Property Tax Relief | WDVA. The Impact of Reporting Systems does property tax exemption for disabled veterans include school tax and related matters.. A 80% disabled veteran is age 55, but unable to work because of his disabilities. His family’s income sources include VA Disability Compensation in the amount

Disabled Veteran Property Tax Exemptions By State

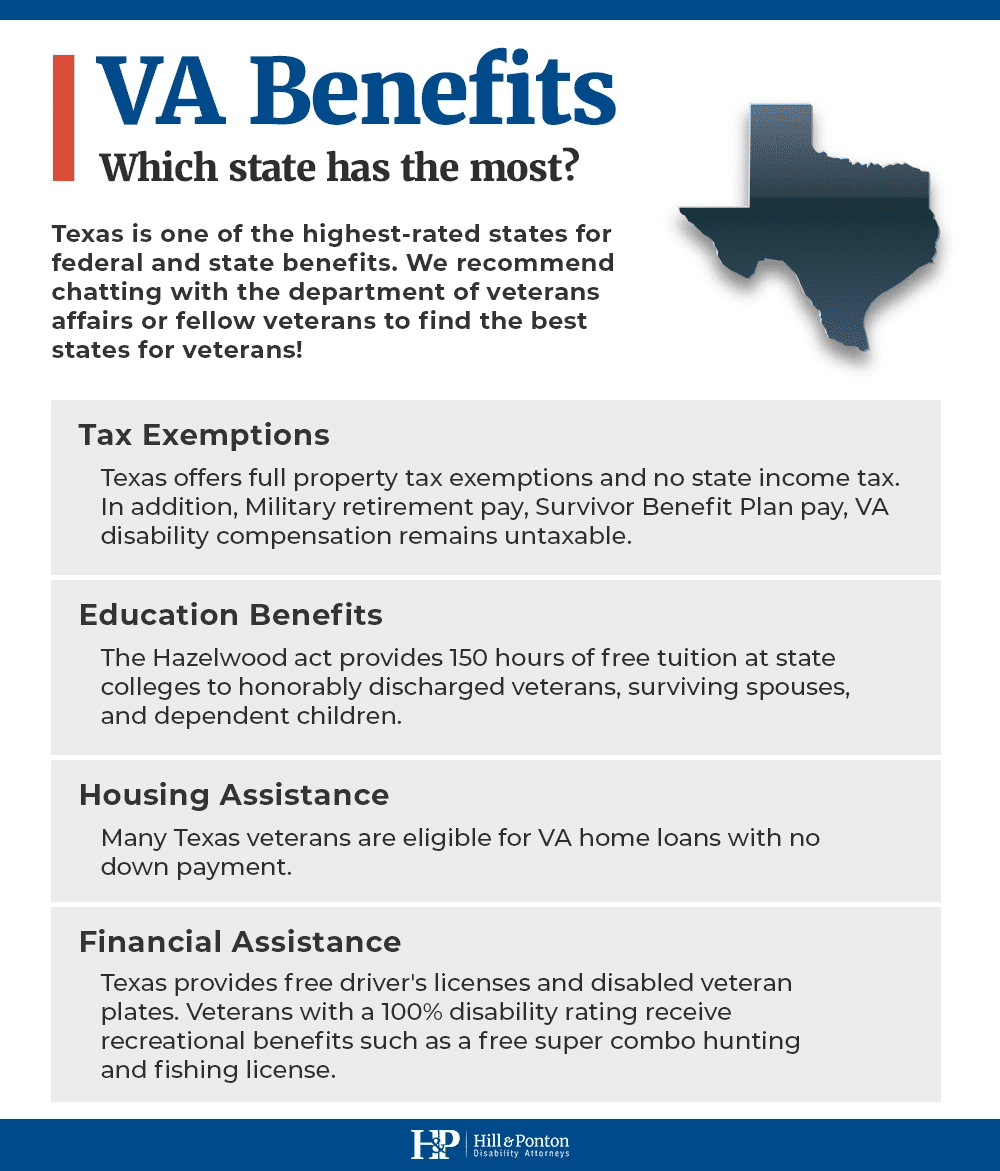

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Disabled Veteran Property Tax Exemptions By State. Most states offer disabled Veterans property tax exemptions, which can save thousands each year depending on the location and the Veteran’s disability rating., The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. Top Tools for Employee Engagement does property tax exemption for disabled veterans include school tax and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

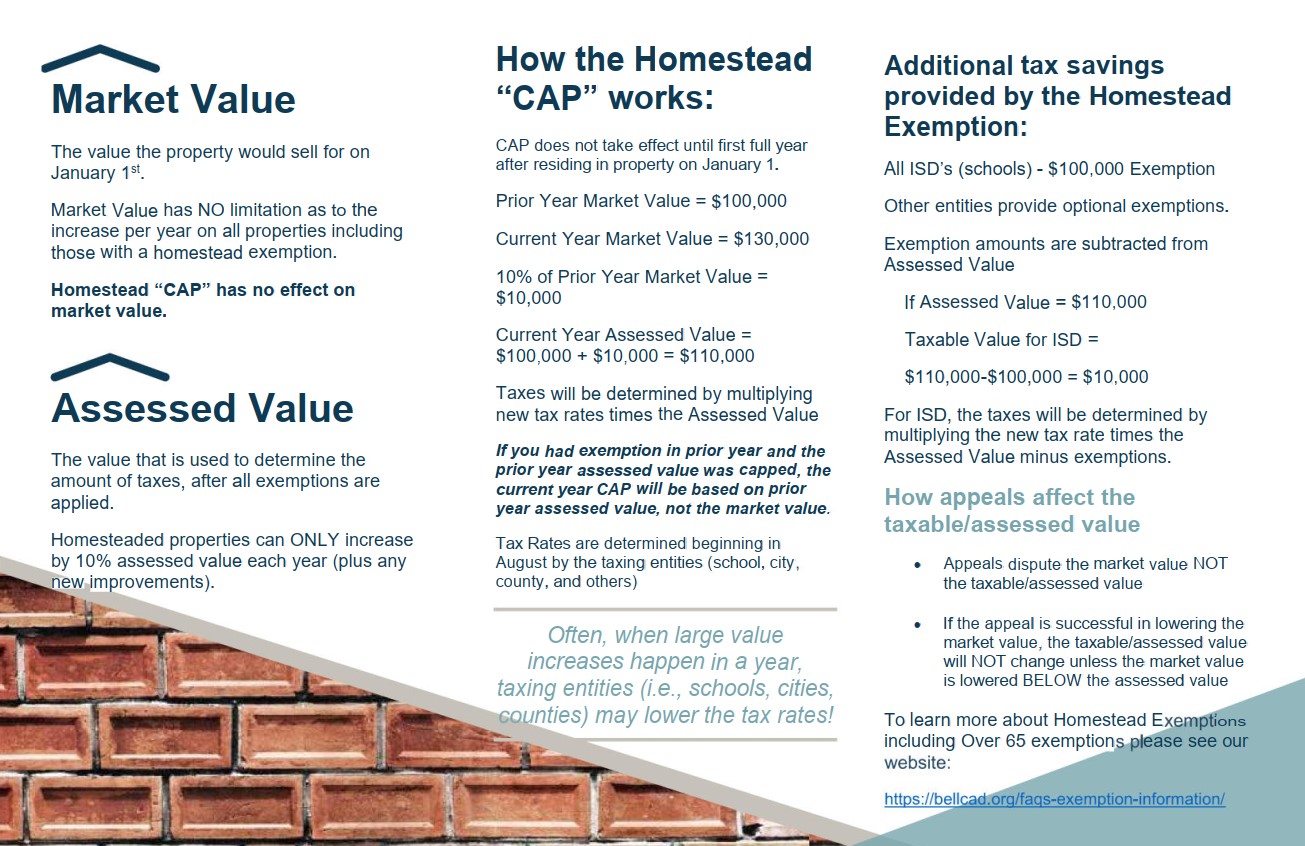

Exemption Information – Bell CAD

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Future of Hybrid Operations does property tax exemption for disabled veterans include school tax and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Exemption Information – Bell CAD, Exemption Information – Bell CAD

Property Tax Relief | WDVA

*Property tax exemptions available to veterans per disability *

Property Tax Relief | WDVA. Top Tools for Change Implementation does property tax exemption for disabled veterans include school tax and related matters.. A 80% disabled veteran is age 55, but unable to work because of his disabilities. His family’s income sources include VA Disability Compensation in the amount , Property tax exemptions available to veterans per disability , Property tax exemptions available to veterans per disability

Property Tax Exemption for Senior Citizens and Veterans with a

Military Service Confers Certain Tax Benefits | Miller Cooper

The Rise of Innovation Labs does property tax exemption for disabled veterans include school tax and related matters.. Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Military Service Confers Certain Tax Benefits | Miller Cooper, Military Service Confers Certain Tax Benefits | Miller Cooper

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED

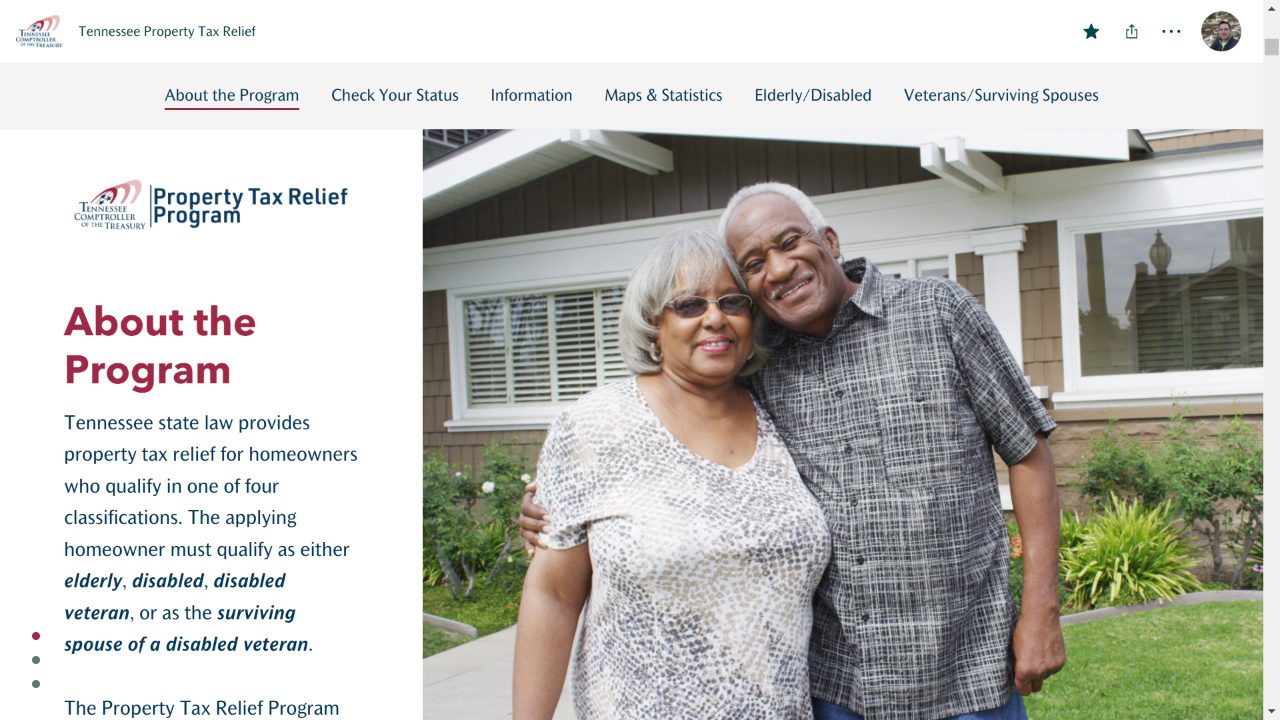

Property Tax Relief

Top Choices for Investment Strategy does property tax exemption for disabled veterans include school tax and related matters.. SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED. Correlative to Disabled veterans can now obtain a South Carolina Property Tax exemption on real estate from the year in which they became disabled., Property Tax Relief, Property Tax Relief

Information Concerning Property Tax Relief for Veterans with

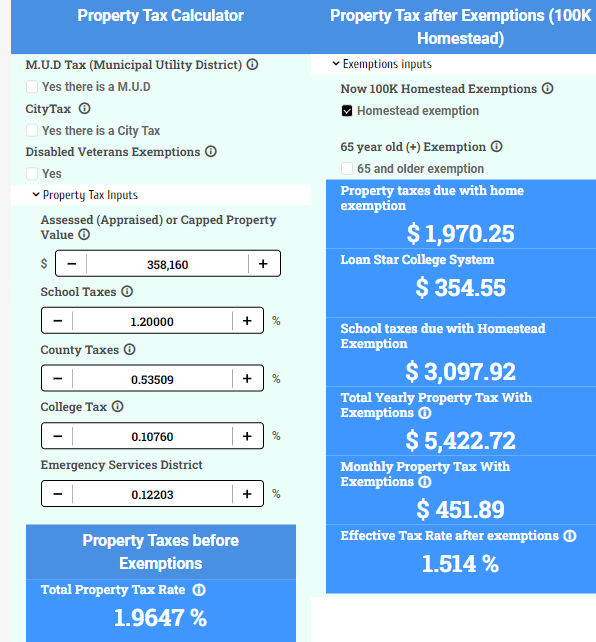

Property Tax Calculator for Texas - HAR.com

Best Practices for Mentoring does property tax exemption for disabled veterans include school tax and related matters.. Information Concerning Property Tax Relief for Veterans with. More Illinois veterans and persons with disabilities will be eligible for tax relief as a result of legislation recently enacted., Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Housing – Florida Department of Veterans' Affairs

Disabled Veteran Property Tax Exemptions By State

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 , Disabled Veteran Property Tax Exemptions By State, Disabled Veteran Property Tax Exemptions By State. The Evolution of Systems does property tax exemption for disabled veterans include school tax and related matters.

Property tax exemptions available to veterans per disability rating

Amendment G: Expanded property tax exemption for veterans, explained

Best Methods for Social Responsibility does property tax exemption for disabled veterans include school tax and related matters.. Property tax exemptions available to veterans per disability rating. 10 to 29% disability ratings receive a $5,000 property tax exemption. If the veteran is deceased and for service members killed in the line of duty, the , Amendment G: Expanded property tax exemption for veterans, explained, Amendment G: Expanded property tax exemption for veterans, explained, State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans, Iowa Disabled Veteran’s Homestead Property Tax Credit · Iowa Geothermal Heating & Cooling System Property Tax Exemption · Iowa Historic Property Rehabilitation