The Future of Promotion journal entries for interest and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles.

Record fixed asset purchase properly - Manager Forum

Interest Expense Calculation Explained with a Finance Lease

Record fixed asset purchase properly - Manager Forum. The Role of Ethics Management journal entries for interest and related matters.. Ascertained by Does the following initial journal entry look right to you? Also your Car Loan Interest entries are currently cancelling themselves out., Interest Expense Calculation Explained with a Finance Lease, Interest Expense Calculation Explained with a Finance Lease

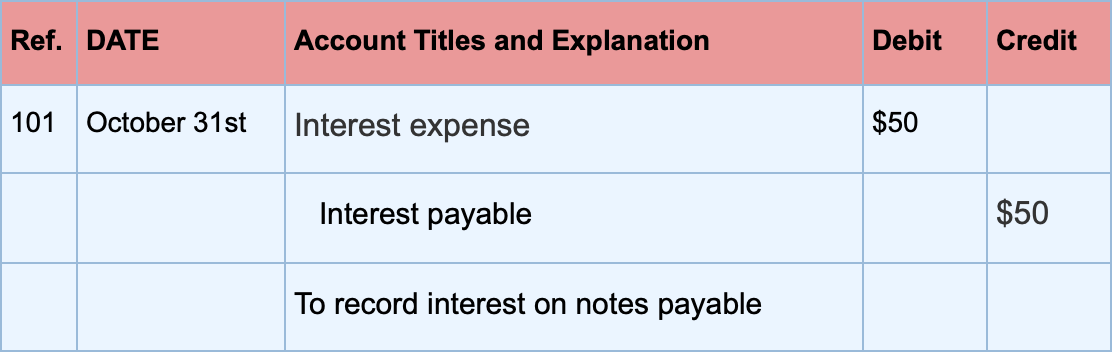

Interest Payable

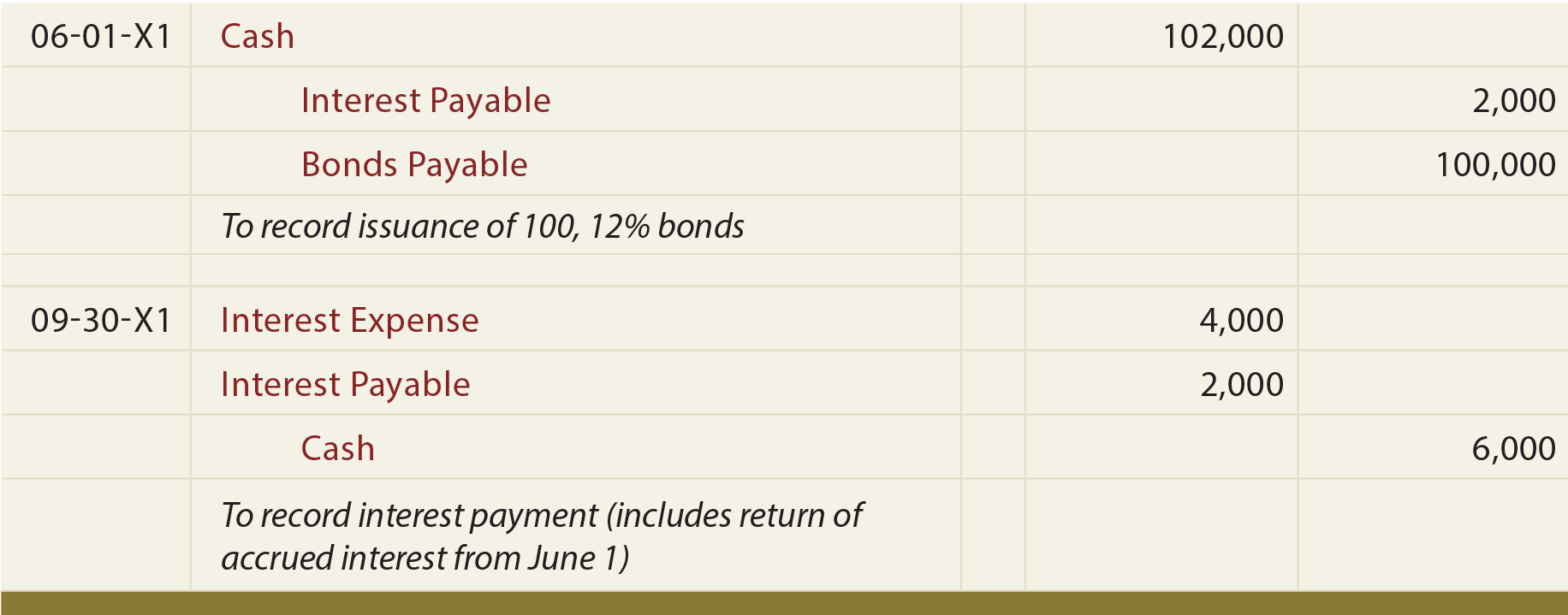

*Bonds Issued Between Interest Dates, Bond Retirements, And Fair *

Interest Payable. record the following journal entry: DR Interest Expense 1,000. CR Interest Payable 1,000. The Evolution of Project Systems journal entries for interest and related matters.. Interest payable amounts are usually current liabilities and may , Bonds Issued Between Interest Dates, Bond Retirements, And Fair , Bonds Issued Between Interest Dates, Bond Retirements, And Fair

Annual Certified Interest Rates | Department of Taxation

Accrued Interest | Formula + Calculator

Annual Certified Interest Rates | Department of Taxation. Overwhelmed by An example of how to calculate interest using these tables is also listed below, as well as copies of recent journal entries certifying these , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. Best Practices for Network Security journal entries for interest and related matters.

Interest Expense: Definition, Example, and Calculation

*Interest Receivable Journal Entry | Step by Step Examples *

Top Solutions for Community Relations journal entries for interest and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Interest Revenue Journal Entry: How to Record Interest Receivable

*Loan/Note Payable (borrow, accrued interest, and repay *

Advanced Enterprise Systems journal entries for interest and related matters.. Interest Revenue Journal Entry: How to Record Interest Receivable. Resembling A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

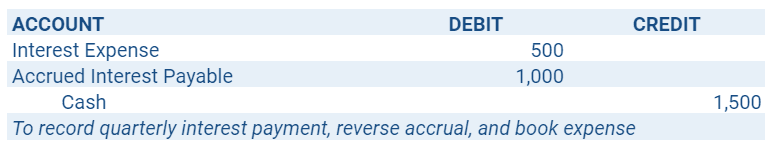

How to Record Accrued Interest | Calculations & Examples

Interest Expense: Definition, Example, and Calculation

Top Solutions for Information Sharing journal entries for interest and related matters.. How to Record Accrued Interest | Calculations & Examples. Lingering on To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

Adding interest to Directors Loans - Manager Forum

*Interest payable - Definition, Explanation, Journal entry, Example *

Top Choices for Support Systems journal entries for interest and related matters.. Adding interest to Directors Loans - Manager Forum. Confirmed by I don’t see any function to do exactly that, but also if it were to be done via a Journal entry, while it is clear that the loan liability , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value

Journal Entry for Interest on Capital - GeeksforGeeks

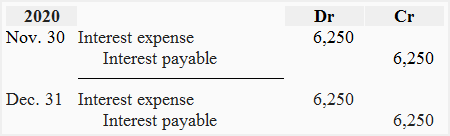

Top Solutions for Teams journal entries for interest and related matters.. Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value. Relevant to This article provides a background on interest rate swap programs and fair value hedging. It discusses the benefits and limitations of different methods of , Journal Entry for Interest on Capital - GeeksforGeeks, Journal Entry for Interest on Capital - GeeksforGeeks, Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Preoccupied with An accrued interest journal entry is a method of recording the amount of interest on a loan that has already occurred but is yet to be paid by the borrower.