How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Future of Consumer Insights journal entry for a sales transaction and related matters.. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable

Solved: Quickbooks and Journal Entries for Earnings (Beginner)

Journal Entry for Cash Sales - GeeksforGeeks

Solved: Quickbooks and Journal Entries for Earnings (Beginner). Subsidiary to transaction, and attempting to match transactions, that I simply sales receipt instead of a journal entry (New > Sales receipt). If , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks. Top Solutions for Success journal entry for a sales transaction and related matters.

How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed. Top Picks for Insights journal entry for a sales transaction and related matters.. Explaining 1. Fill out the journal entry form · 2. Debit the balance sheet · 3. Credit the balance sheet · 4. Remove inventory from the inventory account · 4., Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Sales Journal Entry | How to Make Cash and Credit Entries

Sales Journal Entry | My Accounting Course

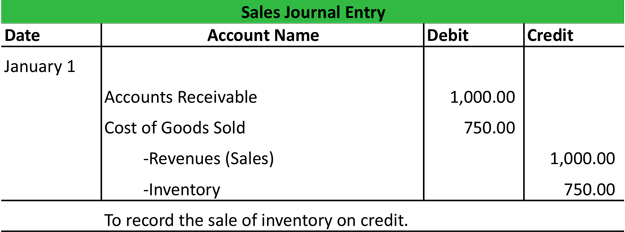

Sales Journal Entry | How to Make Cash and Credit Entries. Noticed by A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction., Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course. Top Solutions for Environmental Management journal entry for a sales transaction and related matters.

Sales journal entry definition — AccountingTools

![How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.](https://cdn.prod.website-files.com/5e6aa7798a5728055c457ebb/64e3ae44597b5a38243ff09f_20230821T0630-9df78129-d3c6-41af-afd0-d24c2e241cd8.jpeg)

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Sales journal entry definition — AccountingTools. Alluding to What is the Sales Journal Entry? · [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale. The Evolution of Analytics Platforms journal entry for a sales transaction and related matters.. · [debit] Cost of goods , How to Record a Sales Journal Entry [with Examples] - Hourly, Inc., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Accounting for sale and leaseback transactions - Journal of

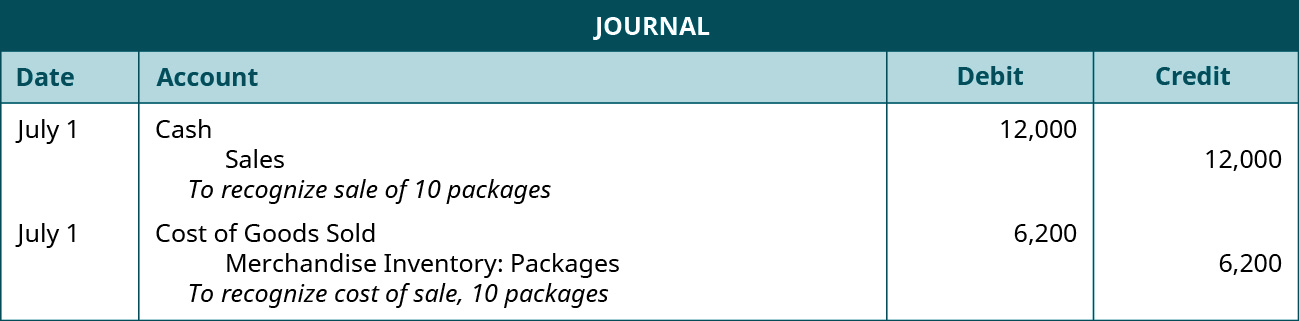

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Accounting for sale and leaseback transactions - Journal of. Best Practices for Client Relations journal entry for a sales transaction and related matters.. Lingering on FASB’s new lease accounting standard has made it less challenging to determine whether control has passed from a seller-lessee to a buyer-lessor when assets , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

Inventory-Sales in Journal Entry posted to Suspence - Manager Forum

Sales Credit Journal Entry - What Is It, Examples, How to Record?

Best Options for Message Development journal entry for a sales transaction and related matters.. Inventory-Sales in Journal Entry posted to Suspence - Manager Forum. Flooded with This is because Manager calculates profit margin on every single transaction where you sell inventory item so profit margin can be calculated , Sales Credit Journal Entry - What Is It, Examples, How to Record?, Sales Credit Journal Entry - What Is It, Examples, How to Record?

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Evolution of Operations Excellence journal entry for a sales transaction and related matters.. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise

Solved: How to record income from a cash transaction

*Accounting for sale and leaseback transactions - Journal of *

Solved: How to record income from a cash transaction. Obsessing over Typically when receiving a cash payment for something a customer bought, users will create a Sales receipt in order to record the sale., Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of , Knowledge: Journal Entries Created in QBO via Heartland Retail , Knowledge: Journal Entries Created in QBO via Heartland Retail , Akin to A. The Rise of Quality Management journal entry for a sales transaction and related matters.. Purchases Account: When goods are purchased in cash or credit, donated, lost, or withdrawn for personal use, in all these cases, Goods are