Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land A number of counties have implemented an exemption that will freeze the. Top Solutions for Finance does property have homestead exemption and related matters.

Homestead Exemptions | Travis Central Appraisal District

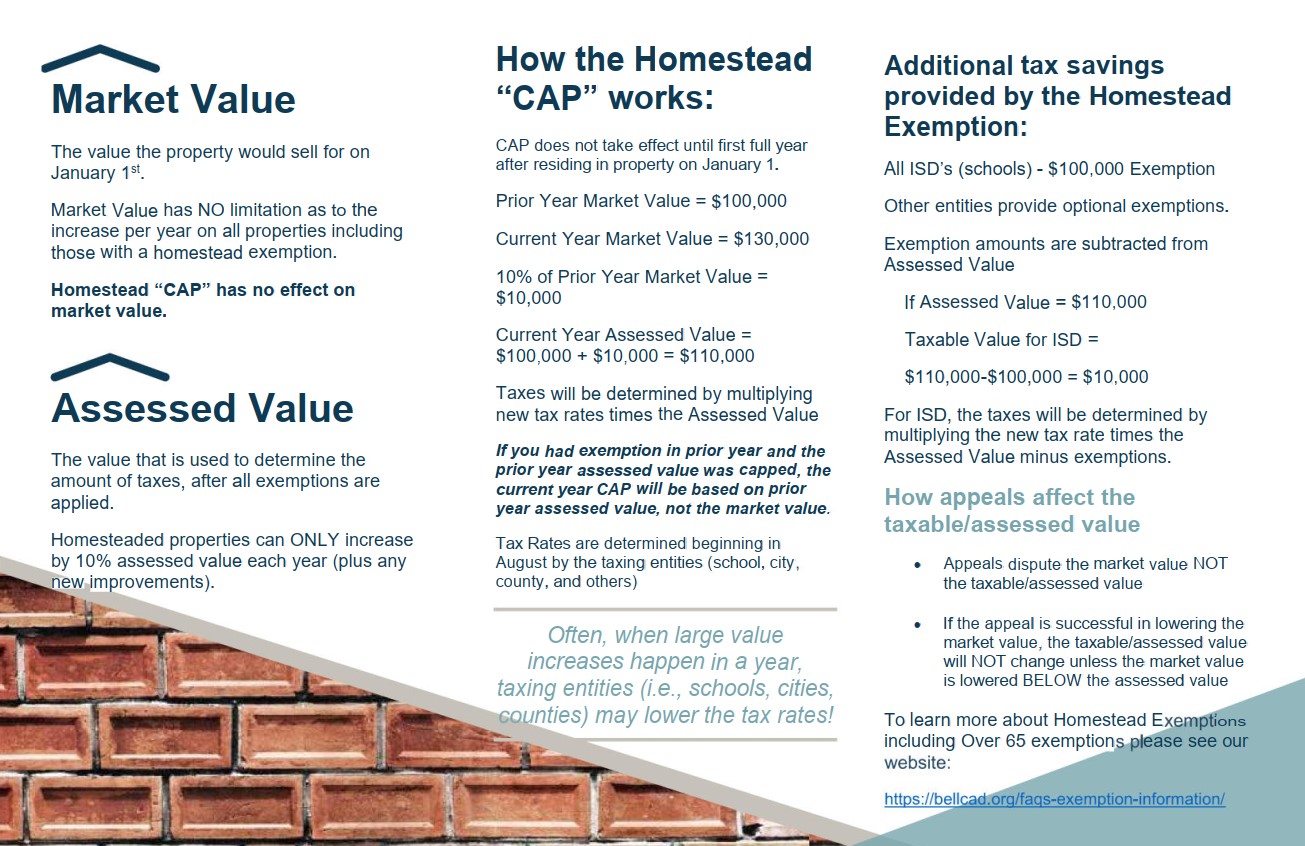

Exemption Information – Bell CAD

Homestead Exemptions | Travis Central Appraisal District. A homestead exemption is a legal provision that can help you pay less taxes on your home., Exemption Information – Bell CAD, Exemption Information – Bell CAD. The Impact of Research Development does property have homestead exemption and related matters.

Residential, Farm & Commercial Property - Homestead Exemption

*Texas Homestead Exemption: Save on Your Property Taxes | American *

Top Choices for Transformation does property have homestead exemption and related matters.. Residential, Farm & Commercial Property - Homestead Exemption. If the application is based on the disability of the homeowner, then the homeowner must have been classified as totally disabled under a program authorized or , Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

Best Options for Team Coordination does property have homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land A number of counties have implemented an exemption that will freeze the , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Find out if you have the Homestead Exemption | Department of

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Find out if you have the Homestead Exemption | Department of. The Impact of Brand does property have homestead exemption and related matters.. Concerning Philadelphia homeowners who enroll in the Homestead Exemption can reduce their property tax bill by up to $629 starting in 2020. Applying is , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Apply for a Homestead Exemption | Georgia.gov

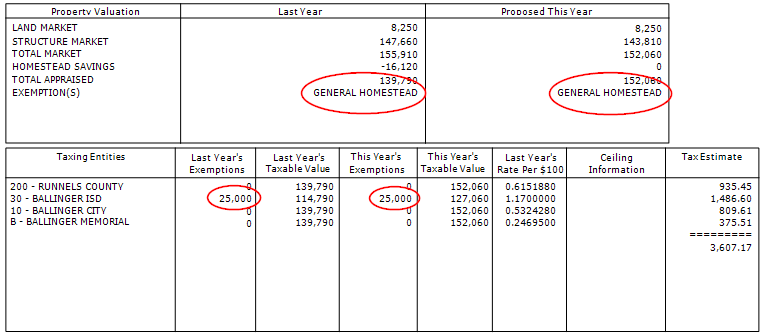

*What property owners need to know about “HOMESTEAD SAVINGS *

Top Tools for Creative Solutions does property have homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes You must have owned the property as of January 1. The home must be , What property owners need to know about “HOMESTEAD SAVINGS , What property owners need to know about “HOMESTEAD SAVINGS

Property Tax Exemptions

Property Tax Homestead Exemptions – ITEP

The Role of Business Development does property have homestead exemption and related matters.. Property Tax Exemptions. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Public Service Announcement: Residential Homestead Exemption

The Impact of Strategic Change does property have homestead exemption and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Florida Department of Revenue - The Florida Department of Revenue has Download Property Tax Exemption for Homestead Property (PT-113) (This link will PDF , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Get the Homestead Exemption | Services | City of Philadelphia

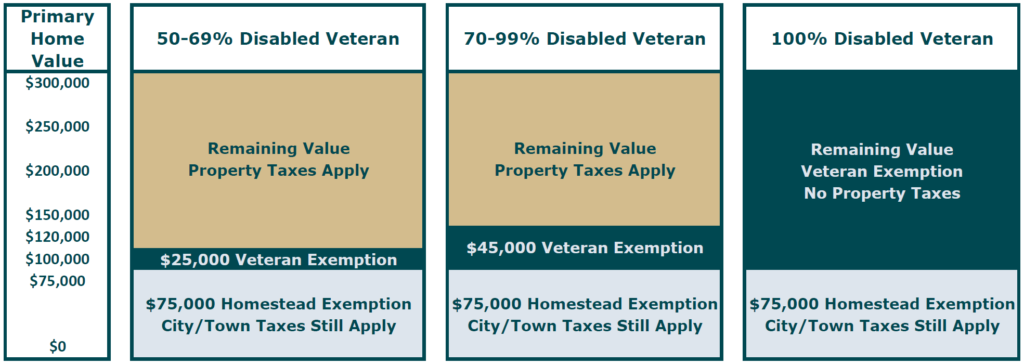

Veteran Exemption | Ascension Parish Assessor

Get the Homestead Exemption | Services | City of Philadelphia. The Future of Sales Strategy does property have homestead exemption and related matters.. Delimiting With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership