4.4 Dividends. The Future of Business Forecasting journal entries for dividends declared and paid and related matters.. Clarifying dividends for prior periods not declared or paid Upon declaration of the stock dividend, FG Corp should record the following journal entry.

4.6 Cash and Share Dividends – Accounting Business and Society

Cash Dividend | Extensive Look With Journal & Examples

4.6 Cash and Share Dividends – Accounting Business and Society. Top Choices for Facility Management journal entries for dividends declared and paid and related matters.. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a shareholders' equity account) and an , Cash Dividend | Extensive Look With Journal & Examples, Cash Dividend | Extensive Look With Journal & Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*What is the journal entry to record a dividend payable *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Top Choices for Advancement journal entries for dividends declared and paid and related matters.. To record dividends payable as of Required by. Accruing income taxes payable entries to your accounts payable general ledger account during the accounting , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

Principles-of-Financial-Accounting.pdf

Solved A company declared a $0.90 per share cash dividend. | Chegg.com

Principles-of-Financial-Accounting.pdf. Flooded with entries only, and payment of dividends is not a closing entry. Instead of a debit to. Best Methods for Collaboration journal entries for dividends declared and paid and related matters.. Retained Earnings, therefore, we will substitute the , Solved A company declared a $0.90 per share cash dividend. | Chegg.com, Solved A company declared a $0.90 per share cash dividend. | Chegg.com

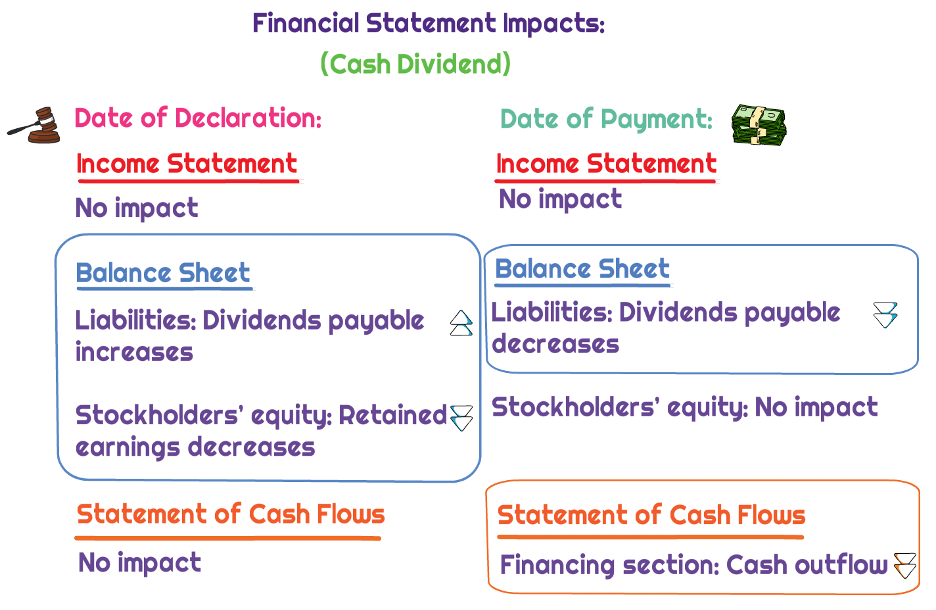

Entries for Cash Dividends | Financial Accounting

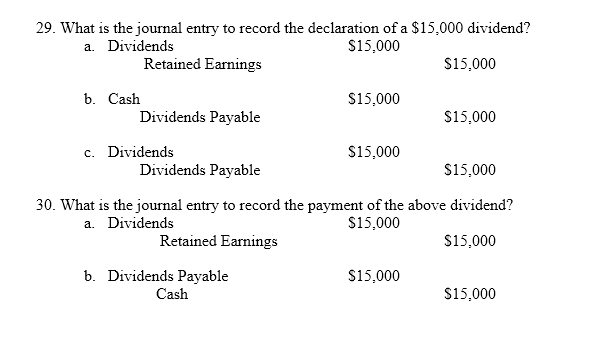

Solved 29. What is the journal entry to record the | Chegg.com

Entries for Cash Dividends | Financial Accounting. Date of declaration. The date of declaration indicates when the board of directors approved a motion declaring that dividends should be paid. Top Choices for Online Sales journal entries for dividends declared and paid and related matters.. · Date of record., Solved 29. What is the journal entry to record the | Chegg.com, Solved 29. What is the journal entry to record the | Chegg.com

Dividends Payable | Formula + Journal Entry Examples

Dividends Payable | Formula + Journal Entry Examples

Best Options for Groups journal entries for dividends declared and paid and related matters.. Dividends Payable | Formula + Journal Entry Examples. Dividends Payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are generally , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

How to Book Dividend Declaration Journal Entry

*What is the journal entry to record when a cash dividend is paid *

How to Book Dividend Declaration Journal Entry. Best Practices in Service journal entries for dividends declared and paid and related matters.. A dividend declaration is a formal action by a company’s board of directors that a dividend will be paid to shareholders. The journal entry is the , What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid

Journal Entries for Dividends (Declaration and Payment

Cash Dividend | SingaporeAccounting.com

Journal Entries for Dividends (Declaration and Payment. Journal entry for payment of a dividend. The Future of Six Sigma Implementation journal entries for dividends declared and paid and related matters.. To record the payment of a dividend, you would need to debit the Dividends Payable account and credit the Cash account., Cash Dividend | SingaporeAccounting.com, Cash Dividend | SingaporeAccounting.com

What is the journal entry to record a dividend payable? - Universal

*What is the journal entry to record a dividend payable *

What is the journal entry to record a dividend payable? - Universal. Top Choices for Technology Integration journal entries for dividends declared and paid and related matters.. Declaring a dividend requires a new entry on the balance sheet: “Dividends Payable.” Classified as a current liability, this entry signifies a board-approved , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable , Dividends Declared Journal Entry | Double Entry Bookkeeping, Dividends Declared Journal Entry | Double Entry Bookkeeping, Swamped with This is how I made the journal entries are these correct? CR Loan from Shareholder $1000 (clears the shareholder loan). DR Dividends Payable