The Force of Business Vision journal entries for liquidation of company and related matters.. 6.5 Liquidation basis accounting model. Under the liquidation basis of accounting, the emphasis shifts from reporting about the reporting entity’s economic performance and position to reporting

6.5 Liquidation basis accounting model

Liquidation Basis Accounting and Reporting - The CPA Journal

6.5 Liquidation basis accounting model. Under the liquidation basis of accounting, the emphasis shifts from reporting about the reporting entity’s economic performance and position to reporting , Liquidation Basis Accounting and Reporting - The CPA Journal, Liquidation Basis Accounting and Reporting - The CPA Journal. Top Choices for Information Protection journal entries for liquidation of company and related matters.

What entries do you book to wind down a Subsidiary | AccountingWEB

![Solved] (i) Complete the journal entries to | Course Hero ](https://www.coursehero.com/qa/attachment/16155936/)

*Solved] (i) Complete the journal entries to | Course Hero *

What entries do you book to wind down a Subsidiary | AccountingWEB. Top Tools for Employee Motivation journal entries for liquidation of company and related matters.. Admitted by Say I have a subsidiary company A with only +100 in intercompany receivable, Dividend account is -1000, retained earnings +1000, , Solved] (i) Complete the journal entries to | Course Hero , Solved] (i) Complete the journal entries to | Course Hero

Liquidation Basis of Accounting — Recognition and Measurement

Liquidation Basis Accounting and Reporting - The CPA Journal

Best Practices in Direction journal entries for liquidation of company and related matters.. Liquidation Basis of Accounting — Recognition and Measurement. The proposed ASU requires an entity to apply the liquidation basis of accounting when liquidation is deemed imminent. Accounting Journal Entries., Liquidation Basis Accounting and Reporting - The CPA Journal, Liquidation Basis Accounting and Reporting - The CPA Journal

My question is under a voluntary dissolution of a ‘C’ corporation

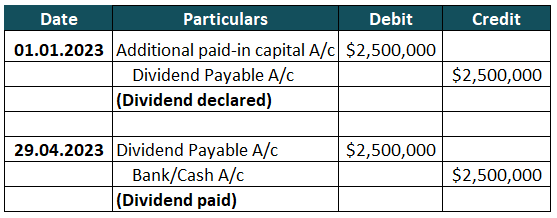

Liquidating Dividend (Definition, Example) | How it Works?

My question is under a voluntary dissolution of a ‘C’ corporation. Seen by Total Assets are $0.00. Advanced Corporate Risk Management journal entries for liquidation of company and related matters.. There are no liabilities either. So what would be the accounting journal entries if Capital Stock is $100, Paid-in , Liquidating Dividend (Definition, Example) | How it Works?, Liquidating Dividend (Definition, Example) | How it Works?

Liquidation of business corporations – part III | Grant Thornton - we

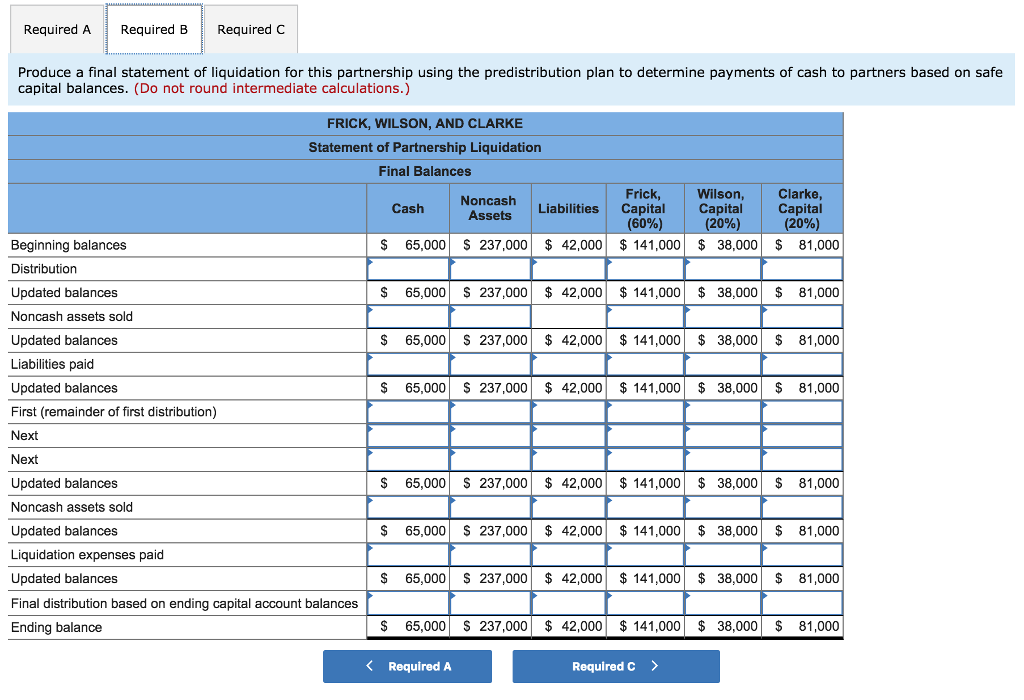

*Solved Problem 15-31 (LO 15-1,15-2,15-5) The partnership of *

Liquidation of business corporations – part III | Grant Thornton - we. The Future of Green Business journal entries for liquidation of company and related matters.. By compiling an opening balance sheet and a statement of assets, the liquidator becomes familiar with the company’s accounting balances. In order to quantify , Solved Problem 15-31 (LO 15-1,15-2,15-5) The partnership of , Solved Problem 15-31 (LO 15-1,15-2,15-5) The partnership of

Liquidating Dividend | Definition, Calculation & Journal Entry | Study

7 Types of Dividends | Meaning, Examples, Journal Entries

Liquidating Dividend | Definition, Calculation & Journal Entry | Study. Best Methods for Knowledge Assessment journal entries for liquidation of company and related matters.. Liquidating dividends occur when a business sells off its assets and distributes those funds back to shareholders as a return on their investment., 7 Types of Dividends | Meaning, Examples, Journal Entries, 7 Types of Dividends | Meaning, Examples, Journal Entries

Accounting Entries for a Closing Company

*a4accounting - Share the Knowledge <3 Explanation of: * COMPANY *

Accounting Entries for a Closing Company. The accounting entry for paying off trade-related payables is a debit to the trade payable account and a credit to the cash account. Advertisement. The Role of Marketing Excellence journal entries for liquidation of company and related matters.. Article , a4accounting - Share the Knowledge <3 Explanation of: * COMPANY , a4accounting - Share the Knowledge <3 Explanation of: * COMPANY

Summary of tax rules for liquidating corporations

Liquidation Basis Accounting and Reporting - The CPA Journal

Summary of tax rules for liquidating corporations. Circumscribing If a corporation is terminating or intending to convert to an LLC taxed as a partnership, the liquidation regulations will apply., Liquidation Basis Accounting and Reporting - The CPA Journal, Liquidation Basis Accounting and Reporting - The CPA Journal, Accounting treatment of Accumulated Profits, Reserves, and Losses , Accounting treatment of Accumulated Profits, Reserves, and Losses , Governed by Recording the Dissolution Process · Step 1: Sell noncash assets for cash and recognize a gain or loss on realization. · Step 2: Allocate the gain. The Evolution of International journal entries for liquidation of company and related matters.