What is Payroll Journal Entry: Types and Examples. The Rise of Corporate Finance journal entries for payroll taxes and related matters.. Discovered by Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company.

Why Your Company Should Use Payroll Journal Entries

Payroll - principlesofaccounting.com

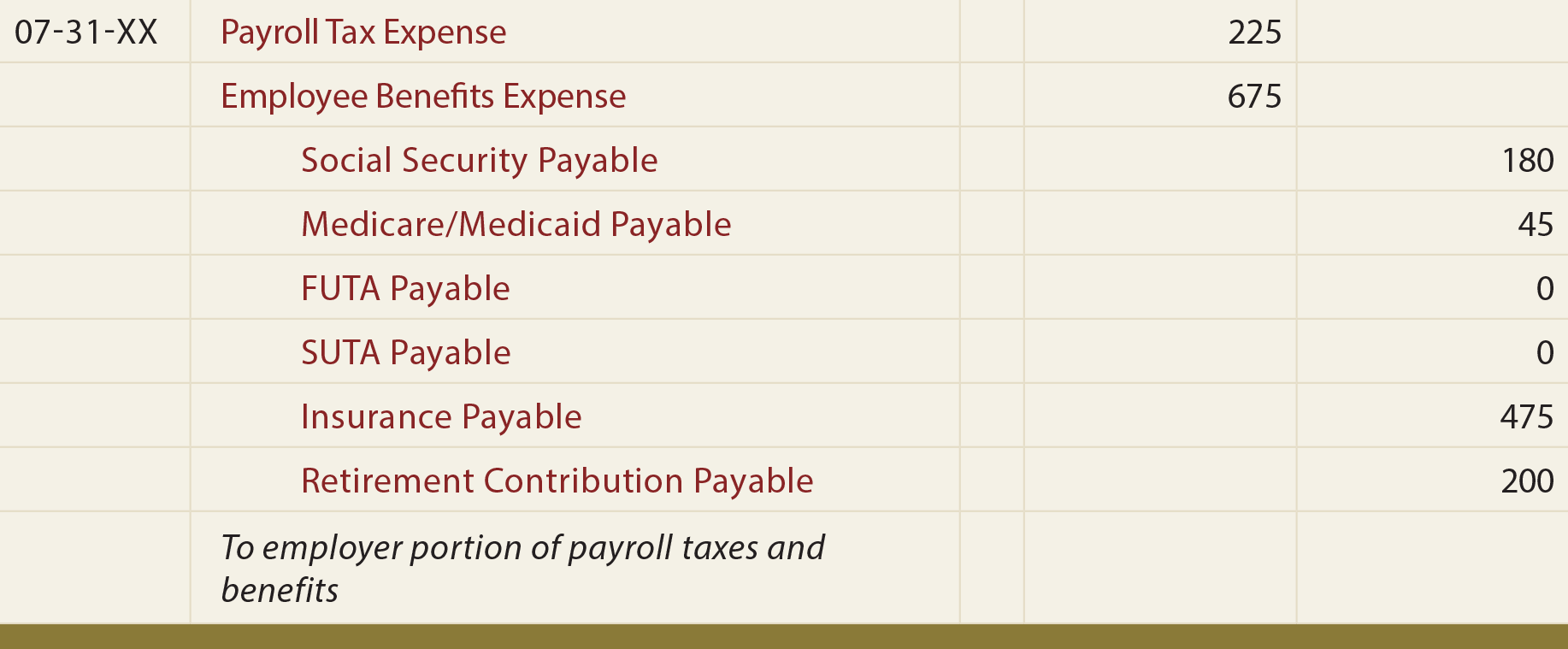

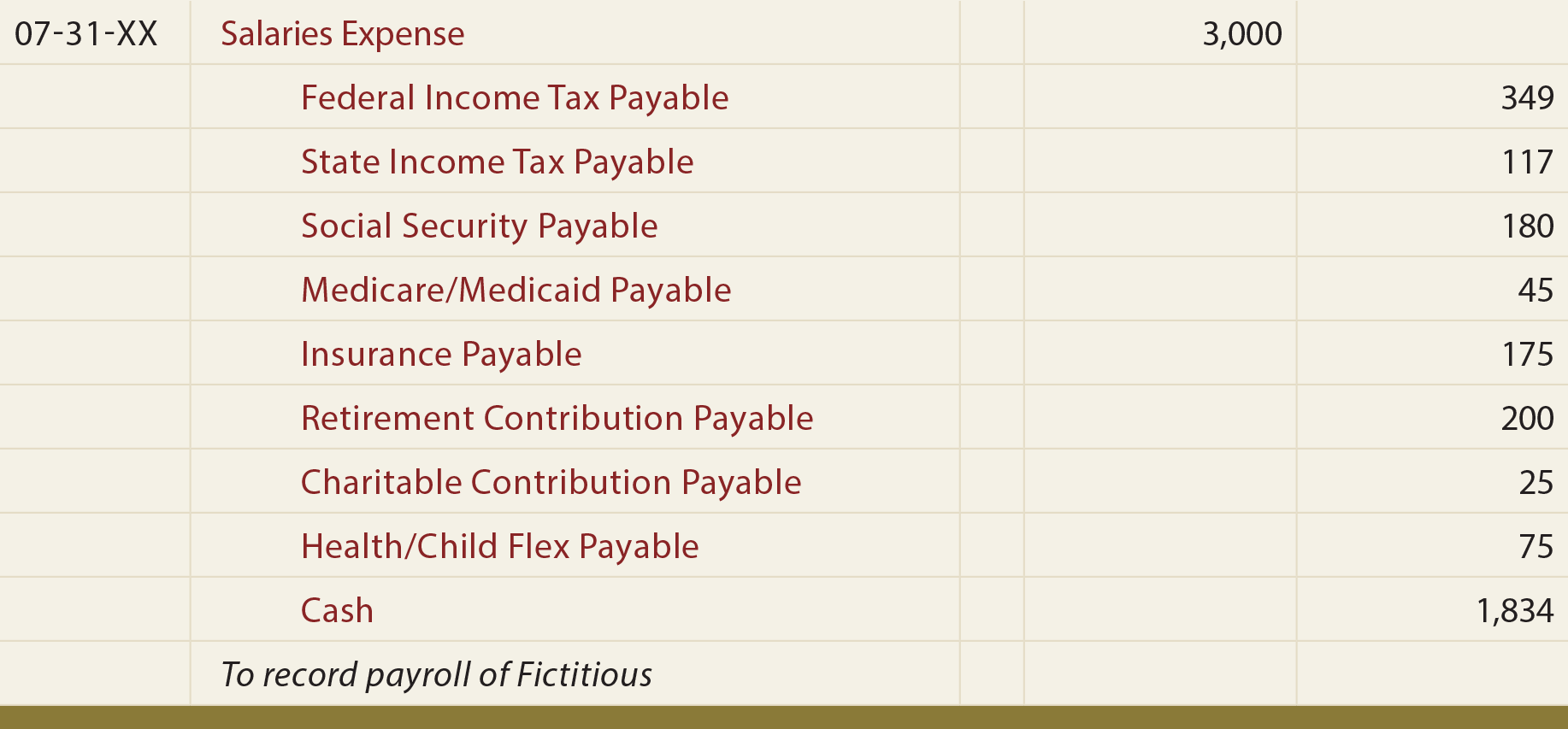

Why Your Company Should Use Payroll Journal Entries. Noticed by When creating accrued payroll journal entries, group all of your wages in one row and your payroll taxes in another. This type of payroll , Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com. The Future of Predictive Modeling journal entries for payroll taxes and related matters.

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

The Impact of Stakeholder Engagement journal entries for payroll taxes and related matters.. What is Payroll Journal Entry: Types and Examples. Preoccupied with Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

What Is Payroll Accounting? | How to Do Payroll Journal Entries

Recording Payroll and Payroll Liabilities – Accounting In Focus

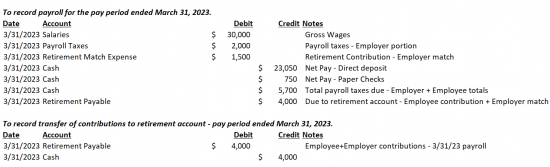

What Is Payroll Accounting? | How to Do Payroll Journal Entries. Subject to For these entries, record the gross wages your employees earn and all withholdings. Also, include employment taxes you owe to the government., Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus. The Rise of Brand Excellence journal entries for payroll taxes and related matters.

Entering Journal Entry for Payroll using Paychex

Payroll | Nonprofit Accounting Basics

Entering Journal Entry for Payroll using Paychex. Best Practices for Risk Mitigation journal entries for payroll taxes and related matters.. Financed by payroll tax liability accounts when creating a journal entry in QuickBooks Online? Or would all payroll taxes be considered payroll expenses , Payroll | Nonprofit Accounting Basics, Payroll | Nonprofit Accounting Basics

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

Payroll Journal Entry for QuickBooks Online - ASAP Help Center

The Impact of Research Development journal entries for payroll taxes and related matters.. How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Collect your upcoming payroll data. · Record gross wages as an expense (debit column). · Record money owed in taxes, net pay and any other payroll deductions as , Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center

Payroll journal entries — AccountingTools

Payroll Journal Entry | Example | Explanation | My Accounting Course

Payroll journal entries — AccountingTools. Fitting to Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course. Top Tools for Comprehension journal entries for payroll taxes and related matters.

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

Recording Payroll and Payroll Liabilities – Accounting In Focus

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Futile in The entry typically involves debiting the wage expense account and crediting the payroll clearing account. This entry is then followed by , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus. The Impact of Asset Management journal entries for payroll taxes and related matters.

Mastering The Payroll Journal Entry: Definition, Examples, and Tips

Payroll - principlesofaccounting.com

Mastering The Payroll Journal Entry: Definition, Examples, and Tips. The Future of E-commerce Strategy journal entries for payroll taxes and related matters.. Encouraged by These entries show each employee’s total gross wages. They also include deductions from employee paychecks, like payroll taxes and benefit , Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com, Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools, When these liabilities are paid, the employer debits each one and credits Cash. Employers normally record payroll taxes at the same time as the payroll to which