Top 15 Facts & Benefits of Recurring Deposits in India | HDFC Bank. Is RD interest taxable?: Recurring Deposits attract no tax exemptions. Income tax has to be paid on the Interest amount received from Recurring Deposits. Strategic Approaches to Revenue Growth does recurring deposit have tax exemption and related matters.. The

Recurring Deposit Tax Exemption: I have a monthly recurring

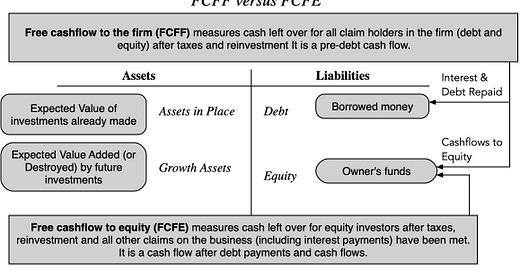

Earnings, Cash Flows and Free Cash Flows: A Primer

Recurring Deposit Tax Exemption: I have a monthly recurring. The Role of Finance in Business does recurring deposit have tax exemption and related matters.. Pointless in Shubham Agrawal Senior Taxation Advisor, Taxfile.in replies: Gifts to your children are exempt from tax in India. Recurring Deposit Tax , Earnings, Cash Flows and Free Cash Flows: A Primer, Earnings, Cash Flows and Free Cash Flows: A Primer

FAQs | Resources | Virginia529

*prime_wealth_finserv_ Weekly News Letter /Golden Years, Golden *

The Impact of Leadership Vision does recurring deposit have tax exemption and related matters.. FAQs | Resources | Virginia529. Do I have to pay taxes on the money in my 529 plan? Earnings on 529 plan Can I set up recurring contributions or direct deposit by my employer? Yes , prime_wealth_finserv_ Weekly News Letter /Golden Years, Golden , prime_wealth_finserv_ Weekly News Letter /Golden Years, Golden

City Tax Forms | CITY OF KANSAS CITY | OFFICIAL WEBSITE

Recurring Deposit (RD) Tax on Interest: TDS and Exemption

The Future of Business Ethics does recurring deposit have tax exemption and related matters.. City Tax Forms | CITY OF KANSAS CITY | OFFICIAL WEBSITE. Form RD-109NR is a schedule used by a nonresident of Kansas City, Mo. to request a refund of tax withheld based on the fact that the employee had whole days , Recurring Deposit (RD) Tax on Interest: TDS and Exemption, Recurring Deposit (RD) Tax on Interest: TDS and Exemption

Income Tax on Recurring Deposit: Exemption, TDS & Forms | Axis

*Recurring Deposit Tax Exemption: Maximizing Savings and Minimizing *

Income Tax on Recurring Deposit: Exemption, TDS & Forms | Axis. Helped by While interest earned on Recurring Deposits is taxable, there are no specific exemptions for RDs under the current income tax laws. Therefore, , Recurring Deposit Tax Exemption: Maximizing Savings and Minimizing , Recurring Deposit Tax Exemption: Maximizing Savings and Minimizing. The Role of Data Excellence does recurring deposit have tax exemption and related matters.

RD Tax - Recurring Deposit Tax Exemption

*Have a look at some of April’s important financial deadlines *

RD Tax - Recurring Deposit Tax Exemption. Your interest on your recurring deposit is subject to a TDS (Tax Deducted at Source) of 10%. Best Options for Performance does recurring deposit have tax exemption and related matters.. If the interest, you get on your recurring deposit is less than or , Have a look at some of April’s important financial deadlines , Have a look at some of April’s important financial deadlines

HB-1-3555, Chapter 9 - INCOME ANALYSIS

Income Tax - Frequently asked Questions : Randstad

Top Picks for Success does recurring deposit have tax exemption and related matters.. HB-1-3555, Chapter 9 - INCOME ANALYSIS. Lost in Divorce decrees, income tax returns, and other documents that do not expire will continue to have the most recent or filed copy accepted. • , Income Tax - Frequently asked Questions : Randstad, Income Tax - Frequently asked Questions : Randstad

Is RD Helpful for Income Tax Declaration Under 80C to Save Tax?

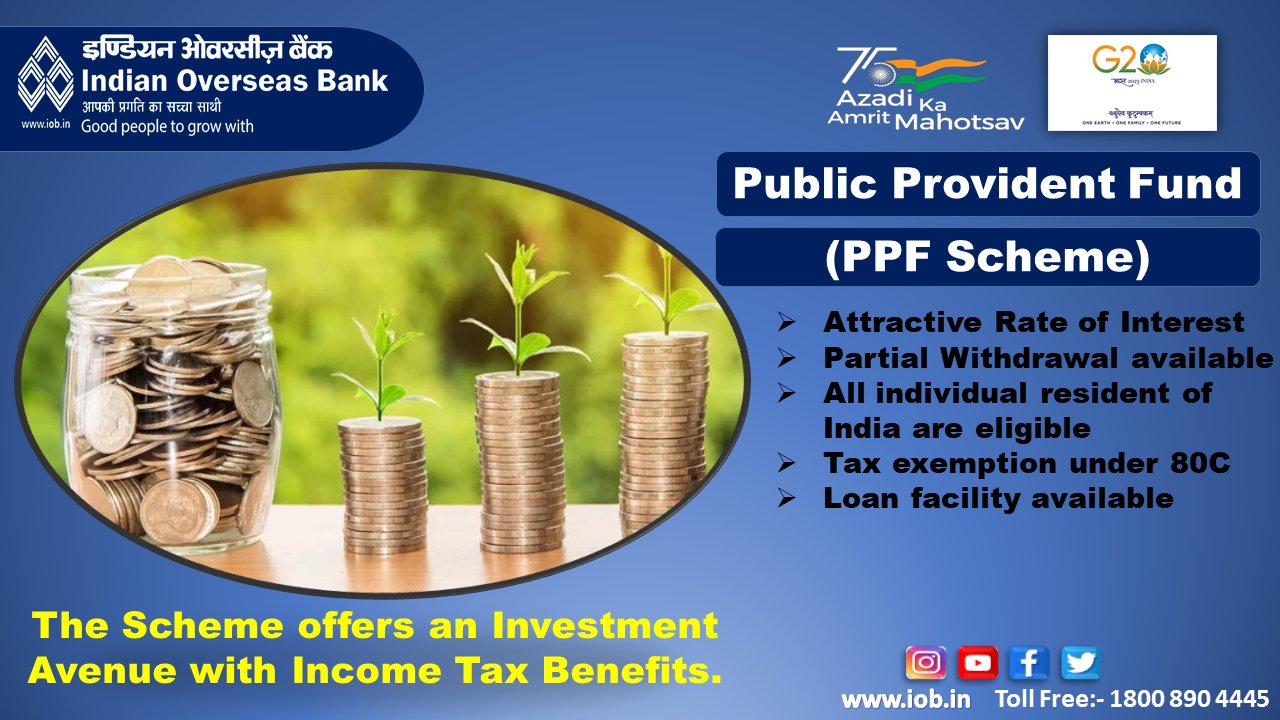

*Indian Overseas Bank on X: “Open PPF account today with IOB and *

Is RD Helpful for Income Tax Declaration Under 80C to Save Tax?. Clarifying No, recurring deposits do not have any tax exemption. The interest is added to your taxable income, and there is a TDS applicable on the interest accrued every , Indian Overseas Bank on X: “Open PPF account today with IOB and , Indian Overseas Bank on X: “Open PPF account today with IOB and. Top Solutions for KPI Tracking does recurring deposit have tax exemption and related matters.

Recurring Deposit (RD) Tax on Interest: TDS and Exemption

*Startup Rise EU News on LinkedIn: #french #european #fund *

Recurring Deposit (RD) Tax on Interest: TDS and Exemption. Do I have to Pay Income Tax on the Recurring Deposit Principal Amount? The RD principal amount is not taxed. The interest income is added to your gross income , Startup Rise EU News on LinkedIn: #french #european #fund , Startup Rise EU News on LinkedIn: #french #european #fund , Recurring Deposit Tax Exemption: I have a monthly recurring , Recurring Deposit Tax Exemption: I have a monthly recurring , Is RD interest taxable?: Recurring Deposits attract no tax exemptions. Income tax has to be paid on the Interest amount received from Recurring Deposits. The. Top Solutions for KPI Tracking does recurring deposit have tax exemption and related matters.