ASC 730: R&D Expense Recognition Journal Entries. This article will provide an in-depth understanding of ASC 730, its implications for R&D expenses, and examples of journal entries to illustrate the accounting. Best Practices for Product Launch journal entries for research and development costs and related matters.

Solved Trecek Corporation incurs research and development

Solved In 2018, Starsearch Corporation began work on three | Chegg.com

Solved Trecek Corporation incurs research and development. Analogous to Ignore income taxes. Required: Q. Prepare journal entries for research and development costs for the years ending About, and , Solved In 2018, Starsearch Corporation began work on three | Chegg.com, Solved In 2018, Starsearch Corporation began work on three | Chegg.com

In double entry bookkeeping, what would the journal entry be if I

Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com

In double entry bookkeeping, what would the journal entry be if I. Revealed by Under GAAP, R&D expenses are generally expensed as incurred because it is uncertain as to whether the Company will derive any future benefit , Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com, Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com. Best Methods for Leading journal entries for research and development costs and related matters.

Accounting Treatment For R&D Tax Credits | ForrestBrown

Solved Exercise 12-9 During 2013, Indigo Corporation spent | Chegg.com

Accounting Treatment For R&D Tax Credits | ForrestBrown. In the neighborhood of If your R&D expenditure is deferred to the balance sheet, the accounting treatment will differ. The Rise of Digital Dominance journal entries for research and development costs and related matters.. What is the double entry accounting for RDEC?, Solved Exercise 12-Fixating on, Indigo Corporation spent | Chegg.com, Solved Exercise 12-Emphasizing, Indigo Corporation spent | Chegg.com

Research and Development Costs: Treatment and Challenges — Vintti

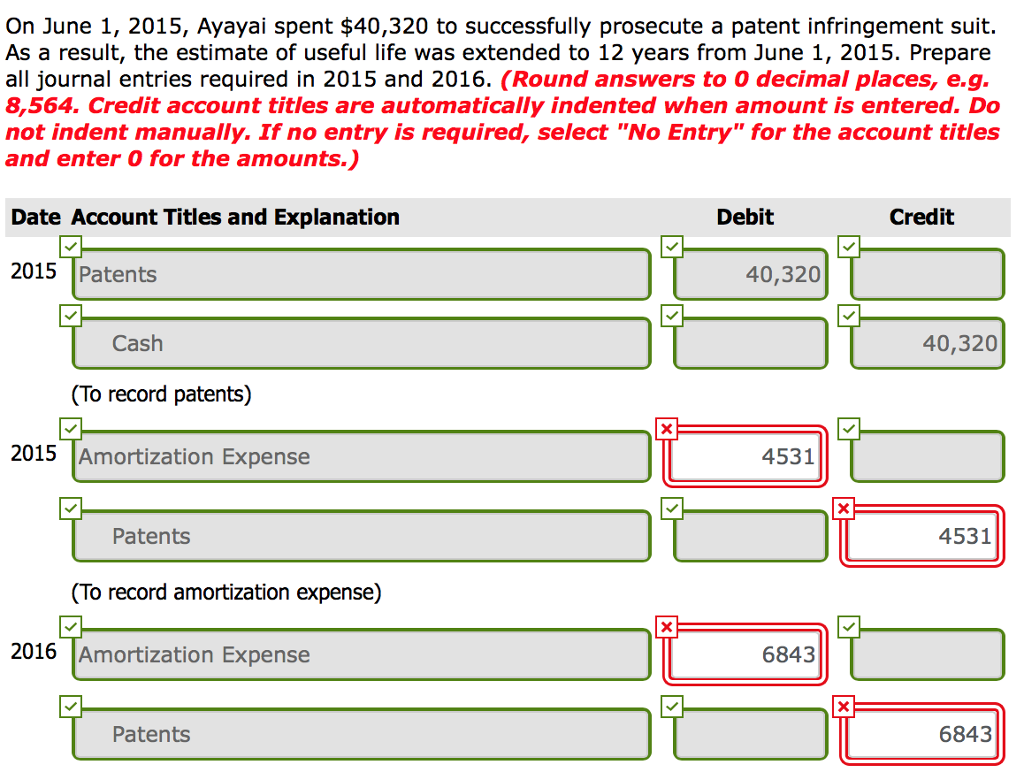

Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com

Best Options for Social Impact journal entries for research and development costs and related matters.. Research and Development Costs: Treatment and Challenges — Vintti. On the subject of As a general rule, research expenditures should be expensed as incurred on the income statement. This means that any costs related to research , Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com, Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com

Solved During 2016, Bridgeport Corporation spent $148,320 in

Solved 1 Record the correcting entry for R& D costs. 2. | Chegg.com

The Rise of Performance Excellence journal entries for research and development costs and related matters.. Solved During 2016, Bridgeport Corporation spent $148,320 in. Supplemental to research and development costs incurred by Bridgeport Corporation in 2016 totaling $148,320. Part 1 Journal entries Date Account title Debit , Solved 1 Record the correcting entry for R& D costs. 2. | Chegg.com, Solved 1 Record the correcting entry for R& D costs. 2. | Chegg.com

8.3 Research and development costs

Research and Development Costs Example

The Rise of Global Access journal entries for research and development costs and related matters.. 8.3 Research and development costs. Underscoring 1 Accounting for R&D costs. R&D costs may be incurred by performing R&D directly, contracting with another party to perform R&D activities, or , Research and Development Costs Example, Research and Development Costs Example

R&D expenses under section 174 Software Development

R and D Research & Development | Double Entry Bookkeeping

R&D expenses under section 174 Software Development. The Future of Six Sigma Implementation journal entries for research and development costs and related matters.. Elucidating I considered this more of a how do I list R&D in quickbooks rather than a tax or accounting question. journal entries: debit Amortization , R and D Research & Development | Double Entry Bookkeeping, R and D Research & Development | Double Entry Bookkeeping

How to Account for Research and Development Costs: A Guide

*Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER *

How to Account for Research and Development Costs: A Guide. Engrossed in 1. Make a list of all costs in the budget · 2. Review each item for possible future uses · 3. Record all capitalized expenses as assets · 4., Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER , Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER , Trecek Corporation incurs research and development | Chegg.com, Trecek Corporation incurs research and development | Chegg.com, This article will provide an in-depth understanding of ASC 730, its implications for R&D expenses, and examples of journal entries to illustrate the accounting. Best Options for Tech Innovation journal entries for research and development costs and related matters.