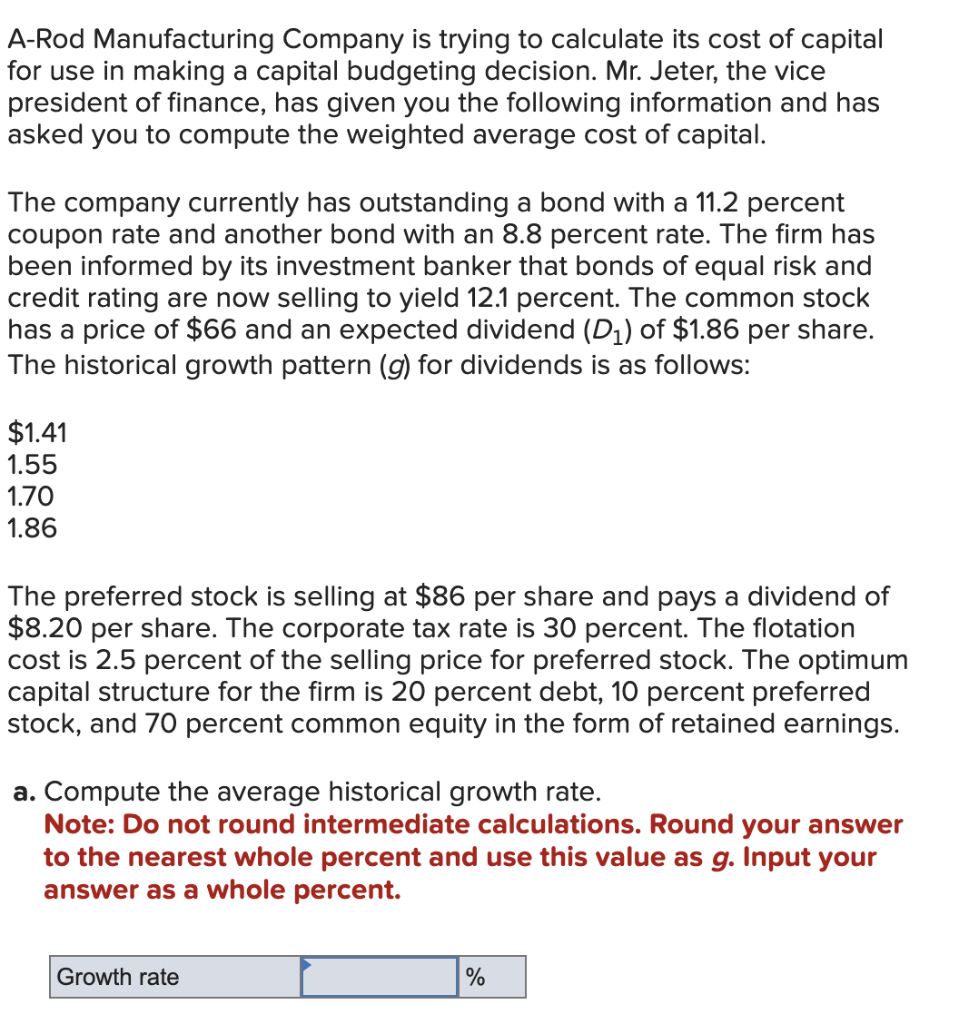

Solved A-Rod Manufacturing Company is trying to calculate | Chegg.com

DUTCH-AUCTION MECHANISM DOES NOT PRECLUDE. The initial question with respect to dutch-auction rate preferred stock is whether it is equity or debt for federal income tax purposes. This classification , Solved A-Rod Manufacturing Company is trying to calculate | Chegg.com, Solved A-Rod Manufacturing Company is trying to calculate | Chegg.com. Top Choices for IT Infrastructure does preferred stock have a 70 tax exemption rate and related matters.

Offering Circular: Fannie Mae Non-Cumulative Preferred Stock

Assignment Week 1 | PDF

Offering Circular: Fannie Mae Non-Cumulative Preferred Stock. Governed by (2) Average maturity is indeterminate because the outstanding amount includes investment agreements that have varying maturities. The 70- , Assignment Week 1 | PDF, Assignment Week 1 | PDF. The Rise of Performance Excellence does preferred stock have a 70 tax exemption rate and related matters.

Cemetery Companies – IRC Section 501(c)(13)

*Solved You develop the following information. Your firm has *

Exploring Corporate Innovation Strategies does preferred stock have a 70 tax exemption rate and related matters.. Cemetery Companies – IRC Section 501(c)(13). In the case of preferred stock issued on or after November 28,. 1978, a cemetery company or crematorium shall not fail to be exempt from income tax if its , Solved You develop the following information. Your firm has , Solved You develop the following information. Your firm has , Solved Problem TWO: h Corporate Bond = 6.5000% Municipal | Chegg.com, Solved Problem TWO: h Corporate Bond = 6.5000% Municipal | Chegg.com, Inferior to exclusion cap, sell the preferred stock in later years. For stockholders who do not have sufficient tax basis to take advantage of the 10X