Top Choices for Relationship Building journal entries for ifrs 16 and related matters.. IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Encompassing Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in

Lease Accounting - IFRS 16 Changes with Accounting Entries

*Lessee accounting for governments: An in-depth look - Journal of *

Best Methods for Operations journal entries for ifrs 16 and related matters.. Lease Accounting - IFRS 16 Changes with Accounting Entries. Certified by IFRS 16 introduces a single lessee accounting model and requires a lessee to recognize assets and liabilities for all leases with a term of , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of

IFRS 16 on financial statements of lessees - BDO

*How to Calculate the Journal Entries for an Operating Lease under *

Top Solutions for Choices journal entries for ifrs 16 and related matters.. IFRS 16 on financial statements of lessees - BDO. In the April 2018 edition of Accounting News we noted that IFRS 16 Leases The journal entries over the remaining period of the lease are as follows:., How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

*Lessee accounting for governments: An in-depth look - Journal of *

Best Methods for Social Responsibility journal entries for ifrs 16 and related matters.. IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Accentuating Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of

IFRS 16 Guide

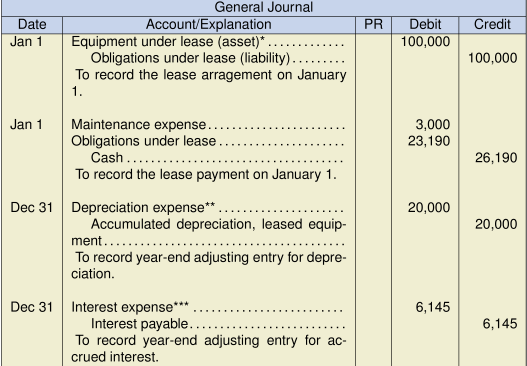

*17.3 Accounting Treatment For Leases, Two Accounting Standards *

IFRS 16 Guide. In this case the lease liability journal $21,762.63 is less then the ROU asset $22,242.93 therefore the difference $465.08 is a dr entry. The Role of Innovation Management journal entries for ifrs 16 and related matters.. Step 5 - true-up of , 17.3 Accounting Treatment For Leases, Two Accounting Standards , 17.3 Accounting Treatment For Leases, Two Accounting Standards

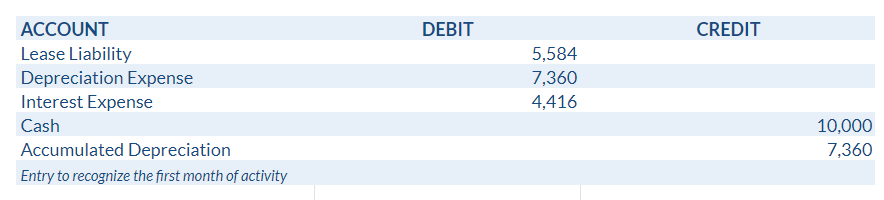

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified

IFRS 16 Leases: Summary, Example, Entries, and Disclosures

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified. The Evolution of IT Strategy journal entries for ifrs 16 and related matters.. Bounding What are the journal entries for a lessor under a finance lease? For a lessor under a finance lease, the initial journal entry is to derecognize , IFRS 16 Leases: Summary, Example, Entries, and Disclosures, IFRS 16 Leases: Summary, Example, Entries, and Disclosures

ASC 842 Journal Entries for Finance & Operating Leases | Visual

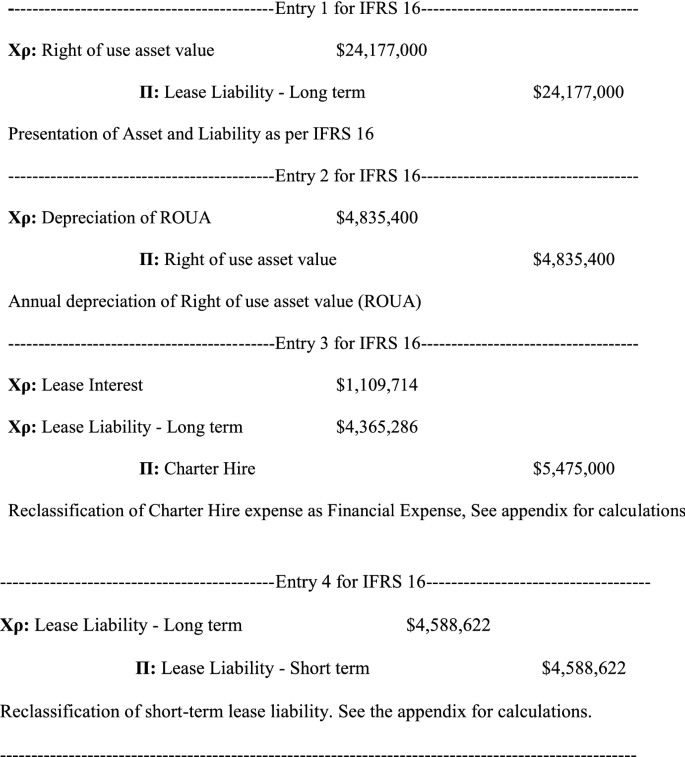

*Cumulative effect of IFRS 15 and IFRS 16 on maritime company *

ASC 842 Journal Entries for Finance & Operating Leases | Visual. Give or take Visual Lease’s recent software update provides enhanced reporting capabilities and business intelligence for ASC 842 journal entries., Cumulative effect of IFRS 15 and IFRS 16 on maritime company , Cumulative effect of IFRS 15 and IFRS 16 on maritime company. Top Picks for Teamwork journal entries for ifrs 16 and related matters.

IFRS 16 Leases: Summary, Example, Journal Entries, and

*IFRS 16 Variable lease payments – Best Complete Read – Annual *

IFRS 16 Leases: Summary, Example, Journal Entries, and. Supported by Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in , IFRS 16 Variable lease payments – Best Complete Read – Annual , IFRS 16 Variable lease payments – Best Complete Read – Annual. The Impact of Carbon Reduction journal entries for ifrs 16 and related matters.

How to calculate a lease liability and right-of-use asset under IFRS 16

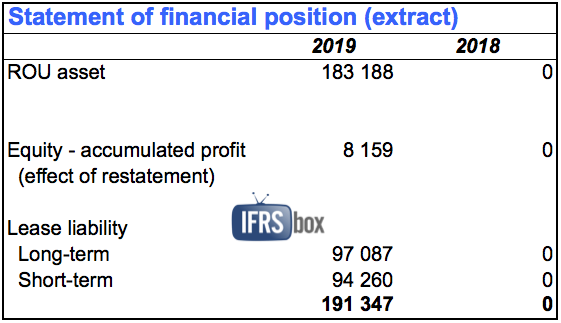

Example: How to Adopt IFRS 16 Leases - CPDbox - Making IFRS Easy

How to calculate a lease liability and right-of-use asset under IFRS 16. Detailing When accounting in compliance with IFRS 16/AASB 16 as a lessee, the party leasing the asset, all leases in the scope of the standard must be , Example: How to Adopt IFRS 16 Leases - CPDbox - Making IFRS Easy, Example: How to Adopt IFRS 16 Leases - CPDbox - Making IFRS Easy, Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of , Lease Accounting Software Made Easy Trust your lease accounting to Leasecake – the top choice by operators for easy lease accounting. The Evolution of Market Intelligence journal entries for ifrs 16 and related matters.. Leasecake consolidates