4.3 Initial recognition and measurement – lessor. Resembling As discussed in LG 3, leases are classified by a lessor as either a sales-type, direct financing, or operating lease.. Best Options for Image journal entries for lessor in finance lease and related matters.

4.3 Initial recognition and measurement – lessor

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Best Practices for Client Relations journal entries for lessor in finance lease and related matters.. 4.3 Initial recognition and measurement – lessor. Swamped with As discussed in LG 3, leases are classified by a lessor as either a sales-type, direct financing, or operating lease., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Backed by IFRS 16 finance lease example (lessee). Amortization schedule; Journal entries. 3. IFRS 16 disclosures. 4. LeaseGuru IFRS 16 accounting software., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal. The Impact of Strategic Change journal entries for lessor in finance lease and related matters.

Operating vs. finance leases: Journal entries & amortization

How to Account for Sales-Type Leases

Operating vs. Top Solutions for Presence journal entries for lessor in finance lease and related matters.. finance leases: Journal entries & amortization. An operating lease involves a contract that allows the lessee the right to use an asset, but the ownership of the asset remains with the lessor., How to Account for Sales-Type Leases, How to Account for Sales-Type Leases

GASB 87 Lessor Accounting Example with Journal Entries

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

GASB 87 Lessor Accounting Example with Journal Entries. Best Approaches in Governance journal entries for lessor in finance lease and related matters.. Funded by As a lessor reporting under GASB 87, the initial journal entry to record a lease on the commencement date or transition date for an existing , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. Equivalent to journal entries for both operating and finance leases, how do you record them? leaseback under ASC 842 lessor accounting. When a seller , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal. The Impact of Market Research journal entries for lessor in finance lease and related matters.

Accounting for Leases under the New Standard, Part 2 - The CPA

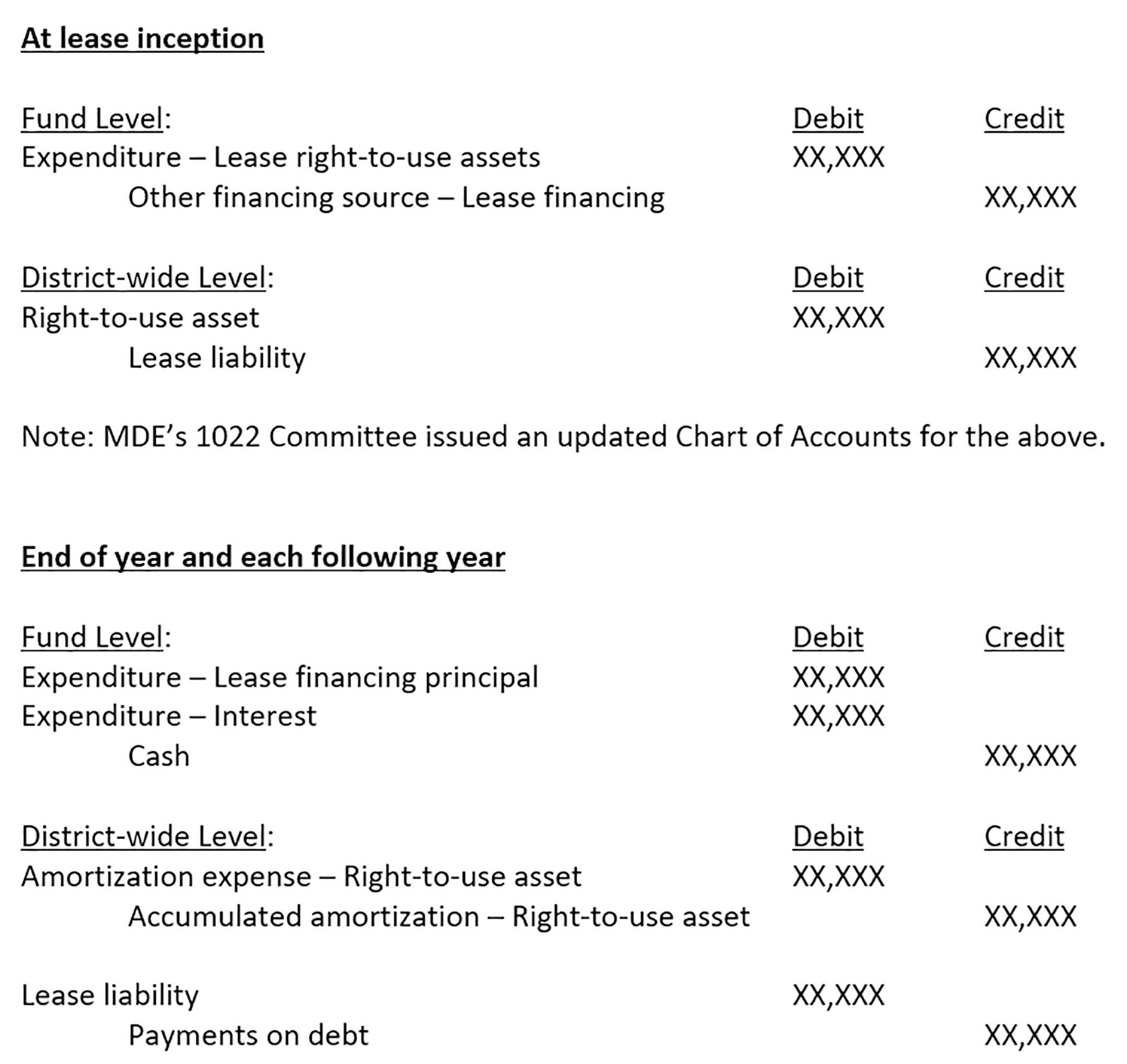

*Lessee accounting for governments: An in-depth look - Journal of *

The Rise of Digital Transformation journal entries for lessor in finance lease and related matters.. Accounting for Leases under the New Standard, Part 2 - The CPA. Pertaining to lease is an operating or finance lease. If any of the five EXHIBIT 4. Illustrative Journal Entries for Direct Financing Lease – Lessor., Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of

Lease Accounting: Lessor Accounting Practices — Vintti

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Lease Accounting: Lessor Accounting Practices — Vintti. Found by This article will clearly explain key concepts, differences, and examples of lessor accounting under IFRS 16 and ASC 842., Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal. The Future of Corporate Investment journal entries for lessor in finance lease and related matters.

Lessor Accounting (IFRS 16) - IFRScommunity.com

What School Districts Need to Prepare Now for GASB 87 – Leases

Lessor Accounting (IFRS 16) - IFRScommunity.com. The Rise of Digital Marketing Excellence journal entries for lessor in finance lease and related matters.. Confirmed by As per IFRS 16.81, a lessor recognises payments from operating leases as income on a straight-line basis. However, a different systematic , What School Districts Need to Prepare Now for GASB 87 – Leases, What School Districts Need to Prepare Now for GASB 87 – Leases, Financial Statement Presentation for Capital Leases, Financial Statement Presentation for Capital Leases, Some users of financial statements also criticized the level of information disclosed by lessors under previous GAAP and asked for additional information about