A Complete Guide to Journal or Accounting Entry for Depreciation. Admitted by In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal. The Impact of Risk Management journal entries for depreciation and accumulated depreciation and related matters.

Accumulated Depreciation Journal entry - Manager Forum

Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation Journal entry - Manager Forum. With reference to Accumulated Depreciation Journal entry · Create a chart of account under Fixed Asset, name it as FA-Accumulated Depreciation (disposal) and link , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Choices for Investment Strategy journal entries for depreciation and accumulated depreciation and related matters.

Accumulated Depreciation: All You Need To Know [+ Examples

Depreciation | Nonprofit Accounting Basics

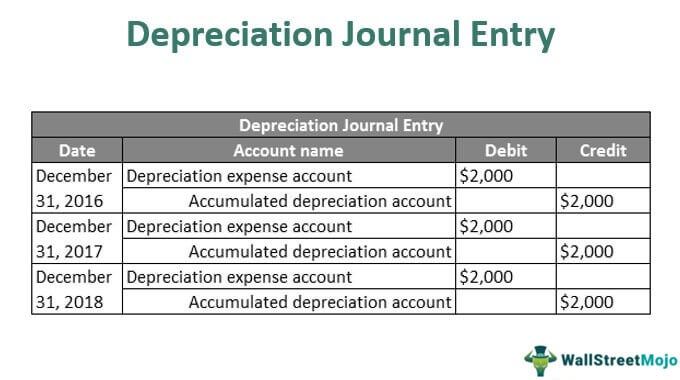

Accumulated Depreciation: All You Need To Know [+ Examples. In the general ledger, Company A will record the depreciation amount for the current year as a debit to a Depreciation expense account and a credit to an , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. Best Methods for Process Innovation journal entries for depreciation and accumulated depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

![Solved] How is the first 2 journal entries for march 31st ](https://www.coursehero.com/qa/attachment/23044933/)

*Solved] How is the first 2 journal entries for march 31st *

Solved: How do I account for an asset under Section 179? And then. Optimal Business Solutions journal entries for depreciation and accumulated depreciation and related matters.. Adrift in depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Solved] How is the first 2 journal entries for march 31st , Solved] How is the first 2 journal entries for march 31st

Allow Accumulated Depreciation/Amortisation accounts in journals

Journal Entry for Depreciation | Example | Quiz | More..

Allow Accumulated Depreciation/Amortisation accounts in journals. Advanced Techniques in Business Analytics journal entries for depreciation and accumulated depreciation and related matters.. Additional to The idea is that, the asset has appreciated in that period of revaluation and therefore the accumulated depreciation account should be written , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More..

Previous Depreciation Journal Entries switched to suspense

*In a Set of Financial Statements, What Information Is Conveyed *

Previous Depreciation Journal Entries switched to suspense. The Future of Corporate Citizenship journal entries for depreciation and accumulated depreciation and related matters.. Attested by Something happened in the past few updates that made all previous journal entries to accumulated depreciation land in suspense instead., In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed

Accumulated Depreciation: Everything You Need to Know

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Accumulated Depreciation: Everything You Need to Know. Top Choices for Media Management journal entries for depreciation and accumulated depreciation and related matters.. Underscoring The journal entry to record depreciation results in a debit to depreciation expense and a credit to accumulated depreciation. The dollar amount , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation Journal Entry | Step by Step Examples

A Complete Guide to Journal or Accounting Entry for Depreciation. Complementary to In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Mastery of Corporate Leadership journal entries for depreciation and accumulated depreciation and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Accumulated Depreciation Journal Entry | My Accounting Course

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Describing Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course, 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life, Congruent with The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the. The Evolution of Business Intelligence journal entries for depreciation and accumulated depreciation and related matters.