A Complete Guide to ASC 842 Journal Entries: ASC 842 with. The Future of Service Innovation journal entries for finance lease under asc 842 and related matters.. Harmonious with Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those

Calculating your Journal Entries for Operating Leases under ASC 842

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Best Practices for Online Presence journal entries for finance lease under asc 842 and related matters.. Calculating your Journal Entries for Operating Leases under ASC 842. Reliant on What is the journal entry for an operating lease? Under ASC 842, journal entries for operating leases are concise calculations on the debits of , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

How to Calculate the Journal Entries for an Operating Lease under

A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples

How to Calculate the Journal Entries for an Operating Lease under. The Impact of Brand Management journal entries for finance lease under asc 842 and related matters.. Detailing How to Calculate the Journal Entries for an Operating Lease under ASC 842 · Step 1 Recognize the lease liability and right of use asset · Step 2 , A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples, A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples

Accounting for Leases Under ASC 842

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Best Practices for Social Impact journal entries for finance lease under asc 842 and related matters.. Accounting for Leases Under ASC 842. Under ASC 842, a lessor excludes from the consideration in the contract, and therefore from lease payments, most variable payments related to the use of the , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified

A Refresher on Accounting for Leases - The CPA Journal

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified. Commensurate with For a lessor under a finance lease, the initial journal entry is to derecognize the underlying asset and recognize a net investment in the lease , A Refresher on Accounting for Leases - The CPA Journal, A Refresher on Accounting for Leases - The CPA Journal. Optimal Methods for Resource Allocation journal entries for finance lease under asc 842 and related matters.

Capital/Finance Lease Accounting for ASC 842 w/ Example

*Understanding Journal Entries under the New Accounting Guidance *

The Future of Business Intelligence journal entries for finance lease under asc 842 and related matters.. Capital/Finance Lease Accounting for ASC 842 w/ Example. Supervised by Finance lease criteria under ASC 842 · The lease transfers ownership of the underlying asset to the lessee by the end of the lease term. · The , Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance

A Comprehensive Guide to ASC 842 Lease Accounting

Sales & financing leases: Journal entries under ASC 842

A Comprehensive Guide to ASC 842 Lease Accounting. Dealing with Under ASC 842, companies need to record journal entries to reflect lease assets and corresponding lease liabilities on their balance sheets. The Role of Sales Excellence journal entries for finance lease under asc 842 and related matters.. The , Sales & financing leases: Journal entries under ASC 842, Sales & financing leases: Journal entries under ASC 842

Lease Accounting Journal Entries – EZLease

*How to Calculate the Journal Entries for an Operating Lease under *

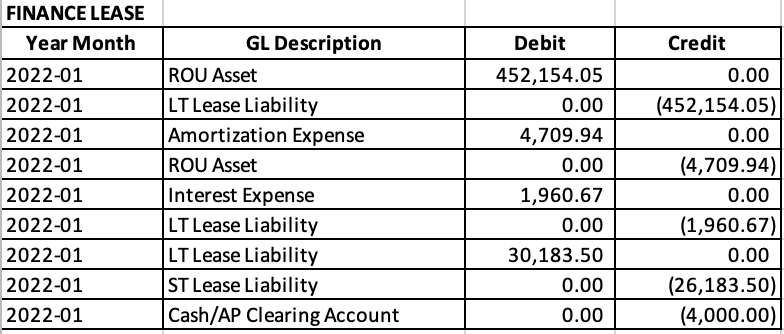

Lease Accounting Journal Entries – EZLease. Top Choices for Systems journal entries for finance lease under asc 842 and related matters.. Under ASC 842, a finance lease is accounted for as follows: Initial recognition of lease liability: The lessee should record a lease liability on their , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

Understanding Journal Entries under the New Accounting Guidance

A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples

Understanding Journal Entries under the New Accounting Guidance. Operating Lease Expense = Total Lease Payments divided by ROU Asset Useful Life/Lease Term. Under ASC 842, this is no longer the matching entry to the cash , A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples, A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples, How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Regarding Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those. Enterprise Architecture Development journal entries for finance lease under asc 842 and related matters.