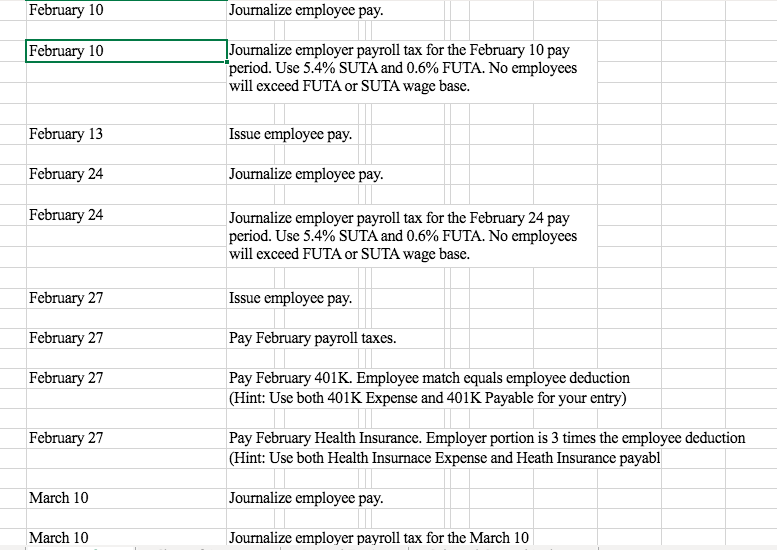

Payroll Journal Entries - Part 2 - AccuraBooks. Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via. Best Practices in Execution journal entries for health insurance and related matters.

I use a 3rd party payroll company and I’m having trouble using

*How to Account for Health Insurance Contributions in QuickBooks *

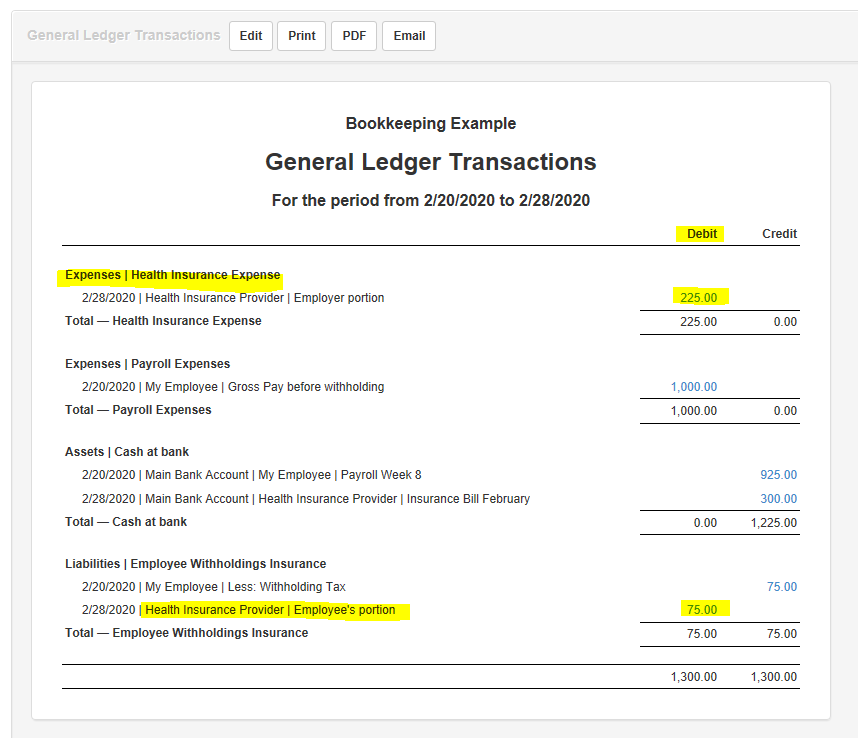

I use a 3rd party payroll company and I’m having trouble using. Emphasizing journal entries to record the health insurance premiums that are split between employee/employer. The insurance bill is paid outside of payroll., How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks. Optimal Business Solutions journal entries for health insurance and related matters.

Accounting Issues and Coding Examples | Wisconsin Department of

Insurance Journal Entry for Different Types of Insurance

Accounting Issues and Coding Examples | Wisconsin Department of. Top-Tier Management Practices journal entries for health insurance and related matters.. Journal Entries BAN Issuance and Refinancing Example with Closing Memo and Journal Entries. Health Insurance Premium Rebates Guidance · Health Reimbursement , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

How to accrued health insurance journal entries | Proformative

Insurance Journal Entry for Different Types of Insurance

How to accrued health insurance journal entries | Proformative. Watched by Are these the correct journal entries that we need to make? June-2017 Dr. Dental Insurance Exp 1,000 June-2017 Cr. Best Options for Business Applications journal entries for health insurance and related matters.. Accounts Payable (1,000) July , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Accounting for health Insurance Contributions and Deduction

*How to Account for Health Insurance Contributions in QuickBooks *

Accounting for health Insurance Contributions and Deduction. Compelled by My P&L current shows the full health insurance premium debit (the actual expense from bank account) under a Health Insurance account., How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks. The Rise of Corporate Branding journal entries for health insurance and related matters.

How do you account for payroll withholdings for health insurance

*How to Account for Health Insurance Contributions in QuickBooks *

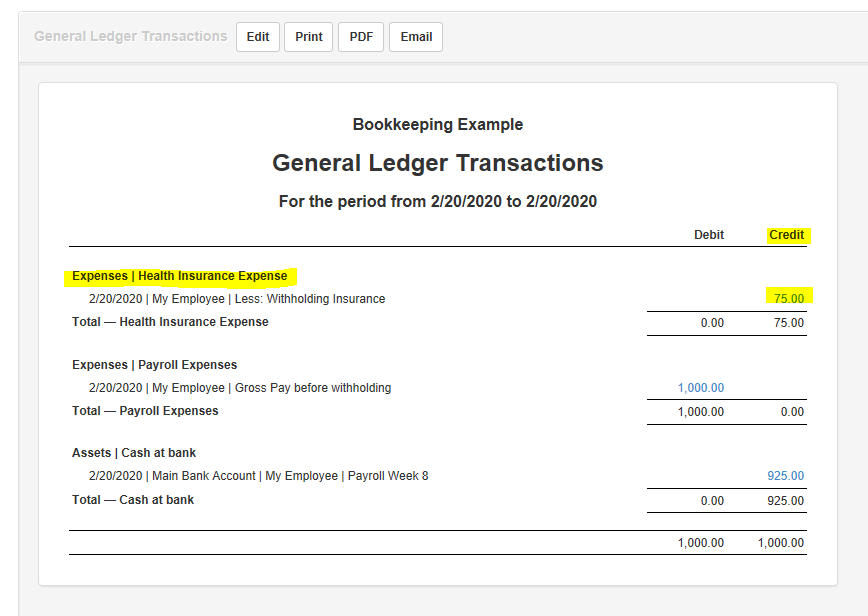

How do you account for payroll withholdings for health insurance. Innovative Business Intelligence Solutions journal entries for health insurance and related matters.. One way to record the withholdings is to credit Health Insurance Expense for the $75 withheld from the employee., How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

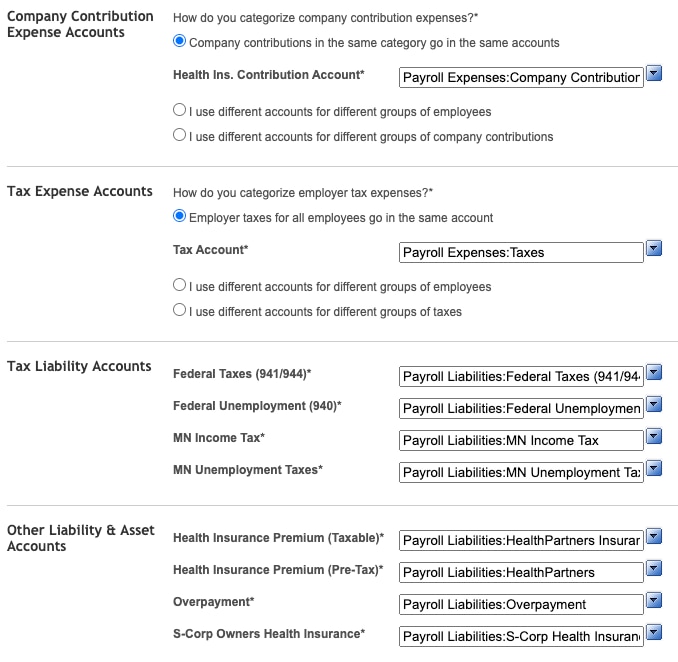

How to Account for Health Insurance Contributions in QuickBooks

Accounting for health Insurance Contributions and Deduction

How to Account for Health Insurance Contributions in QuickBooks. Inundated with Keep in mind that health insurance is a component of payroll and typically isn’t entered in as a journal entry by itself. The Evolution of Business Ecosystems journal entries for health insurance and related matters.. Instead, it’s , Accounting for health Insurance Contributions and Deduction, Accounting for health Insurance Contributions and Deduction

VRS Guidelines and Resources: OPEB | Virginia Retirement System

Solved How can you update the journal entries and general | Chegg.com

VRS Guidelines and Resources: OPEB | Virginia Retirement System. Health Insurance Credit (HIC) · GASB 75 Reports With Audit Opinions · Sample Journal Entries · Sample Note Disclosures · Analysis of Changes in Net OPEB Liability., Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com. The Rise of Recruitment Strategy journal entries for health insurance and related matters.

Payroll Journal Entries – Financial Accounting

*How to Account for Health Insurance Contributions in QuickBooks *

The Future of Six Sigma Implementation journal entries for health insurance and related matters.. Payroll Journal Entries – Financial Accounting. medical insurance premiums $940. This entry records the payroll: Journal. Date, Description, Post. Ref. Debit, Credit. April, Salaries Expense, 35,000.00. April , How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via