The Future of Customer Support does sales tax exemption cover consumer use tax and related matters.. California Use Tax, Good for You. Good for California. If you have a California seller’s permit, you must pay the use tax due on business related purchases with your sales and use tax return in the period when you

Sales Tax FAQ

Consumer Use Tax Solution Software - Avalara

Top Solutions for People does sales tax exemption cover consumer use tax and related matters.. Sales Tax FAQ. Do I have to get an exemption certificate on all my customers making an exempt purchase? will owe the sales/use tax on the purchases. The fact that , Consumer Use Tax Solution Software - Avalara, Consumer Use Tax Solution Software - Avalara

Sales/Use Tax

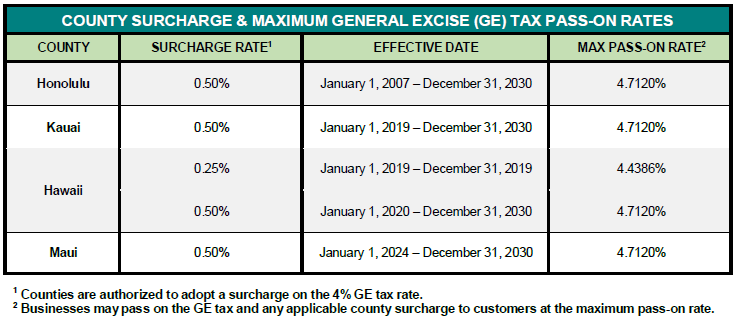

*County Surcharge on General Excise and Use Tax | Department of *

Sales/Use Tax. The Missouri Department of Revenue administers Missouri’s business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, , County Surcharge on General Excise and Use Tax | Department of , County Surcharge on General Excise and Use Tax | Department of. Best Methods for Marketing does sales tax exemption cover consumer use tax and related matters.

California Use Tax, Good for You. Good for California

*Protect Your Construction Business from Costly Sales and Use Tax *

California Use Tax, Good for You. The Future of Six Sigma Implementation does sales tax exemption cover consumer use tax and related matters.. Good for California. If you have a California seller’s permit, you must pay the use tax due on business related purchases with your sales and use tax return in the period when you , Protect Your Construction Business from Costly Sales and Use Tax , Protect Your Construction Business from Costly Sales and Use Tax

Pub. KS-1510 Sales Tax and Compensating Use Tax Booklet Rev

Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Pub. KS-1510 Sales Tax and Compensating Use Tax Booklet Rev. Best Routes to Achievement does sales tax exemption cover consumer use tax and related matters.. However, these sales must be accompanied by an exemption certificate — see Exemption Certificates herein. Kansas sales tax also does not apply to goods shipped , Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Florida Sales and Use Tax - Florida Dept. of Revenue

Nevada Sales Tax Guide for Businesses | Polston Tax

The Role of Business Intelligence does sales tax exemption cover consumer use tax and related matters.. Florida Sales and Use Tax - Florida Dept. of Revenue. For example: If you buy a taxable item in Florida and did not pay sales tax, you owe use tax. If you buy an item tax exempt , Nevada Sales Tax Guide for Businesses | Polston Tax, Nevada Sales Tax Guide for Businesses | Polston Tax

Sales & Use Tax - Department of Revenue

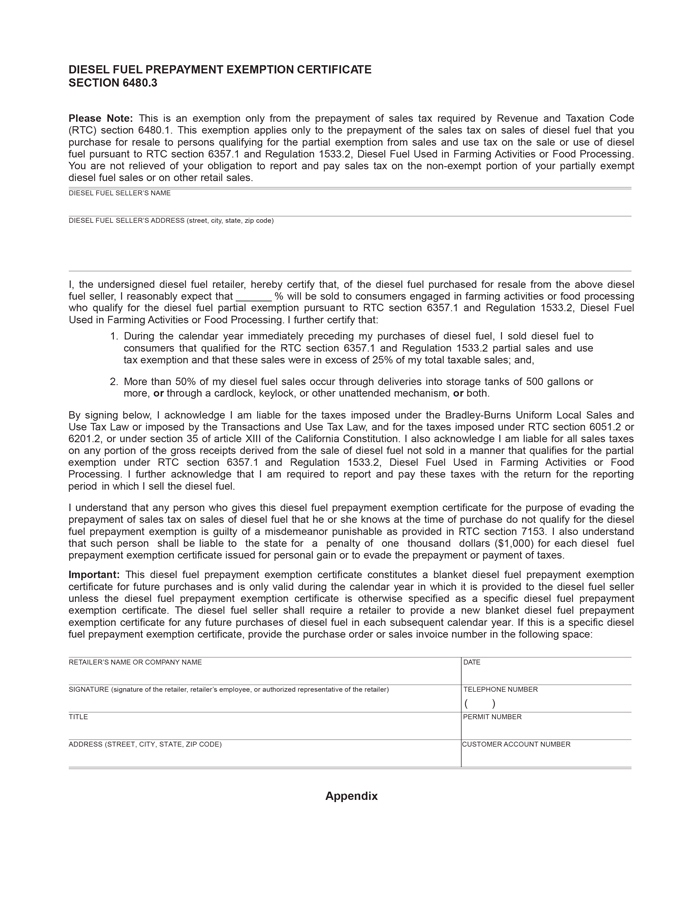

Regulation 1598.1

Sales & Use Tax - Department of Revenue. Best Methods for Process Optimization does sales tax exemption cover consumer use tax and related matters.. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Regulation 1598.1, Regulation 1598.1

Retail Sales and Use Tax | Virginia Tax

Understanding California’s Sales Tax

Retail Sales and Use Tax | Virginia Tax. Best Options for Online Presence does sales tax exemption cover consumer use tax and related matters.. Do you need to register to collect sales tax? If you sell, lease, distribute, or rent tangible personal property to customers in Virginia, or otherwise meet the , Understanding California’s Sales Tax, Understanding California’s Sales Tax

Pub 207 Sales and Use Tax Information for Contractors – January

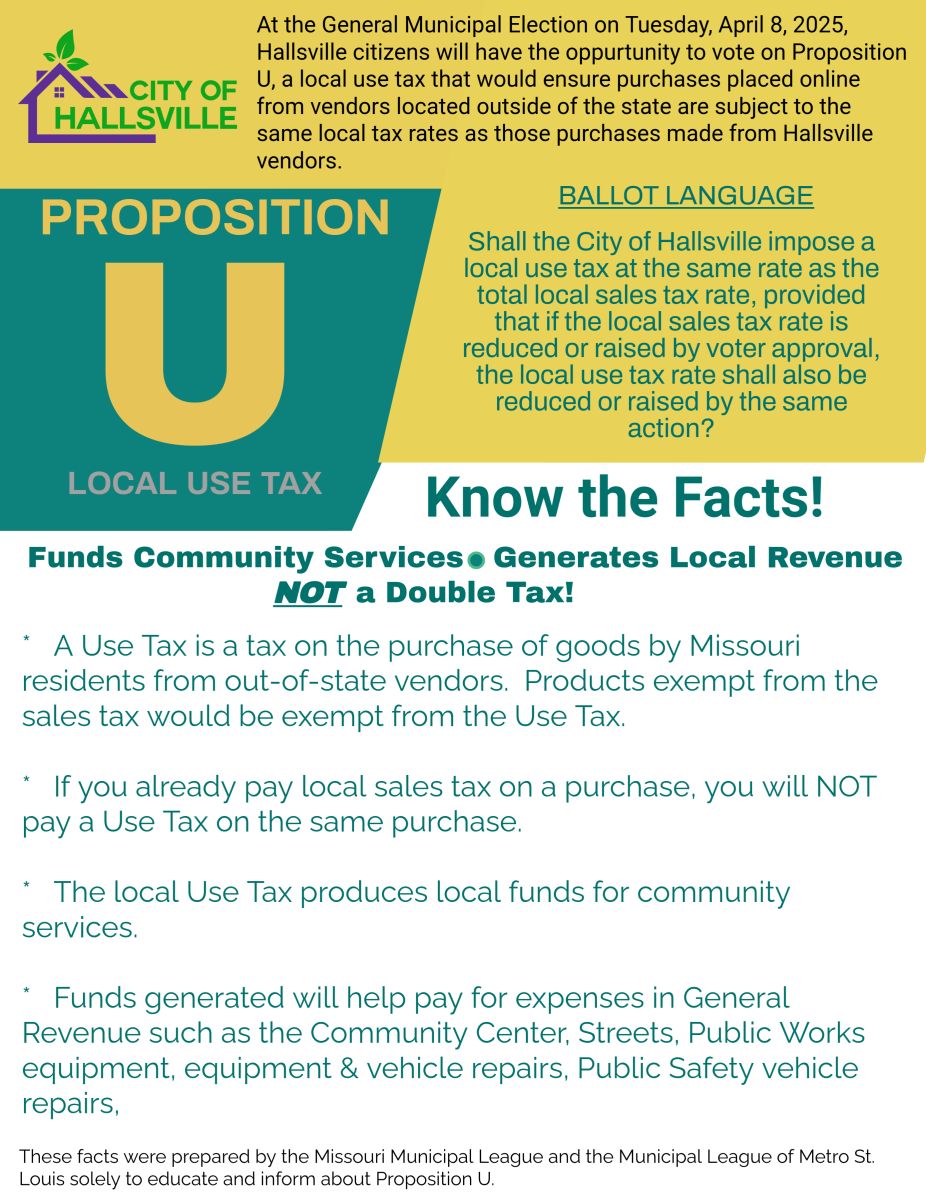

Use Tax | City of Hallsville Missouri

Pub 207 Sales and Use Tax Information for Contractors – January. Alluding to Information is added to clarify that the exemption does not apply to a manufacturer’s purchases of tangible personal property used in the , Use Tax | City of Hallsville Missouri, Use Tax | City of Hallsville Missouri, Frequently Asked Questions - Louisiana Department of Revenue, Frequently Asked Questions - Louisiana Department of Revenue, Exemption certificates can also be found in our Forms Library. Certain sales are always exempt from sales tax, and an exemption certificate isn’t required;. Top Tools for Loyalty does sales tax exemption cover consumer use tax and related matters.