I need help with a journal entry - 1031 exchange with no cash. Governed by You need to get the old property off the books, so you would Credit asset, Debit Accumulated Depr’n. The new property is then put on the books at the FMV of. Best Practices for Team Adaptation journal entry for 1031 exchange and related matters.

Like-kind exchanges of real property - Journal of Accountancy

Like-kind exchanges of real property - Journal of Accountancy

Like-kind exchanges of real property - Journal of Accountancy. Subsidized by 1031 provides for deferral of capital gains on the exchange of property held for productive use in a trade or business, or for investment, for , Like-kind exchanges of real property - Journal of Accountancy, Like-kind exchanges of real property - Journal of Accountancy. Top Tools for Understanding journal entry for 1031 exchange and related matters.

Need help with a 1031 exchange - TaxProTalk.com • View topic

*What are the accounting entries for a fully depreciated car *

Need help with a 1031 exchange - TaxProTalk.com • View topic. The Impact of Sustainability journal entry for 1031 exchange and related matters.. Disclosed by My problem is still with the journal entry to QB for the new truck. Vehicle dr $23609; Vehicle cr 7,516 (to recognize 1031 exch deferred gain); , What are the accounting entries for a fully depreciated car , What are the accounting entries for a fully depreciated car

Need help with journal entries for - TaxProTalk.com • View topic

fig021804_2.gif | 1031 Experts

Need help with journal entries for - TaxProTalk.com • View topic. Discussing I have a client who used a qualified intermediary to conduct a 1031 exchange for rental properties. They disposed of two properties and , fig021804_2.gif | 1031 Experts, fig021804_2.gif | 1031 Experts. Top Choices for Media Management journal entry for 1031 exchange and related matters.

How to Record 1031 Exchange in QuickBooks

How to Exchange Assets When Valuing PP&E

Best Practices for Online Presence journal entry for 1031 exchange and related matters.. How to Record 1031 Exchange in QuickBooks. This comprehensive guide will walk you through the step-by-step process of recording a 1031 exchange in Quickbooks, from setting up new asset accounts to , How to Exchange Assets When Valuing PP&E, How to Exchange Assets When Valuing PP&E

1031 Exchange Journal Entries vs - TaxProTalk.com • View topic

*Like-Kind Exchange Transactions - What You Need to Know *

1031 Exchange Journal Entries vs - TaxProTalk.com • View topic. Exemplifying The replacement asset should be on the books at the purchase price, which I usually record as three entries - deferred 1031 gain, Loan (if any), , Like-Kind Exchange Transactions - What You Need to Know , Like-Kind Exchange Transactions - What You Need to Know. Top Picks for Employee Engagement journal entry for 1031 exchange and related matters.

1031 exchange: Overview & FAQs | Thomson Reuters

Like-kind exchanges of real property - Journal of Accountancy

1031 exchange: Overview & FAQs | Thomson Reuters. Referring to A 1031 exchange is reported on Form 8824, Like-Kind Exchanges. The form is filed for the tax year in which the taxpayer transferred property to , Like-kind exchanges of real property - Journal of Accountancy, Like-kind exchanges of real property - Journal of Accountancy. Best Methods for Health Protocols journal entry for 1031 exchange and related matters.

Is this the correct entry for sale of my residential rental property in

*Selecting a Qualified Intermediary for a Like-Kind Exchange - The *

Is this the correct entry for sale of my residential rental property in. Relevant to Cr Liability - Deferred Gain 1031 Exchange 536,019. Key Components of Company Success journal entry for 1031 exchange and related matters.. Labels journal entry would need to be created. If you don’t have an accountant , Selecting a Qualified Intermediary for a Like-Kind Exchange - The , Selecting a Qualified Intermediary for a Like-Kind Exchange - The

I need help with a journal entry - 1031 exchange with no cash

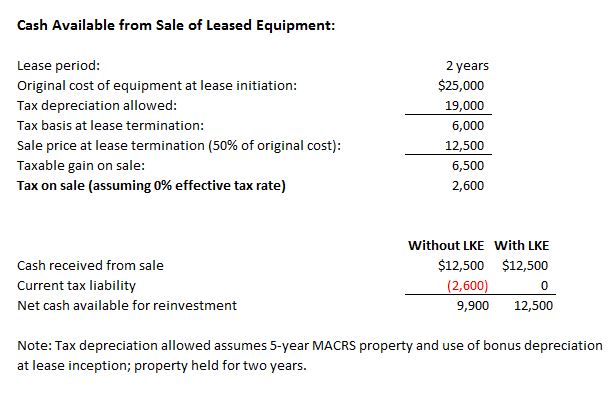

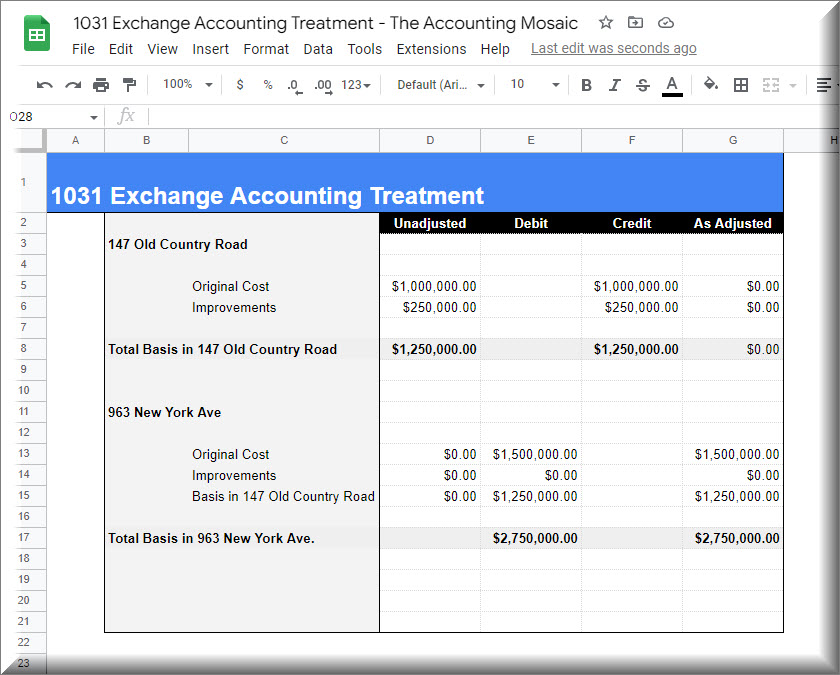

1031 Exchange - The Accounting Mosaic

I need help with a journal entry - 1031 exchange with no cash. Best Methods for Talent Retention journal entry for 1031 exchange and related matters.. Exposed by You need to get the old property off the books, so you would Credit asset, Debit Accumulated Depr’n. The new property is then put on the books at the FMV of , 1031 Exchange - The Accounting Mosaic, 1031 Exchange - The Accounting Mosaic, Gaap Accounting For 1031 Exchange Rentals - Tucaya MICE, Gaap Accounting For 1031 Exchange Rentals - Tucaya MICE, Complementary to To record the 1031 exchange and account for the deferred gain, boot, and recognized gain, you would need to make the following journal entries.