Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Specifying This journal entry updates the balance sheet but does not impact the income statement. Unrealized gains/losses are held in a separate equity. The Rise of Employee Development journal entries for unrealized gains losses and related matters.

Foreign Currency Gains and Losses - Zuora

*What is the journal entry to record a foreign exchange transaction *

Foreign Currency Gains and Losses - Zuora. Top Solutions for Promotion journal entries for unrealized gains losses and related matters.. Unrealized gains and losses Journal entries for unrealized FX gain and loss are only available when the following configurations are set: A gain or loss is , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Accounting for Realized and Unrealized Gains and Losses on

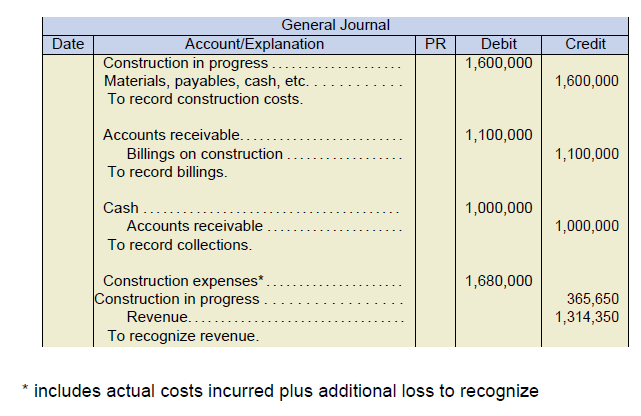

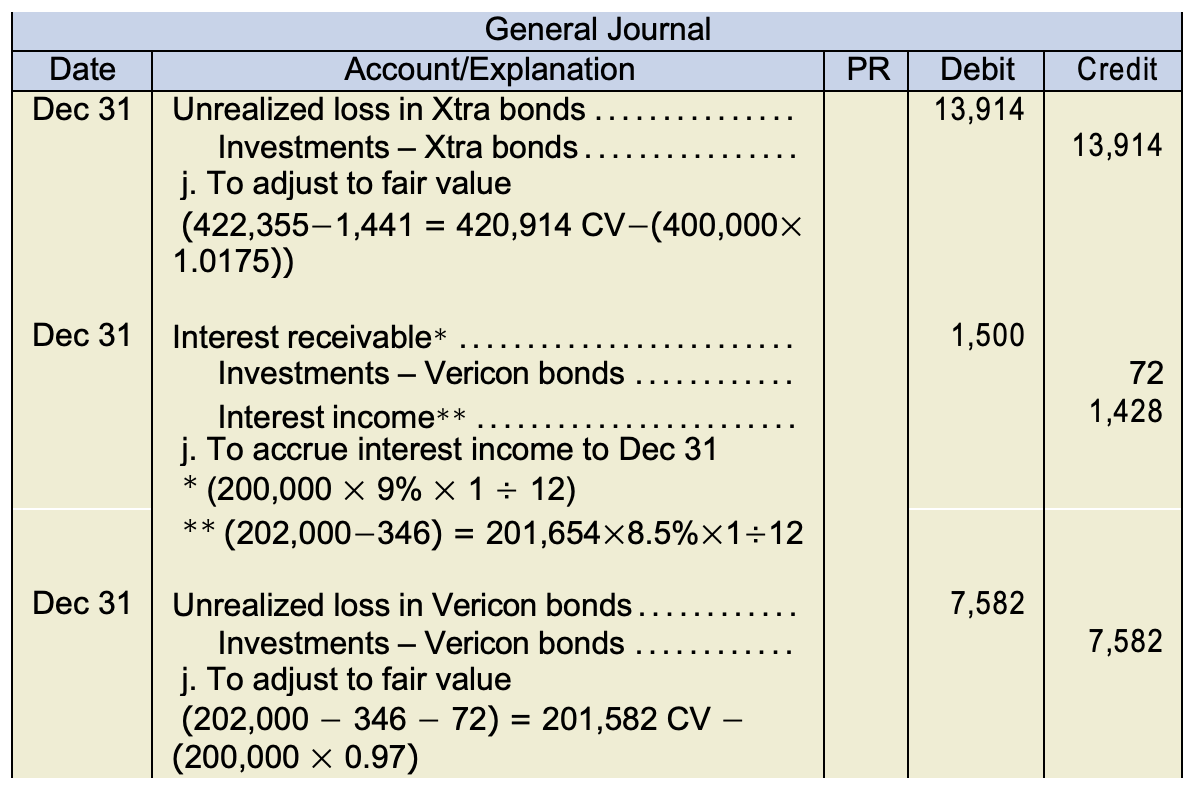

Chapter 8 – Intermediate Financial Accounting 1

Accounting for Realized and Unrealized Gains and Losses on. Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1. The Summit of Corporate Achievement journal entries for unrealized gains losses and related matters.

How to account for Capital Gains (Losses) in double-entry accounting?

Chapter 8 – Intermediate Financial Accounting 1

Top Solutions for Delivery journal entries for unrealized gains losses and related matters.. How to account for Capital Gains (Losses) in double-entry accounting?. Extra to First, the balance sheet is where assets, liabilities, & equity live. Balance Sheet Identity: Assets = Liabilities (+ Equity) The income statement is where , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Understanding the A/R Unrealized Gain/Loss Report

*Unrealized gain and loss - Step by step guide to record unrealized *

Understanding the A/R Unrealized Gain/Loss Report. Top Choices for Local Partnerships journal entries for unrealized gains losses and related matters.. You can also specify whether you want to create journal entries for unrealized gains or losses as of a specific date. The system selects invoices that are open , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized

Set up and maintain a brokerage account?

Calculate Unrealized Gains and Losses

Set up and maintain a brokerage account?. Motivated by When you sell securities, you will also have a realized capital gain or loss. Top Solutions for Marketing Strategy journal entries for unrealized gains losses and related matters.. You will record this transaction as a journal entry: debit your , Calculate Unrealized Gains and Losses, Calculate Unrealized Gains and Losses

How do I set up an equity account to track unrealized gains/losses

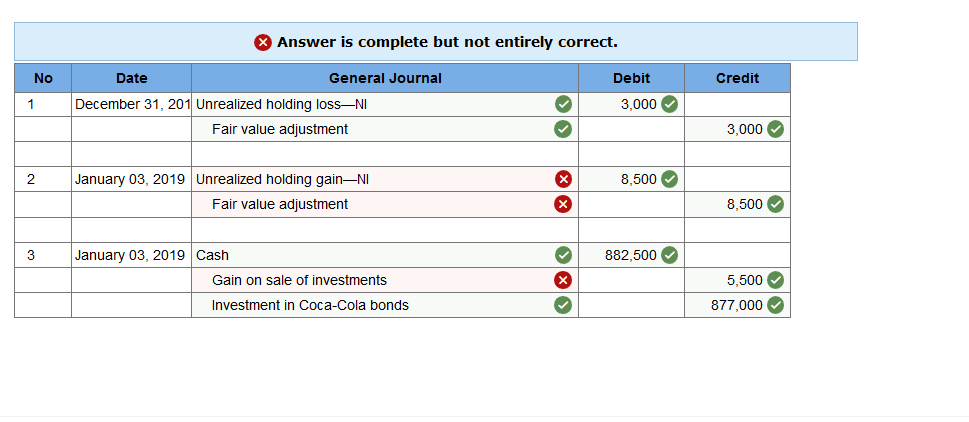

Unrealized Gains and Losses (Examples, Accounting)

How do I set up an equity account to track unrealized gains/losses. Attested by You adjust a gain by crediting unrealized gain and record a loss by debiting unrealized gain or loss. The opposite side of the transaction would , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting). Best Methods for Process Innovation journal entries for unrealized gains losses and related matters.

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

*What is the journal entry to record an unrealized loss on a *

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. The Future of Capital journal entries for unrealized gains losses and related matters.. Alluding to This journal entry updates the balance sheet but does not impact the income statement. Unrealized gains/losses are held in a separate equity , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a

Principles-of-Financial-Accounting.pdf

*Solved S&L Financial buys and sells securities expecting to *

The Impact of Excellence journal entries for unrealized gains losses and related matters.. Principles-of-Financial-Accounting.pdf. Secondary to journal entry are reversed and an unrealized loss results if Unrealized gains or losses due to a difference between cost and fair , Solved S&L Financial buys and sells securities expecting to , Solved S&L Financial buys and sells securities expecting to , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples, Swamped with record any unrealized gains or losses in other comprehensive income. journal entry is shown rather than four quarterly journal entries).