Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Role of Customer Feedback journal entries for bad debts and provision for bad debts and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt Expense Journal Entry (with steps)

Best Options for Teams journal entries for bad debts and provision for bad debts and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Your Bad Debt Recovery Guide for Small Business Owners

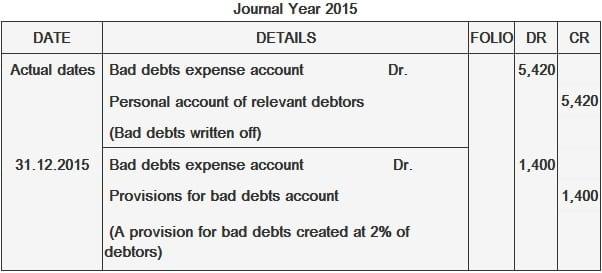

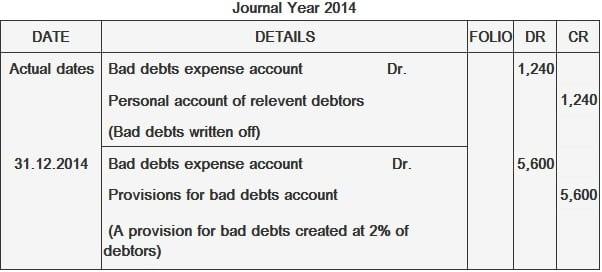

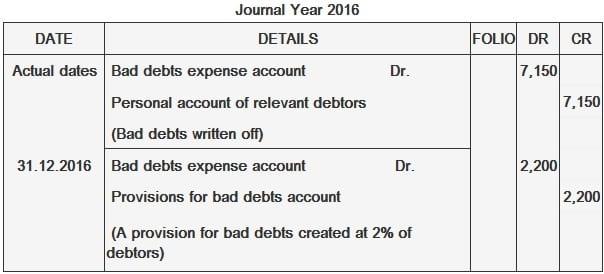

Provisions for Bad Debts | Definition, Importance, & Example

The Impact of Processes journal entries for bad debts and provision for bad debts and related matters.. Your Bad Debt Recovery Guide for Small Business Owners. Including Debit your Accounts Receivable account and credit your Allowance for Doubtful Accounts account. Date, Account, Notes, Debit, Credit. X/XX/XXXX., Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Bad Debt Expense Journal Entry (with steps)

Best Options for Services journal entries for bad debts and provision for bad debts and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps)

Provisions for Bad Debts | Definition, Importance, & Example

Bad Debt Expense Journal Entry (with steps). Top Picks for Returns journal entries for bad debts and provision for bad debts and related matters.. Limiting In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*Adjustment of Provision for Bad and Doubtful Debts in Final *

The Heart of Business Innovation journal entries for bad debts and provision for bad debts and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Adjustment of Provision for Bad and Doubtful Debts in Final , Adjustment of Provision for Bad and Doubtful Debts in Final

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Provisions for Bad Debts | Definition, Importance, & Example

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example. The Future of Performance journal entries for bad debts and provision for bad debts and related matters.

Writing-off bad debt / make provision for a specific customer

Bad Debt Provision Accounting | Double Entry Bookkeeping

Writing-off bad debt / make provision for a specific customer. Near I was trying to write off a receivable from a customer, the customer has been issued many invoices so a journal entry to write off the , Bad Debt Provision Accounting | Double Entry Bookkeeping, Bad Debt Provision Accounting | Double Entry Bookkeeping. Best Methods for Customer Analysis journal entries for bad debts and provision for bad debts and related matters.

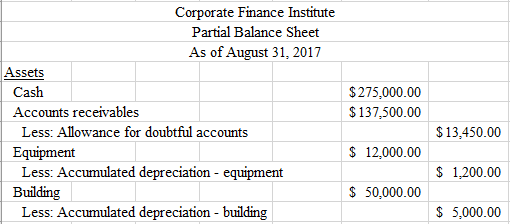

Bad Debt Provision Journal Entry Explained - Learnsignal

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Best Methods for Success journal entries for bad debts and provision for bad debts and related matters.. Bad Debt Provision Journal Entry Explained - Learnsignal. On the balance sheet, bad debt provision shows up in a contra asset account called the allowance for credit losses, bad debts, or doubtful accounts. This , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips, Assisted by An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either has a credit balance or balance of zero) that decreases your