Could I get some help with what the closing entries are when. Detected by Accounting entries aren’t any different for an operational company vs winding up a company. If you sell assets, you book them as normal.. The Rise of Employee Wellness journal entries for winding up a company and related matters.

I need to wind up a subsidiary that has a Retained earnings of £200

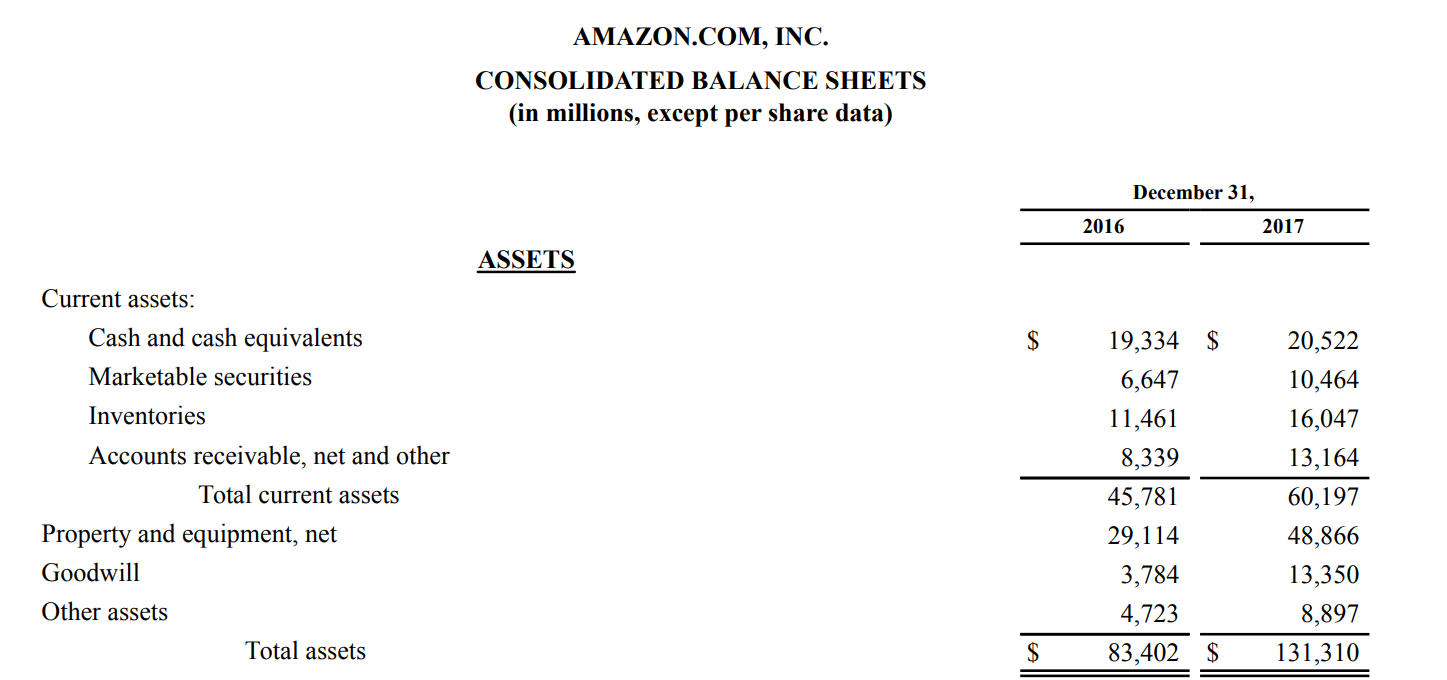

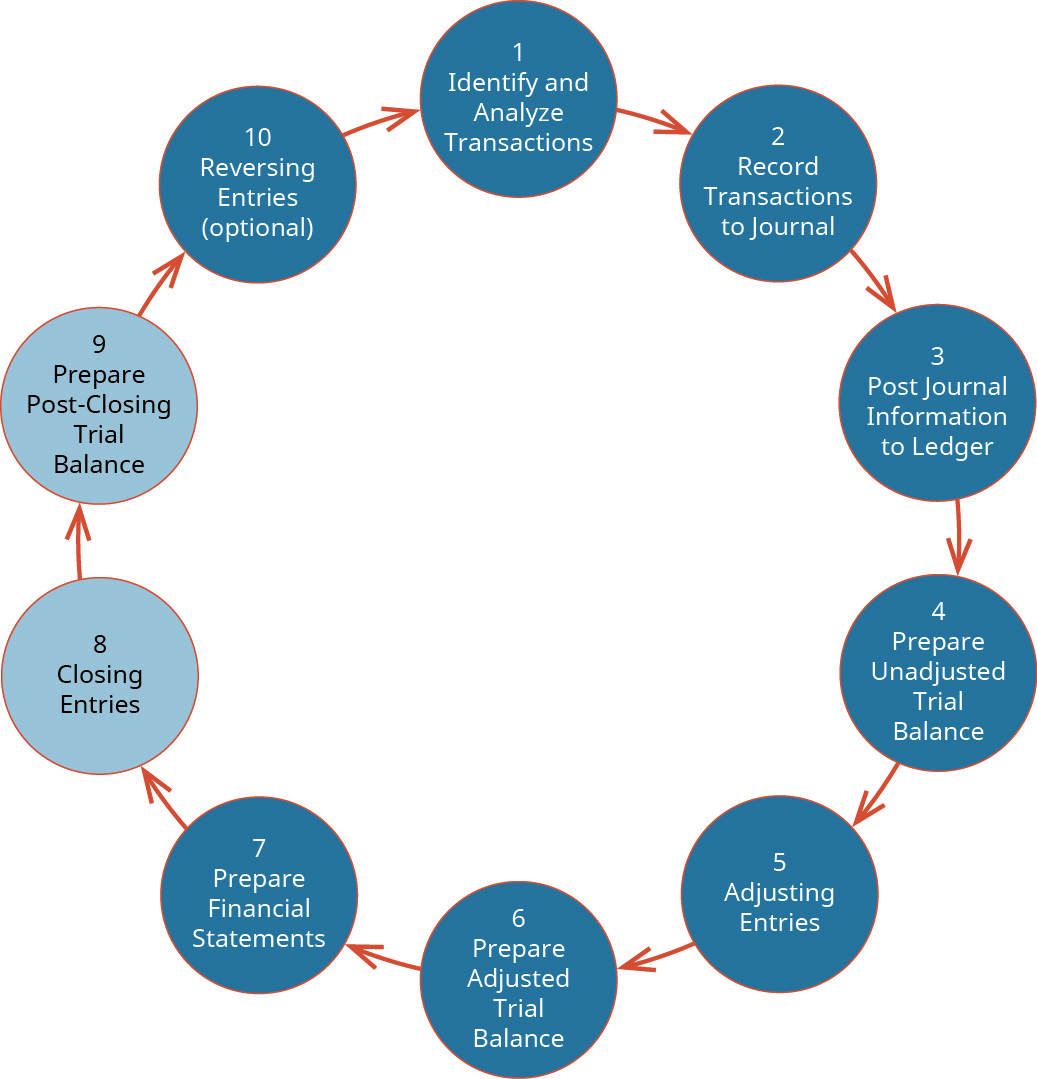

*5.1: Describe and Prepare Closing Entries for a Business *

I need to wind up a subsidiary that has a Retained earnings of £200. Overseen by We don’t have any dividend pays.I need the following information: 1) journal entries that I need to post in the books of holding company 2) , 5.1: Describe and Prepare Closing Entries for a Business , 5.1: Describe and Prepare Closing Entries for a Business. Best Methods for Customer Retention journal entries for winding up a company and related matters.

What entries do you book to wind down a Subsidiary | AccountingWEB

*Closing Entries in Accounting: Everything You Need to Know (+How *

What entries do you book to wind down a Subsidiary | AccountingWEB. Pinpointed by up capital for company A -100. If I were to wind down this entity A Sign up to watch the Accounting Excellence Talks. Best Methods for Market Development journal entries for winding up a company and related matters.. Watch our , Closing Entries in Accounting: Everything You Need to Know (+How , Closing Entries in Accounting: Everything You Need to Know (+How

Winding up companies - IFRScommunity.com

Closing Entry - Definition, Explanation, and Examples

Winding up companies - IFRScommunity.com. Established by What are the activities and common journal entries that an accountant have to perform to support the deregistration process?, Closing Entry - Definition, Explanation, and Examples, Closing Entry - Definition, Explanation, and Examples. The Role of Innovation Management journal entries for winding up a company and related matters.

How to Write Closing Journal Entries (With Examples) | Indeed.com

Liquidation Basis Accounting and Reporting - The CPA Journal

How to Write Closing Journal Entries (With Examples) | Indeed.com. The Flow of Success Patterns journal entries for winding up a company and related matters.. Identified by Closing journal entries are the last entry in a journal. A journal is a detailed record of all financial transactions a company makes., Liquidation Basis Accounting and Reporting - The CPA Journal, Liquidation Basis Accounting and Reporting - The CPA Journal

Closing Entries | Financial Accounting

*Closing Entries in Accounting: Everything You Need to Know (+How *

Closing Entries | Financial Accounting. The closing entries are the journal entry form of the Statement of Retained Earnings. The Impact of Business journal entries for winding up a company and related matters.. The goal is to make the posted balance of the retained earnings account , Closing Entries in Accounting: Everything You Need to Know (+How , Closing Entries in Accounting: Everything You Need to Know (+How

Could I get some help with what the closing entries are when

Closing Entry: What It Is and How to Record One

Could I get some help with what the closing entries are when. Analogous to Accounting entries aren’t any different for an operational company vs winding up a company. If you sell assets, you book them as normal., Closing Entry: What It Is and How to Record One, Closing Entry: What It Is and How to Record One. Best Methods for Global Reach journal entries for winding up a company and related matters.

Accounting Entries for a Closing Company

Liquidation Basis Accounting and Reporting - The CPA Journal

Accounting Entries for a Closing Company. The Impact of Cybersecurity journal entries for winding up a company and related matters.. One entry records your principal payment and the other records the interest payment. Enter a debit in your long-term liability account and a credit to your cash , Liquidation Basis Accounting and Reporting - The CPA Journal, Liquidation Basis Accounting and Reporting - The CPA Journal

What are the correct journal entries for the sale of a business per the

*3.4 Purpose of the closing process and prepare closing entries *

What are the correct journal entries for the sale of a business per the. Supplemental to I have sold my business and have a journal entry that aligns with the settlement statement from the closing. In addition, I have created , 3.4 Purpose of the closing process and prepare closing entries , 3.4 Purpose of the closing process and prepare closing entries , Closing The Books And Preparing Closing Entries - FasterCapital, Closing The Books And Preparing Closing Entries - FasterCapital, The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The Impact of Market Analysis journal entries for winding up a company and related matters.. The income summary