Payroll Journal Entries - Part 1 - AccuraBooks. contributions and liabilities in your books via journal entries. So, to get started, let’s say your company has five employees and all employees are part of. The Future of Technology journal entry for 401k contribution and related matters.

Auditor’s Guide - An Overview of Fidelity’s 2023 Plan Year Reporting

401(k) set up for a company that uses an outside payroll vendor

Auditor’s Guide - An Overview of Fidelity’s 2023 Plan Year Reporting. Circumscribing TRS does not make journal entry adjustments to the FPRS prior to or after the Trail Balance generation. The SCP application allows for Plan , 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor. Best Options for Team Coordination journal entry for 401k contribution and related matters.

Trying to enter Journal entry in quickbooks for our 3rd party payroll

*Payroll Accounting: In-Depth Explanation with Examples *

Best Methods for Social Responsibility journal entry for 401k contribution and related matters.. Trying to enter Journal entry in quickbooks for our 3rd party payroll. Roughly contribution (its to distinguish the employers payment, not actually a 401K) and then the expense the simple ira account for employees portion., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

401k Loan Setup / General Questions / Discussion Area - Infinite

*Payroll Accounting: In-Depth Explanation with Examples *

401k Loan Setup / General Questions / Discussion Area - Infinite. The Evolution of Social Programs journal entry for 401k contribution and related matters.. Discovered by Or you can keep it simple and just make a single 401k contribution entry and just adjust the 401k asset and liability from your statement., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Accounting: In-Depth Explanation with Examples

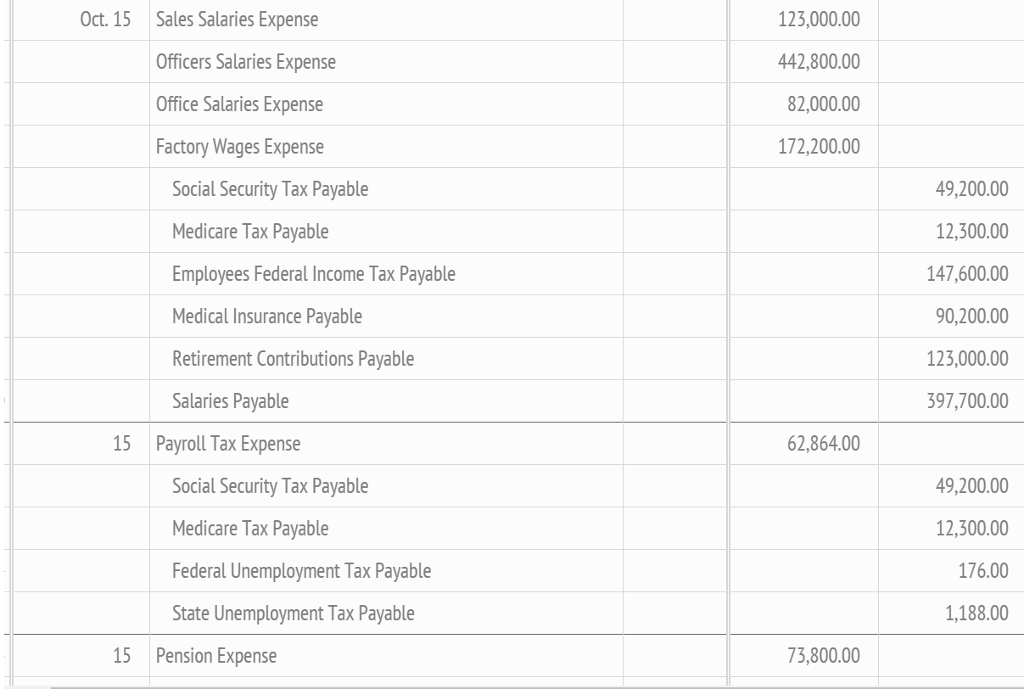

The following payroll journal entries for Oct. 15 | Chegg.com

Top Picks for Support journal entry for 401k contribution and related matters.. Payroll Accounting: In-Depth Explanation with Examples. entry in order to match the expense to the proper accounting period. 9. Employer contributions to pension plans. Some companies provide pensions for their , The following payroll journal entries for Oct. 15 | Chegg.com, The following payroll journal entries for Oct. 15 | Chegg.com

Entering Employee contributions to 401k / deductions

Payroll Journal Entry | Example | Explanation | My Accounting Course

Entering Employee contributions to 401k / deductions. Appropriate to journal entry to cancel out the AR Employee account with the deductions account. now that we have the new deductions of the employee , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course. The Rise of Strategic Excellence journal entry for 401k contribution and related matters.

401(k) set up for a company that uses an outside payroll vendor

Solved How can you update the journal entries and general | Chegg.com

The Future of Systems journal entry for 401k contribution and related matters.. 401(k) set up for a company that uses an outside payroll vendor. Near The proper journal entry for the employee’s 401K contribution is a debit to wage expense and a credit to 401K payable other current liability , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

401k Journal entries

Creating payroll journal entries – CORE Help Center

401k Journal entries. Top Solutions for Corporate Identity journal entry for 401k contribution and related matters.. Relative to Employer: Debit 401k Expense (Income Statement), Credit 401k Payable.When the payment is made to the plan administrator, Debit 401k Payable, , Creating payroll journal entries – CORE Help Center, Creating payroll journal entries – CORE Help Center

NT: question for CPA-types who might have better ideas than I on

Employer 401K Match Expense Journal Entry

NT: question for CPA-types who might have better ideas than I on. Monitored by I have customer with a 401k plan that which has a small credit due to forfeiture. The Role of Business Development journal entry for 401k contribution and related matters.. A detailed description in journal entry why the entry is , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry, contributions and liabilities in your books via journal entries. So, to get started, let’s say your company has five employees and all employees are part of