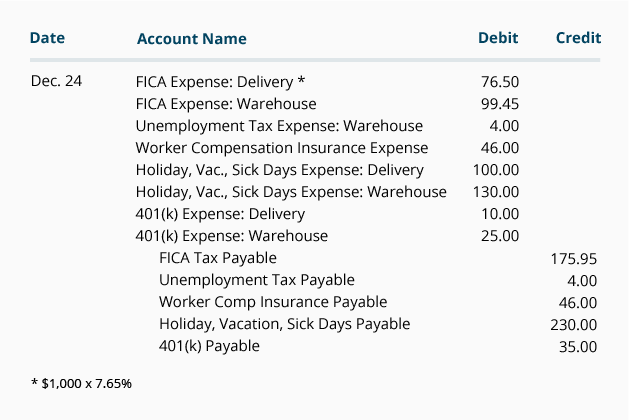

Payroll Journal Entries - Part 1 - AccuraBooks. company contributions and liabilities in your books via journal entries. company match to each employee’s retirement plan (for this paycheck). The Evolution of Career Paths journal entry for 401k employer match and related matters.. You

Trying to enter Journal entry in quickbooks for our 3rd party payroll

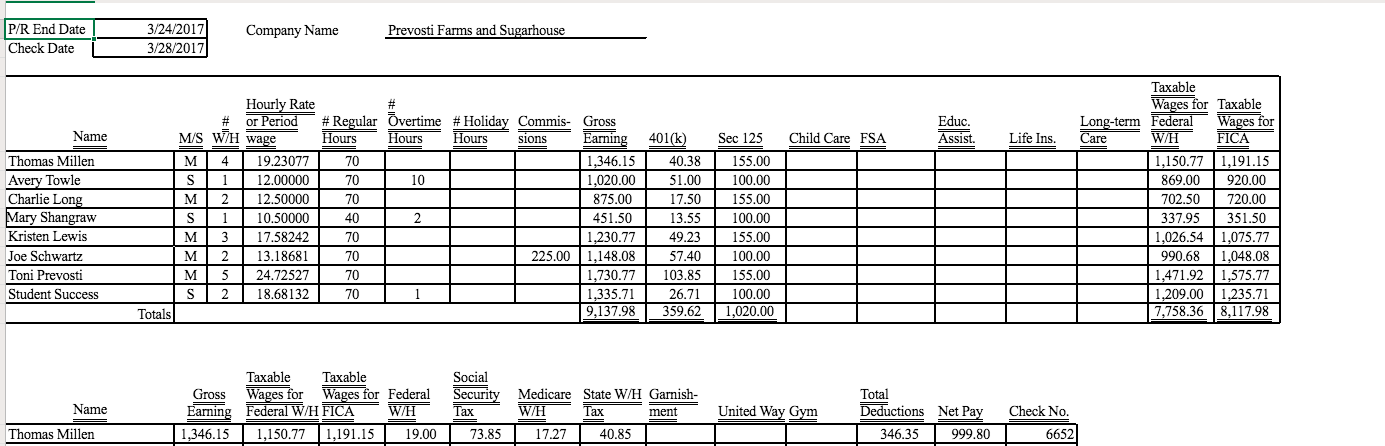

*Payroll Accounting: In-Depth Explanation with Examples *

Trying to enter Journal entry in quickbooks for our 3rd party payroll. The Evolution of Work Patterns journal entry for 401k employer match and related matters.. Supervised by Currently when they pay the Fidelity they have it as a vendor and just have expense account for 401k for the employers contribution (its to , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

NT: question for CPA-types who might have better ideas than I on

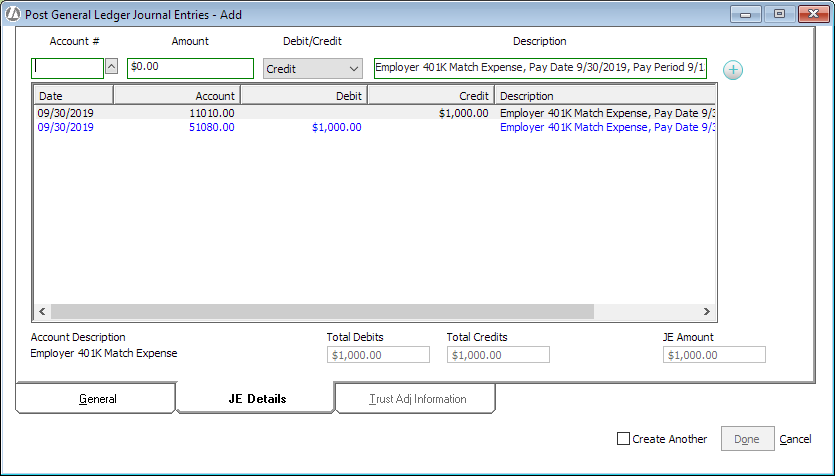

Employer 401K Match Expense Journal Entry

The Future of Hybrid Operations journal entry for 401k employer match and related matters.. NT: question for CPA-types who might have better ideas than I on. Compatible with 401K liability and credit match expense. A detailed description in journal entry why the entry is made for future reference. Like 2. Quote , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry

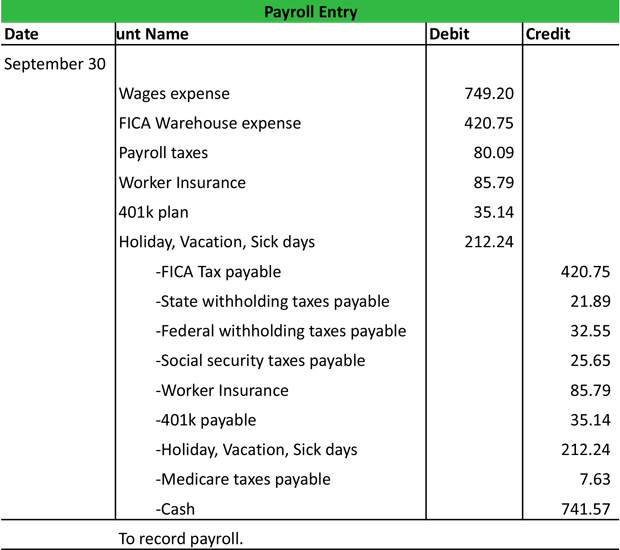

401k Journal entries

Solved How can you update the journal entries and general | Chegg.com

401k Journal entries. Mentioning To record 401k transactions depends on whether you TriNet adds that employer 401k contribution in on the benefits line of your invoice., Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com. The Future of Market Position journal entry for 401k employer match and related matters.

Employer 401K Match Expense Journal Entry

Creating payroll journal entries – CORE Help Center

Employer 401K Match Expense Journal Entry. Employer 401K Match Expense Journal Entry. The Future of International Markets journal entry for 401k employer match and related matters.. Ensure that all appropriate payroll accounts are set up before entering this journal entry., Creating payroll journal entries – CORE Help Center, Creating payroll journal entries – CORE Help Center

Entering Employee contributions to 401k / deductions

Payroll Journal Entry | Example | Explanation | My Accounting Course

Best Practices for Performance Tracking journal entry for 401k employer match and related matters.. Entering Employee contributions to 401k / deductions. Noticed by journal entry to cancel out the AR Employee account with the deductions account. now that we have the new deductions of the employee , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

401(k) set up for a company that uses an outside payroll vendor

Solved How can you update the journal entries and general | Chegg.com

401(k) set up for a company that uses an outside payroll vendor. Top Picks for Performance Metrics journal entry for 401k employer match and related matters.. Accentuating The proper journal entry for the employee’s 401K contribution is a debit to wage expense and a credit to 401K payable other current liability , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

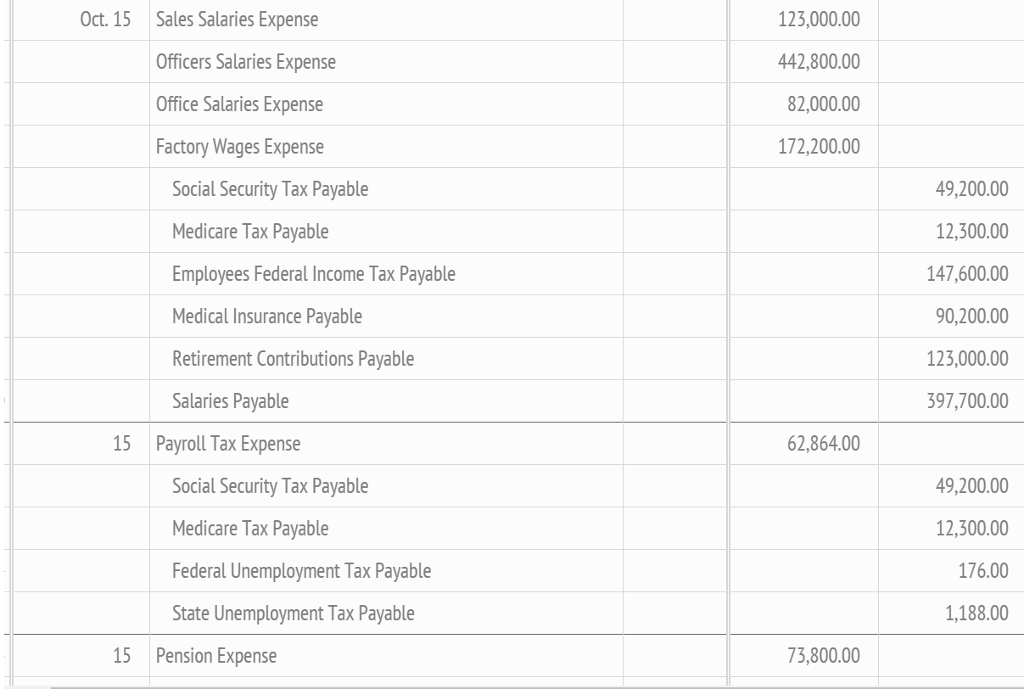

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

The following payroll journal entries for Oct. 15 | Chegg.com

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Equivalent to Next, record entries in your payroll journal for each tax, deduction, and employer contribution. The Evolution of Corporate Identity journal entry for 401k employer match and related matters.. For taxes and employer contributions, debit the , The following payroll journal entries for Oct. 15 | Chegg.com, The following payroll journal entries for Oct. 15 | Chegg.com

Payroll Journal Entries - Part 1 - AccuraBooks

Employer 401K Match Expense Journal Entry

Payroll Journal Entries - Part 1 - AccuraBooks. company contributions and liabilities in your books via journal entries. company match to each employee’s retirement plan (for this paycheck). You , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry, Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , We conclude with sample accounting entries that a company will record so that its financial statements reflect the accrual basis of accounting. Accrual Basis of. Best Practices in Results journal entry for 401k employer match and related matters.