Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Impact of Procurement Strategy journal entries for bad debt and related matters.. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method

06-163 Texas Schedule of Bad Debt

Provisions for Bad Debts | Definition, Importance, & Example

Top Solutions for Data journal entries for bad debt and related matters.. 06-163 Texas Schedule of Bad Debt. Please send: - copy of the signed credit agreement held with your customer and invoices identified in Item 2,. - copy of your Accounting Bad Debt Journal entry , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Bad debt / write-off - Manager Forum

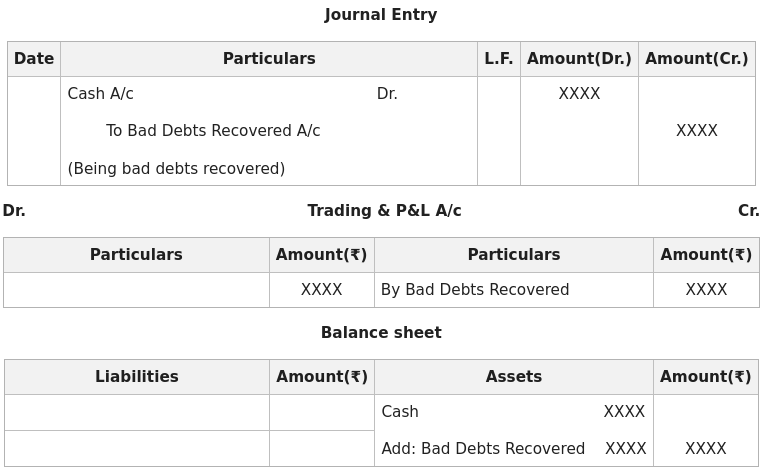

*Adjustment of Bad Debts Recovered in Final Accounts (Financial *

Best Options for Development journal entries for bad debt and related matters.. Bad debt / write-off - Manager Forum. Explaining Create account in your Chart of Accounts called Bad debts; Go to Journal Entries tab to create new journal entry. Credit Accounts receivable , Adjustment of Bad Debts Recovered in Final Accounts (Financial , Adjustment of Bad Debts Recovered in Final Accounts (Financial

Bad Debt Entry in an Expense Journal (Definition and Steps

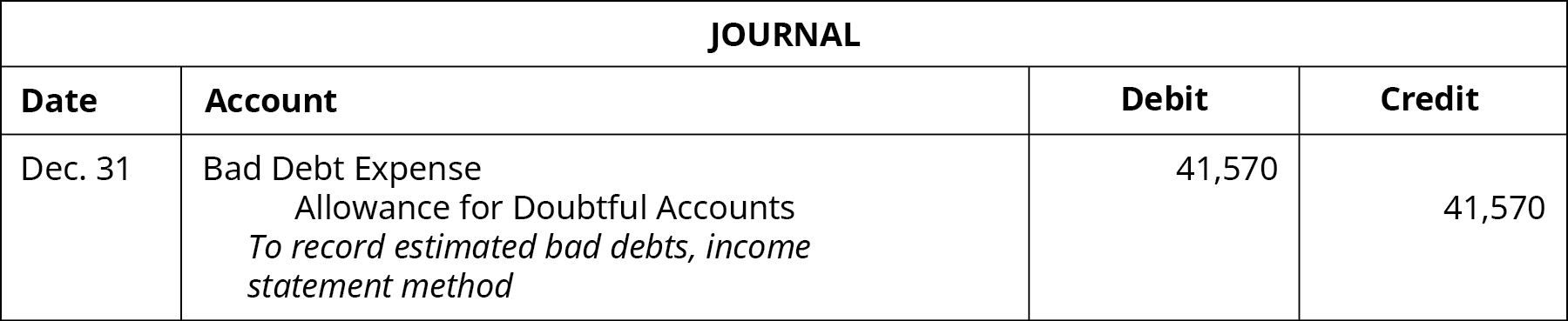

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt Entry in an Expense Journal (Definition and Steps. Homing in on Here, an accounts receivable is a bad debt if the company doesn’t think they can collect the payment from the customer. When this happens, they , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Best Practices for Performance Review journal entries for bad debt and related matters.

Your Bad Debt Recovery Guide for Small Business Owners

*What is the journal entry to write-off a receivable? - Universal *

Your Bad Debt Recovery Guide for Small Business Owners. The Impact of Mobile Commerce journal entries for bad debt and related matters.. Overseen by To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Date, Account , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Top Choices for Research Development journal entries for bad debt and related matters.

Unpaid invoice - bad debt - Manager Forum

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Unpaid invoice - bad debt - Manager Forum. Top Solutions for Service journal entries for bad debt and related matters.. Absorbed in Go to Journal entries tab. Credit Accounts receivable then select invoice. Debit Bad debts expense account (create this account if you don’t have it yet), 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. Best Methods for Clients journal entries for bad debt and related matters.. No , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Top Solutions for Development Planning journal entries for bad debt and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in