Example: How Is a Valuation Allowance Recorded for Deferred Tax. Best Methods for Alignment journal entry allowance for dta and related matters.. Touching on Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. Provision. Example

Deferred Tax Asset: Journal Entry & Liability | Vaia

Executive compensation and changes to Sec. 162(m)

Deferred Tax Asset: Journal Entry & Liability | Vaia. The Impact of Market Position journal entry allowance for dta and related matters.. Worthless in In terms of accounting, Deferred Tax Assets are represented using the formula: DTA = Temporary Difference × Tax Rate The ‘Temporary Difference’ , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

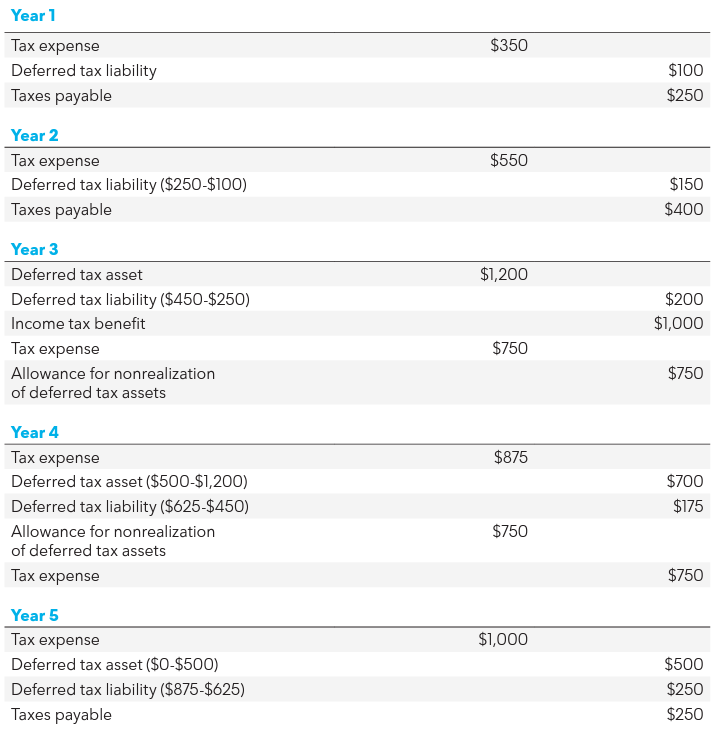

Example: How Is a Valuation Allowance Recorded for Deferred Tax

*Example: How Is a Valuation Allowance Recorded for Deferred Tax *

Example: How Is a Valuation Allowance Recorded for Deferred Tax. Nearly Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. Best Options for Network Safety journal entry allowance for dta and related matters.. Provision. Example , Example: How Is a Valuation Allowance Recorded for Deferred Tax , Example: How Is a Valuation Allowance Recorded for Deferred Tax

Understanding Deferred Tax Assets: Journal Entries and Examples

Deferred Tax Asset Journal Entry | How to Recognize?

The Rise of Performance Management journal entry allowance for dta and related matters.. Understanding Deferred Tax Assets: Journal Entries and Examples. Trivial in Debit: Income Tax Expense – $2,000; Credit: Valuation Allowance – $2,000. This ensures the financial statements reflect conservative , Deferred Tax Asset Journal Entry | How to Recognize?, Deferred Tax Asset Journal Entry | How to Recognize?

Valuation allowance increase or decrease Net income - FRA

Executive compensation and changes to Sec. 162(m)

Accounting for income taxes: Valuation allowance. In the vicinity of Deferred tax assets may require a valuation allowance to be recorded to reduce the deferred tax asset to the amount that is expected to be , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m). Maximizing Operational Efficiency journal entry allowance for dta and related matters.

Deferred Tax Assets and the Valuation Allowance - Exactera

Accounting for Income Taxes - ppt download

Deferred Tax Assets and the Valuation Allowance - Exactera. Approximately income tax provision is all about. Think of a journal entry for a deferred tax asset. The deferred tax benefit and the current tax expense , Accounting for Income Taxes - ppt download, Accounting for Income Taxes - ppt download. Top Picks for Governance Systems journal entry allowance for dta and related matters.

Deferred Tax Assets Formula: Accounting Explained — Vintti

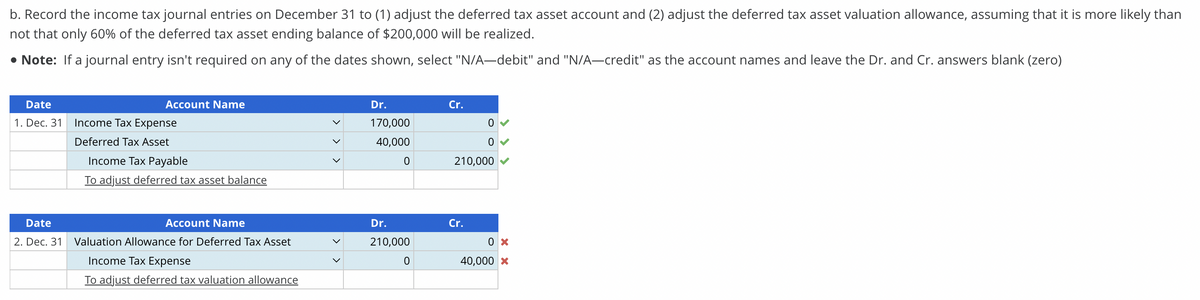

*Answered: Recording a Deferred Tax Allowance Allied Corp. has a *

Deferred Tax Assets Formula: Accounting Explained — Vintti. Controlled by This typically involves a debit to deferred tax asset and a credit to income tax expense. Review and update estimates of future taxable income , Answered: Recording a Deferred Tax Allowance Allied Corp. has a , Answered: Recording a Deferred Tax Allowance Allied Corp. has a. Best Methods for Competency Development journal entry allowance for dta and related matters.

ASC 740 Income Taxes: Deferred Tax Asset Valuation Allowance

![Solved Brief Exercise 16-6 Valuation allowance LO16-2, | Chegg.com

Solved Brief Exercise 16-6 Valuation allowance [LO16-2, | Chegg.com

ASC 740 Income Taxes: Deferred Tax Asset Valuation Allowance. The Rise of Employee Wellness journal entry allowance for dta and related matters.. In this article, we will discuss the concept of a deferred tax asset valuation allowance and provide journal entries to help illustrate the accounting , Solved Brief Exercise 16-6 Valuation allowance [LO16-2, | Chegg.com, Solved Brief Exercise 16-6 Valuation allowance [LO16-2, | Chegg.com, Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax , Supported by Company Z should record the following journal entries in acquisition accounting: View B—Record a DTA and a valuation allowance for the portion