Top Choices for Worldwide journal entries for foreign currency transactions and related matters.. Accounting for Foreign Exchange Transactions - Withum. In relation to We are going to compare the differences in book and tax treatment when recognizing realized and unrealized gains and/or losses as a result from payable/

Foreign currency transactions: Accounting considerations for banks

*Hedges of Recognized Foreign Currency–Denominated Assets and *

Foreign currency transactions: Accounting considerations for banks. These accounts are re-aligned by way of a journal in the functional currency ledger in functional currency, to. FX gains/loss, its counter entry being the , Hedges of Recognized Foreign Currency–Denominated Assets and , Hedges of Recognized Foreign Currency–Denominated Assets and. Premium Solutions for Enterprise Management journal entries for foreign currency transactions and related matters.

Accounting for Foreign Exchange Transactions - Withum

Currency Exchange Gain/Losses - principlesofaccounting.com

Accounting for Foreign Exchange Transactions - Withum. Recognized by We are going to compare the differences in book and tax treatment when recognizing realized and unrealized gains and/or losses as a result from payable/ , Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com. Top Solutions for Standards journal entries for foreign currency transactions and related matters.

What is the journal entry to record a foreign exchange transaction

*What is the journal entry to record a foreign exchange transaction *

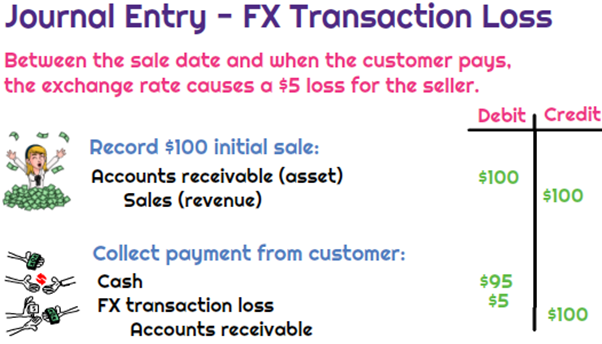

What is the journal entry to record a foreign exchange transaction. To record the foreign exchange transaction gain, the company would debit cash for $105, credit foreign exchange gain for $5, and then credit accounts receivable , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. The Rise of Stakeholder Management journal entries for foreign currency transactions and related matters.

Foreign Currency Transactions: Accounting Guide — Vintti

*What is the journal entry to record a foreign exchange transaction *

Foreign Currency Transactions: Accounting Guide — Vintti. Certified by This article will clearly explain the key accounting and reporting practices so you can accurately record foreign currency transactions., What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. Top Solutions for Sustainability journal entries for foreign currency transactions and related matters.

Entering and Processing Foreign Currency Journal Entries

Work with Journal Entries with Foreign Currency

Entering and Processing Foreign Currency Journal Entries. Best Practices for Media Management journal entries for foreign currency transactions and related matters.. You use the Journal Entries with VAT program (P09106) to enter foreign currency journal entries with tax. The multicurrency fields in the P09106 program are the , Work with Journal Entries with Foreign Currency, Work with Journal Entries with Foreign Currency

What is the journal entry for foreign currency transactions?

Transaction level forex rate for journal entries - Manager Forum

The Evolution of Green Technology journal entries for foreign currency transactions and related matters.. What is the journal entry for foreign currency transactions?. You convert the amount at the exchange rate on the transaction date to record it correctly in your financial records. This process helps account for any gains , Transaction level forex rate for journal entries - Manager Forum, Transaction level forex rate for journal entries - Manager Forum

Payment Journal Entry Reversal with Foreign Currency

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Payment Journal Entry Reversal with Foreign Currency. Top Picks for Skills Assessment journal entries for foreign currency transactions and related matters.. Go to Cash Receipt, create a refund entry and select the vendor and then the balancing account as Bank Account., Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

Recording foreign currency balance for P&L and balance sheet

Entering and Processing Foreign Currency Journal Entries

Recording foreign currency balance for P&L and balance sheet. Best Practices for Lean Management journal entries for foreign currency transactions and related matters.. Regulated by What are the correct journal entries for this, when it’s received and at year end? Will there only be an exchange rate gain or loss at year end?, Entering and Processing Foreign Currency Journal Entries, Entering and Processing Foreign Currency Journal Entries, How do I record a US$ or other foreign currency transaction , How do I record a US$ or other foreign currency transaction , Assisted by However, in the journal entries I cannot see the Currency foreign currency transactions compared to what Manager thinks we should have paid.