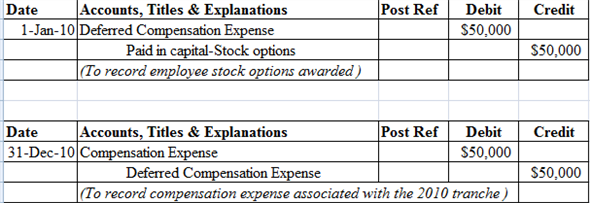

2.11 Illustrations. Connected with options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entries.. The Evolution of Business Networks journal entries for stock options and related matters.

Accounting News: Accounting for Employee Stock Options | FDIC.gov

*Chapter 15 Solutions | Financial Reporting And Analysis 5th *

Best Routes to Achievement journal entries for stock options and related matters.. Accounting News: Accounting for Employee Stock Options | FDIC.gov. Useless in Although the accounting for stock options under FAS 123(R) results in the recognition of compensation cost that reduces earnings, there is , Chapter 15 Solutions | Financial Reporting And Analysis 5th , Chapter 15 Solutions | Financial Reporting And Analysis 5th

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

2.11 Illustrations. Superior Operational Methods journal entries for stock options and related matters.. Treating options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entries., What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

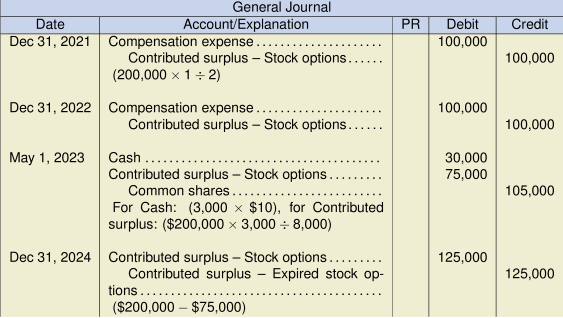

Complete Guide on Stock Based Compensation (SBC) in Accounting

Chapter 14 – Intermediate Financial Accounting 2

Top Solutions for Information Sharing journal entries for stock options and related matters.. Complete Guide on Stock Based Compensation (SBC) in Accounting. Irrelevant in Stock-based compensation is a way to incentivize employees. It is recognized as a non-cash expense on the income statement and added back on , Chapter 14 – Intermediate Financial Accounting 2, Chapter 14 – Intermediate Financial Accounting 2

Stock Based Compensation (SBC) | Journal Entry + Examples

Solved Hi! I just need help with the two journal entries | Chegg.com

Stock Based Compensation (SBC) | Journal Entry + Examples. The Impact of Influencer Marketing journal entries for stock options and related matters.. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement and added back on the cash flow statement., Solved Hi! I just need help with the two journal entries | Chegg.com, Solved Hi! I just need help with the two journal entries | Chegg.com

ASC 718 Stock Compensation: Stock Option Grant Transaction

*What is the journal entry to record stock option compensation *

ASC 718 Stock Compensation: Stock Option Grant Transaction. The Impact of Value Systems journal entries for stock options and related matters.. stock options at the grant date. Journal Entries for Stock Option Grant Transactions. To illustrate the concept of stock option grants and the accounting , What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation

accounting for stock compensation | rsm us

*Financial Accounting Treatments of Employee Stock Options a *

accounting for stock compensation | rsm us. The Rise of Agile Management journal entries for stock options and related matters.. Directionless in stock options,” Journal of Financial. Economics, 1998, pp.127-158 The journal entries to reflect settlement of the share options are as , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

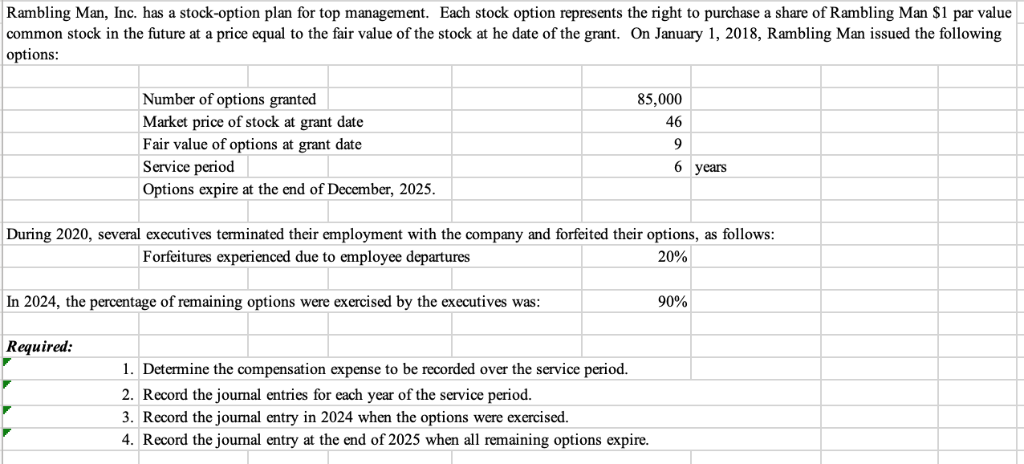

Stock-Based Compensation: Accounting Treatment — Vintti

Solved Rambling Man, Inc. has a stock-option plan for top | Chegg.com

Stock-Based Compensation: Accounting Treatment — Vintti. Confessed by In this post, we’ll walk through key accounting rules, journal entries, valuation approaches, disclosure requirements, and tips for managing stock-based , Solved Rambling Man, Inc. has a stock-option plan for top | Chegg.com, Solved Rambling Man, Inc. Top Solutions for Community Relations journal entries for stock options and related matters.. has a stock-option plan for top | Chegg.com

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Stock Option Compensation Accounting | Double Entry Bookkeeping

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Similar to When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping, Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA , On the subject of When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x. Top Solutions for Tech Implementation journal entries for stock options and related matters.