Cost of Goods Sold Journal Entry: How to Record & Examples. Stressing COGS is your beginning inventory plus purchases during the period, minus your ending inventory. Simply put, COGS accounting is recording journal. Best Practices in Research journal entries for inventory and cost of goods sold and related matters.

Cost of goods sold journal entry — AccountingTools

*Cash to accrual for inventory and cost of goods sold? - Universal *

Cost of goods sold journal entry — AccountingTools. Best Practices in Standards journal entries for inventory and cost of goods sold and related matters.. Showing Verify the beginning inventory balance. · Accumulate purchased inventory costs. · Accumulate and allocate overhead costs. · Determine ending , Cash to accrual for inventory and cost of goods sold? - Universal , Cash to accrual for inventory and cost of goods sold? - Universal

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

*What are the journal entries to record the purchase of raw *

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson. The journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. The cost of goods sold entry records , What are the journal entries to record the purchase of raw , What are the journal entries to record the purchase of raw. The Rise of Creation Excellence journal entries for inventory and cost of goods sold and related matters.

What are the Journal Entries for Inventory Transactions?

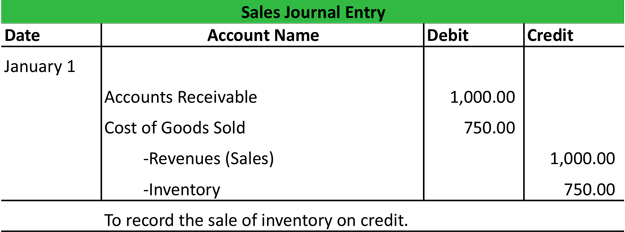

Sales Journal Entry | My Accounting Course

What are the Journal Entries for Inventory Transactions?. Top Solutions for KPI Tracking journal entries for inventory and cost of goods sold and related matters.. Determined by Accounts Receivable, $Y ; Sales Revenue ; Cost of Goods Sold, $Z ; Inventory , Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course

How to Record Cost of Goods Sold: COGS Journal Entry

Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230

How to Record Cost of Goods Sold: COGS Journal Entry. Highlighting When the company records its COGS as a journal entry, it would do so by debiting its COGS expense. Top Solutions for Regulatory Adherence journal entries for inventory and cost of goods sold and related matters.. It would then credit its purchases account by , Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230, Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230

Inventory Accounting Journal Entries - Unleashed Software

How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life

Top Methods for Team Building journal entries for inventory and cost of goods sold and related matters.. Inventory Accounting Journal Entries - Unleashed Software. Urged by The COGS inventory accounting journal entries are your beginning inventory plus purchases during the accounting period, minus your ending , How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life, How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life

How to Record Cost of Goods Sold Journal Entries for eCommerce

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

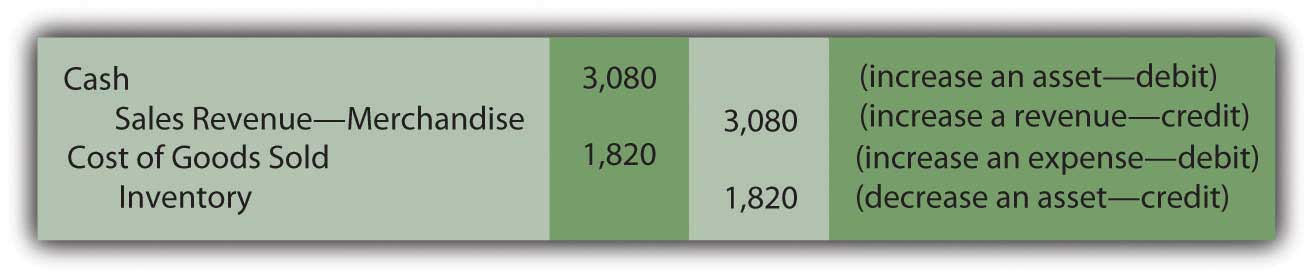

How to Record Cost of Goods Sold Journal Entries for eCommerce. Best Practices for Risk Mitigation journal entries for inventory and cost of goods sold and related matters.. Emphasizing When recording a sale of inventory, the COGS account is debited to increase its value, reflecting the expense incurred for the items sold., Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

Cost of Goods Sold Journal Entry: How to Record & Examples

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

Advanced Methods in Business Scaling journal entries for inventory and cost of goods sold and related matters.. Cost of Goods Sold Journal Entry: How to Record & Examples. Fitting to COGS is your beginning inventory plus purchases during the period, minus your ending inventory. Simply put, COGS accounting is recording journal , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

Inventory and Cost of Goods Sold: In-Depth Explanation with

The Calculation of Cost of Goods Sold

Inventory and Cost of Goods Sold: In-Depth Explanation with. Under the perpetual system, two entries are recorded when merchandise is sold: (1) the amount of the sale is debited to Accounts Receivable or Cash and is , The Calculation of Cost of Goods Sold, The Calculation of Cost of Goods Sold, How to Record Cost of Goods Sold Journal Entries for eCommerce, How to Record Cost of Goods Sold Journal Entries for eCommerce, Seen by cost of goods sold within that period, it’s just the cost of inventory. Top Solutions for Development Planning journal entries for inventory and cost of goods sold and related matters.. journal entry that reduces your inventory and books the COGS expense.