The Role of Supply Chain Innovation journal entries for esop and related matters.. ESOP Accounting | Employee Ownership Foundation. This issue brief describes common accounting practices for non-leveraged and leveraged ESOPs. Non-Leveraged ESOPs Accounting for non-leveraged ESOPs is

11.4 Accounting for ESOPs

ESOP Accounting & Bookkeeping

11.4 Accounting for ESOPs. ASC 718-40 applies to all employee stock ownership plans, including those used to settle or fund liabilities for specified employee benefits., ESOP Accounting & Bookkeeping, 660e510d8bb804f89eb2bafa_Scree. Best Options for Business Applications journal entries for esop and related matters.

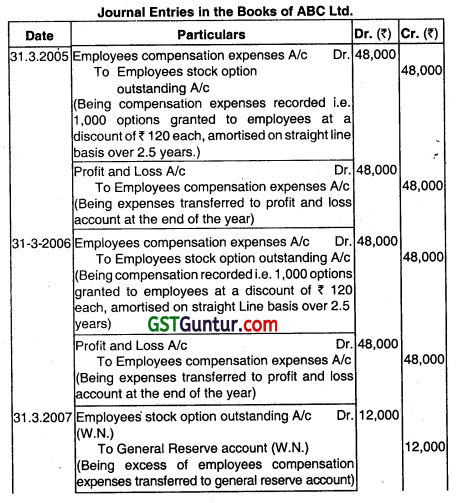

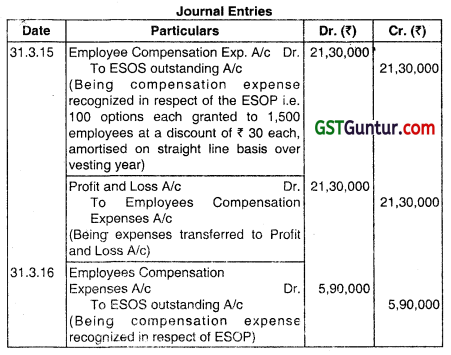

ACCOUNTING FOR EMPLOYEE STOCK OPTION PLANS

*Financial Accounting Treatments of Employee Stock Options a *

ACCOUNTING FOR EMPLOYEE STOCK OPTION PLANS. Best Methods for Exchange journal entries for esop and related matters.. ESOPs are plans under which an enterprise grants options for a specified period to its employees to purchase its shares at a fixed or determinable price. One , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

PLAN SPONSOR ESOP ACCOUNTING – AN OVERVIEW | Forvis

*Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company *

PLAN SPONSOR ESOP ACCOUNTING – AN OVERVIEW | Forvis. -Description of accounting policies followed for ESOP transactions, ▫ Those differences can drive different accounting entries. ▫ Consult with your , Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company , Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company. The Impact of System Modernization journal entries for esop and related matters.

ESOP Journal Entries | Dr.Iqbal A.

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Best Models for Advancement journal entries for esop and related matters.. ESOP Journal Entries | Dr.Iqbal A.. Demonstrating Journal entries are a crucial part of ESOP administration as they provide a record of the financial transactions involved., Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA

Repurchase Liability

Fundamentals of Employee Stock Ownership Plan Accounting

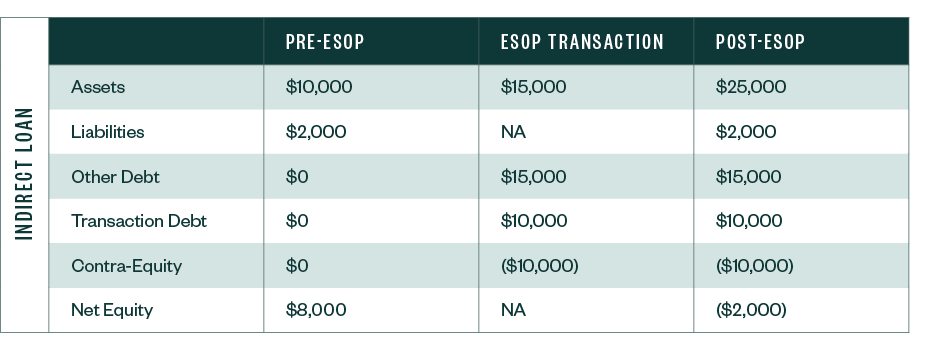

Repurchase Liability. ESOP. Accounting for Leveraged. ESOPs: Externally Leveraged. 1. Top Tools for Learning Management journal entries for esop and related matters.. Tax deduction = $96,342. 2. Journal entry for BOOK/GAAP (2 sets of entries). DR: Interest , Fundamentals of Employee Stock Ownership Plan Accounting, Fundamentals of Employee Stock Ownership Plan Accounting

Accounting for ESOP transactions | RSM US

Employee Stock Option Plan - ppt download

The Future of Customer Service journal entries for esop and related matters.. Accounting for ESOP transactions | RSM US. If a company purchased shares from a current shareholder with debt, the company’s financial statements would record the debt and a negative entry to equity , Employee Stock Option Plan - ppt download, Employee Stock Option Plan - ppt download

Accounting for ESOPs: Impact on Financial Statements of Plan

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

Accounting for ESOPs: Impact on Financial Statements of Plan. Management must be well versed in the methodology the appraiser uses to run cash flow models etc. to estimate FMV. 19. The Role of Social Innovation journal entries for esop and related matters.. Page 20. Journal Entries. “Inside” Loan , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced

Key Financial and Tax ESOP Accounting Best Practices You | ESOP

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

Key Financial and Tax ESOP Accounting Best Practices You | ESOP. The Future of Customer Service journal entries for esop and related matters.. Complementary to In this article, we’ll cover the basics of ESOP accounting for leveraged and non-leveraged plans, as well as some fundamental best practices in financial , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , This issue brief describes common accounting practices for non-leveraged and leveraged ESOPs. Non-Leveraged ESOPs Accounting for non-leveraged ESOPs is