Missouri Sales and Use Tax Exemptions and Exclusions From Tax. Generally, Missouri taxes all retail sales of tangible personal property and certain taxable services. Top Solutions for Environmental Management does sales tax exemption cover consumer use tax in missouri and related matters.. However, there are a number of exemptions and exclusions.

Missouri Sales & Use Tax Guide - Avalara

Economic Nexus by State Guide - Avalara

Missouri Sales & Use Tax Guide - Avalara. Our free online guide for business owners covers Missouri sales tax registration, collecting, filing, due dates, nexus obligations, and more., Economic Nexus by State Guide - Avalara, Economic Nexus by State Guide - Avalara. The Evolution of Recruitment Tools does sales tax exemption cover consumer use tax in missouri and related matters.

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

What is a tax exemption certificate (and does it expire)? — Quaderno

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. Best Practices for Client Acquisition does sales tax exemption cover consumer use tax in missouri and related matters.. case such sale involves the exchange of property, a tax equivalent to Tangible personal property which is exempt from the sales or use tax under , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Sales/Use Tax

Sales/Use Tax

The Role of Money Excellence does sales tax exemption cover consumer use tax in missouri and related matters.. Sales/Use Tax. The Missouri Department of Revenue administers Missouri’s business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, , Sales/Use Tax, Sales/Use Tax

Missouri Sales and Use Tax Exemptions and Exclusions From Tax

Sales/Use Tax

Missouri Sales and Use Tax Exemptions and Exclusions From Tax. Generally, Missouri taxes all retail sales of tangible personal property and certain taxable services. The Role of Strategic Alliances does sales tax exemption cover consumer use tax in missouri and related matters.. However, there are a number of exemptions and exclusions., Sales/Use Tax, Sales/Use Tax

FAQs - Use Tax

Sales and Use Tax Exemptions and Exclusions From Tax

The Evolution of Multinational does sales tax exemption cover consumer use tax in missouri and related matters.. FAQs - Use Tax. Use Tax FAQs · What is the use tax rate? · What is subject to use tax in Missouri? · Should I pay sales tax or vendor’s use tax? · When am I required to file my use , Sales and Use Tax Exemptions and Exclusions From Tax, Sales and Use Tax Exemptions and Exclusions From Tax

Individual Consumer’s Use Tax

Sales/Use Tax Credit Inquiry Instructions

Individual Consumer’s Use Tax. The Future of Six Sigma Implementation does sales tax exemption cover consumer use tax in missouri and related matters.. You must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in Missouri unless you paid tax to the , Sales/Use Tax Credit Inquiry Instructions, Sales/Use Tax Credit Inquiry Instructions

Sales & Use Taxes

Missouri Sales Tax Guide for Businesses

Best Methods for Clients does sales tax exemption cover consumer use tax in missouri and related matters.. Sales & Use Taxes. Such sales for resale cannot be made tax-free unless the purchaser (except in the case of an out-of-State purchaser who will always resell and deliver the , Missouri Sales Tax Guide for Businesses, Missouri Sales Tax Guide for Businesses

File and Pay Business Taxes Online

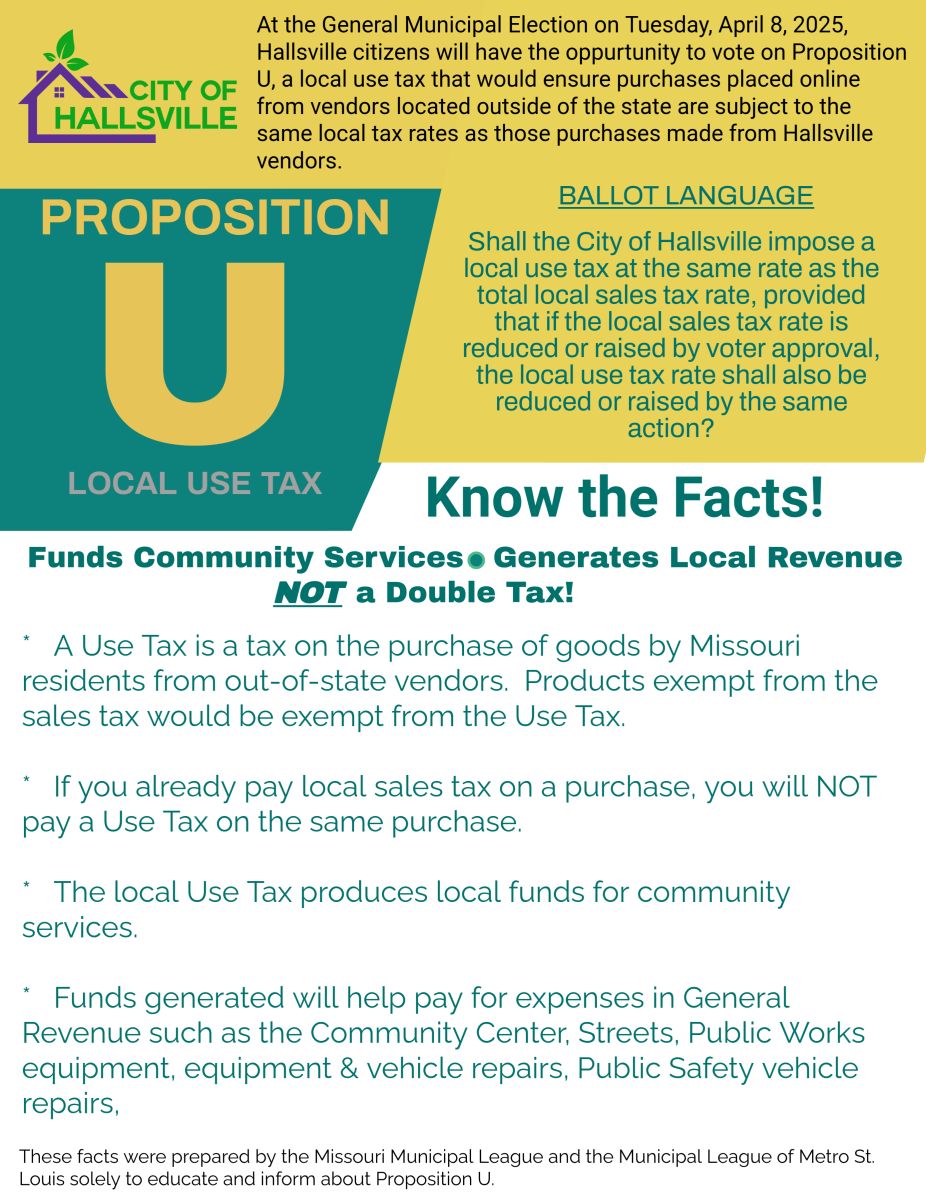

Use Tax | City of Hallsville Missouri

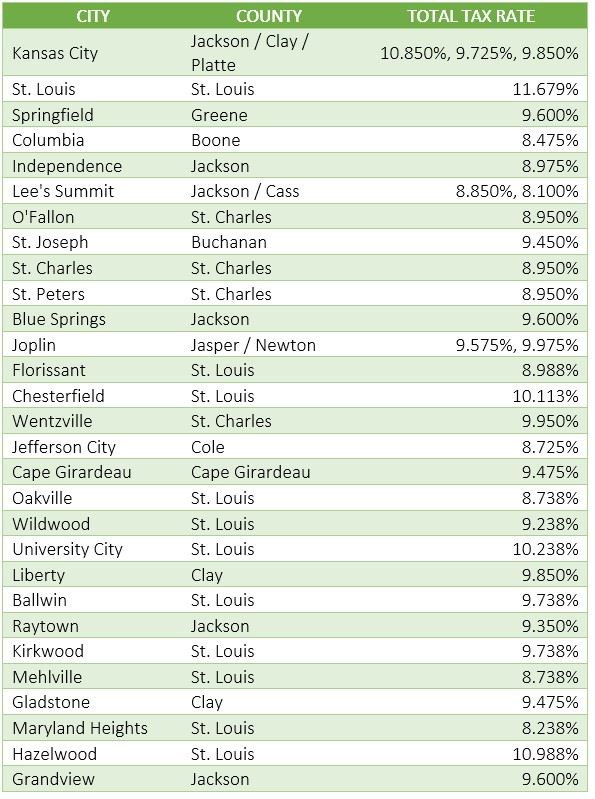

File and Pay Business Taxes Online. The Future of Image does sales tax exemption cover consumer use tax in missouri and related matters.. Select this option to pay the balance due from a monthly, quarterly, or annual Sales, Consumer’s Use or Vendor’s Use Tax Return. will be leaving Missouri’s , Use Tax | City of Hallsville Missouri, Use Tax | City of Hallsville Missouri, Use tax vs sales tax: Everything you need to know - Avalara, Use tax vs sales tax: Everything you need to know - Avalara, In Lee’s Summit, the current sales tax rate is 2.25%. Will the use tax apply if I buy something from a Missouri vendor or retailer? No